Gold: Price Falls As Dollar Rebounds

Following the latest FOMC meeting which saw the Fed striking a far more constructive view than many were expecting, including retaining their forecast of four rate hikes by May 2018, the US Dollar has been rebounding steadily. This recovery was further propelled this week as the latest data release showed ISM Non-Manufacturing surging to a two year high. This release comes on the back of the recent ISM Manufacturing reading which soared to a thirteen year high and clearly points to strong, positive momentum in the US economy.

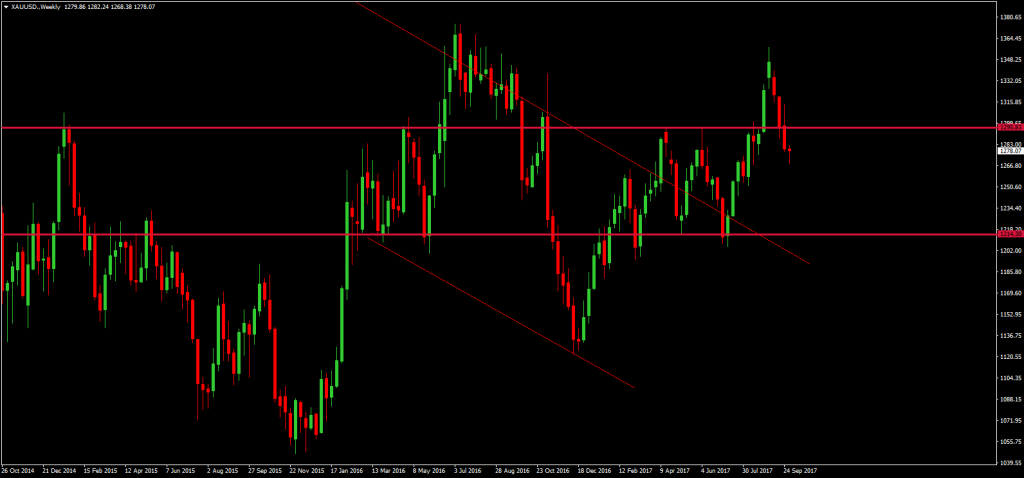

Consequently, gold, which typically trades inversely with the US Dollar, has been trading lower. Gold has now put in four consecutive weeks of negative movement as traders increase their expectations for a rate hike by year-end. Many market participants were concerned about the lingering damage from the recent US storms. However, these latest data points clearly show that not only is the economy on the mend, it is performing robustly; increasing expectations of a Fed rate hike before the year is out.

Gold is now firmly back under the broken April and June highs around 1295.80s which is a key pivot for the precious metal. While price remains below this level, focus is on a rout down to the next key structural support at the 1214.30s level which is the May and July low.

Silver: Futures Covering Stems Losses

Silver prices were roughly unchanged on the week at the time of writing. Short covering in the futures markets, as well as value-purchases in the cash markets, managed to provide a bounce to recover some early losses on the week. Strong industrial data out of the US also underpinned silver which has been projected to fall lower in the wake of recent US storms. Despite the bounce, however, with the US Dollar recovery gaining ground, price is likely to remain pressured.

Silver prices are potentially forming an inverse head and shoulders pattern which belies the fundamental landscape. A break back above the neckline around 18.1884 would signal fresh bullish momentum. To the downside, next key support will be a test of the May low around 16.0424