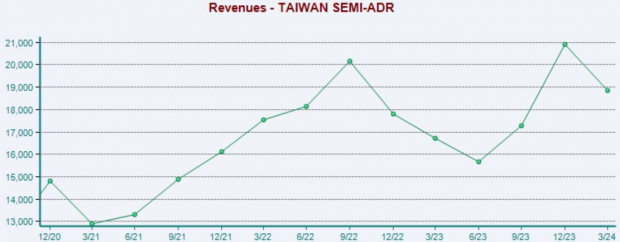

Everybody loves dividends, as they provide a passive income stream, limit drawdowns in other positions, and provide more than one way to profit from an investment.Recently, several companies, including Taiwan Semiconductor Manufacturing () , PACCAR () , and PepsiCo () , have announced a boost to their quarterly payouts. For those interested in income, let’s take a closer look at each. Taiwan SemiconductorTSM posted better-than-expected results in its latest release, exceeding the Zacks Consensus EPS estimate by nearly 7% and posting sales 2.7% ahead of expectations. Earnings grew 5% year-over-year, whereas revenue jumped 13% from the year-ago period. Image Source: Zacks Investment ResearchThe company announced a 10% boost to its payout, bringing the quarterly total to $0.45/share. TSM’s commitment to increasingly rewarding shareholders has kept it a favorite among income-focused investors seeking technology exposure.Shares currently yield 1.1% annually, nicely above the Zacks Computer & Technology sector average.

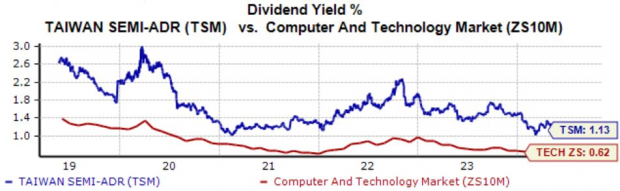

Image Source: Zacks Investment ResearchThe company announced a 10% boost to its payout, bringing the quarterly total to $0.45/share. TSM’s commitment to increasingly rewarding shareholders has kept it a favorite among income-focused investors seeking technology exposure.Shares currently yield 1.1% annually, nicely above the Zacks Computer & Technology sector average.

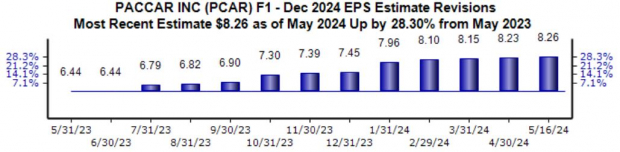

Image Source: Zacks Investment ResearchTSM shares have been notable outperformers in 2024 on the back of the semiconductor trade, up nearly 50% and crushing the S&P 500. PACCARPACCAR is a leading manufacturer of heavy-duty trucks worldwide, with substantial manufacturing exposure to light/medium trucks. The company recently announced an 11% boost to its payout, bringing the quarterly total to $0.30/share.The earnings estimate revisions trend has been considerably bullish for its current fiscal year (FY24), up nearly 30% to $8.26 per share over the last year. Growth is expected to cool in FY24, with earnings forecasted to see a decline before resuming growth in FY25. Image Source: Zacks Investment ResearchThe company’s quarterly results have consistently beat our expectations as of late, exceeding the Zacks Consensus EPS estimate by an average of 12% across its last four releases. PepsiCoPepsiCo, a current Zacks Rank #2 (Buy), manufactures, markets, and distributes grain-based snack foods, beverages, and other products. The company upped its quarterly payout by 7%, bringing the total to $1.35/share.The company has long been a favorite among income-focused investors, holding the ranks of a Dividend Aristocrat.(Click on image to enlarge)

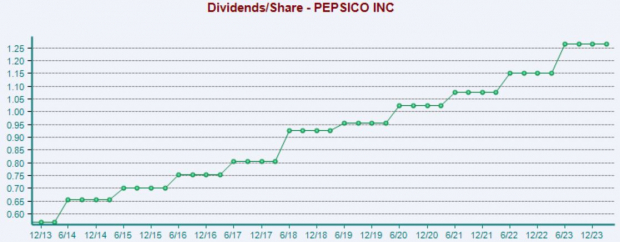

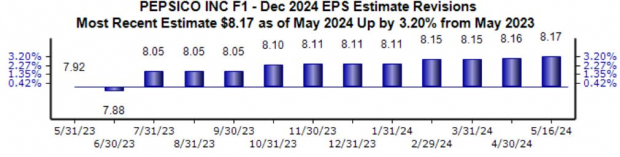

Image Source: Zacks Investment ResearchThe company’s quarterly results have consistently beat our expectations as of late, exceeding the Zacks Consensus EPS estimate by an average of 12% across its last four releases. PepsiCoPepsiCo, a current Zacks Rank #2 (Buy), manufactures, markets, and distributes grain-based snack foods, beverages, and other products. The company upped its quarterly payout by 7%, bringing the total to $1.35/share.The company has long been a favorite among income-focused investors, holding the ranks of a Dividend Aristocrat.(Click on image to enlarge) Image Source: Zacks Investment ResearchThe earnings estimate revisions trend has been considerably bullish for its current fiscal year, up 3% to $8.17 per share over the last year and suggesting 7% year-over-year growth. Better-than-expected quarterly results have kept analysts positive, with the company exceeding the Zacks Consensus EPS estimate by an average of 5% across its last four releases.(Click on image to enlarge)

Image Source: Zacks Investment ResearchThe earnings estimate revisions trend has been considerably bullish for its current fiscal year, up 3% to $8.17 per share over the last year and suggesting 7% year-over-year growth. Better-than-expected quarterly results have kept analysts positive, with the company exceeding the Zacks Consensus EPS estimate by an average of 5% across its last four releases.(Click on image to enlarge) Image Source: Zacks Investment Research Bottom LineTargeting dividend-paying stocks is an excellent strategy that investors can deploy.Dividends soften the blow from drawdowns in other positions, provide more than one way to reap a return from an investment, and allow maximum returns through dividend reinvestment.And all three companies above – Taiwan Semiconductor Manufacturing (TSM Quick Quote – ) , PACCAR (PCAR Quick Quote – ) , and PepsiCo (PEP Quick Quote – ) – have recently boosted their payouts.3 Stocks To Buy Following Positive Earnings Results Earnings Season: 3 Companies Enjoying Margin ExpansionBuyback Bonanza: 3 Companies Scooping Up Shares

Image Source: Zacks Investment Research Bottom LineTargeting dividend-paying stocks is an excellent strategy that investors can deploy.Dividends soften the blow from drawdowns in other positions, provide more than one way to reap a return from an investment, and allow maximum returns through dividend reinvestment.And all three companies above – Taiwan Semiconductor Manufacturing (TSM Quick Quote – ) , PACCAR (PCAR Quick Quote – ) , and PepsiCo (PEP Quick Quote – ) – have recently boosted their payouts.3 Stocks To Buy Following Positive Earnings Results Earnings Season: 3 Companies Enjoying Margin ExpansionBuyback Bonanza: 3 Companies Scooping Up Shares