A short-term downtrend began today, and the PMO index is already in the oversold range.

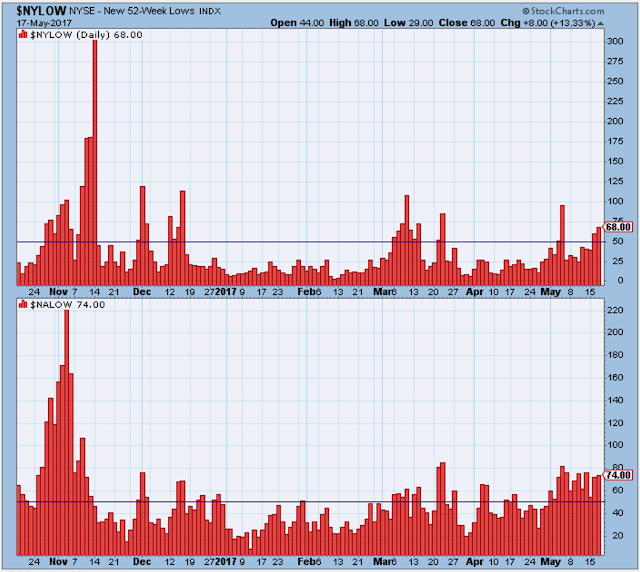

We’ve had elevated levels of new lows for awhile indicating that the market was getting a bit weaker behind the scenes.

The trend is lower. The bottom panel shows the market has been under pressure since mid March. The market really needs some selling to refresh the trend, and to give us an opportunity to buy our favorite stocks at better prices.

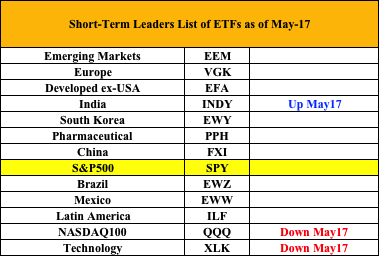

The Leader List

India is back in the leader list where it should have been for a number of months. My mistake. The Q’s and Technology fell off the list, but I will continue to hold these for the time being.

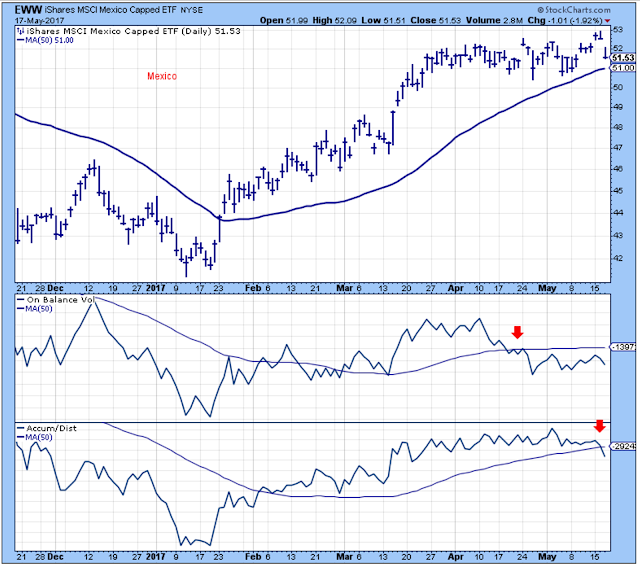

This chart is interesting. Foreign ETFs have been very hot, even the ones tied to oil. But the volume indicators are starting to show some weakness in the Mexico ETF.

Outlook

The Value Line Survey is cautious towards the market due to high stock valuations.

The long-term outlook is positive.

The medium-term trend is down as of May-17.

The short-term trend is down as of May-17.