Image: BigstockAlong with its Magnificent Seven peer Amazon ( – ), Apple ( – ) highlighted a week that saw a nice rally in broader markets after Fed Chair Jerome Powell dismissed the possibility of rate hikes on Wednesday. Adding momentum to the market, Apple was able to exceed quarterly expectations for its fiscal second quarter and announced an increase in its dividend and stock buybacks.

Image: BigstockAlong with its Magnificent Seven peer Amazon ( – ), Apple ( – ) highlighted a week that saw a nice rally in broader markets after Fed Chair Jerome Powell dismissed the possibility of rate hikes on Wednesday. Adding momentum to the market, Apple was able to exceed quarterly expectations for its fiscal second quarter and announced an increase in its dividend and stock buybacks.

Q2 Financial Highlights

Revenue records in more than a dozen countries helped Apple post an all-time high for Q2 EPS at $1.53, which edged estimates of $1.51 a share and rose a percentage point from the comparative quarter. Canada, Latin America, and the Middle East were some of the international segments that saw record growth, with Q2 sales of $90.75 billion beating estimates by 1% despite decreasing from $94.83 billion a year ago.Notably, Apple has exceeded top and bottom-line expectations for five consecutive quarters, posting an average earnings surprise of 4.14% in its last four quarterly reports. Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

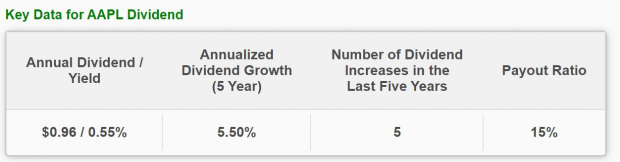

Dividend Increase & Stock Buybacks

Apple’s board authorized an additional $110 billion for share repurchases, given continued confidence in its business as the tech giant aims to be cash-neutral. Additionally, Apple will be raising its dividend by 4% to $0.25 per share (quarterly), and it is planning for more annual payout increases going forward. Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

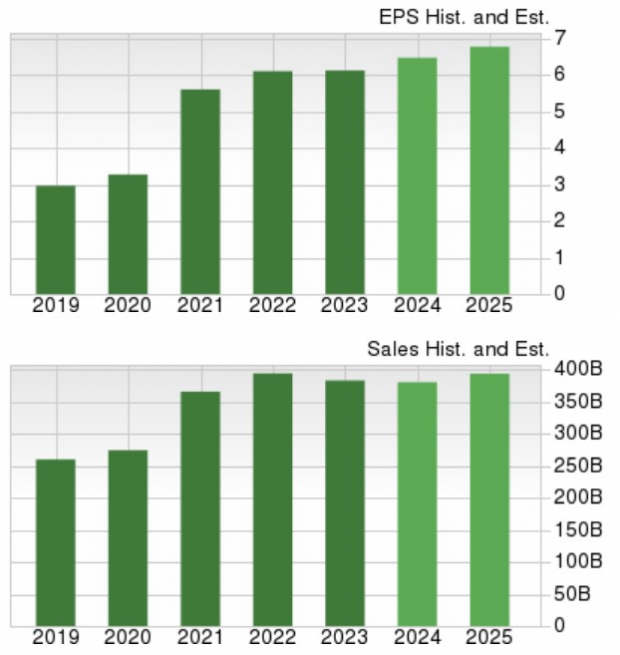

Growth Trajectory

Based on Zacks estimates, Apple’s annual earnings are now expected to be up 6% in fiscal 2024, and are projected to rise another 8% in FY25 to $7.10 per share. Total sales are forecasted to be virtually flat this year, but are projected to rise 5% in FY25 to $403.72 billion. Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Takeaway

Apple’s stock currently lands a Zacks Rank #3 (Hold). To that point, Apple appears to be pushing past domestic monopoly concerns and regulatory issues in China by expanding in other foreign markets, although there could still be better buying opportunities ahead.3 Intriguing Stocks To Buy After Beating Q1 Earnings ExpectationsTop 5 Momentum Stocks For May After A Disappointing April2 Major Regional Banks To Buy On High Rates, Economic Growth