Image Source:

Image Source:

On Tuesday afternoon I joined Charles Payne on Fox Business to discuss market indicators, market outlook, and three positions. Thanks to Charles, Nicholas Palazzo, and Kayla Arestivo for having me on:Video Length: 00:04:41After Fox Business, I went over to the Yahoo! Finance studio to talk with Akiko Fujita and Josh Lipton about picks, market positioning, and more. Thanks to Hayley Marks, Kathleen Welch, Akiko, and Josh for having me on:Video Length: 00:07:02And finally, thanks to Camille Smith and Chris Wragge for having me on CBS news last Friday to discuss the fed decision and market outlook:Video Length: 00:05:06

Small Caps and Emerging Markets (+Nat Gas)

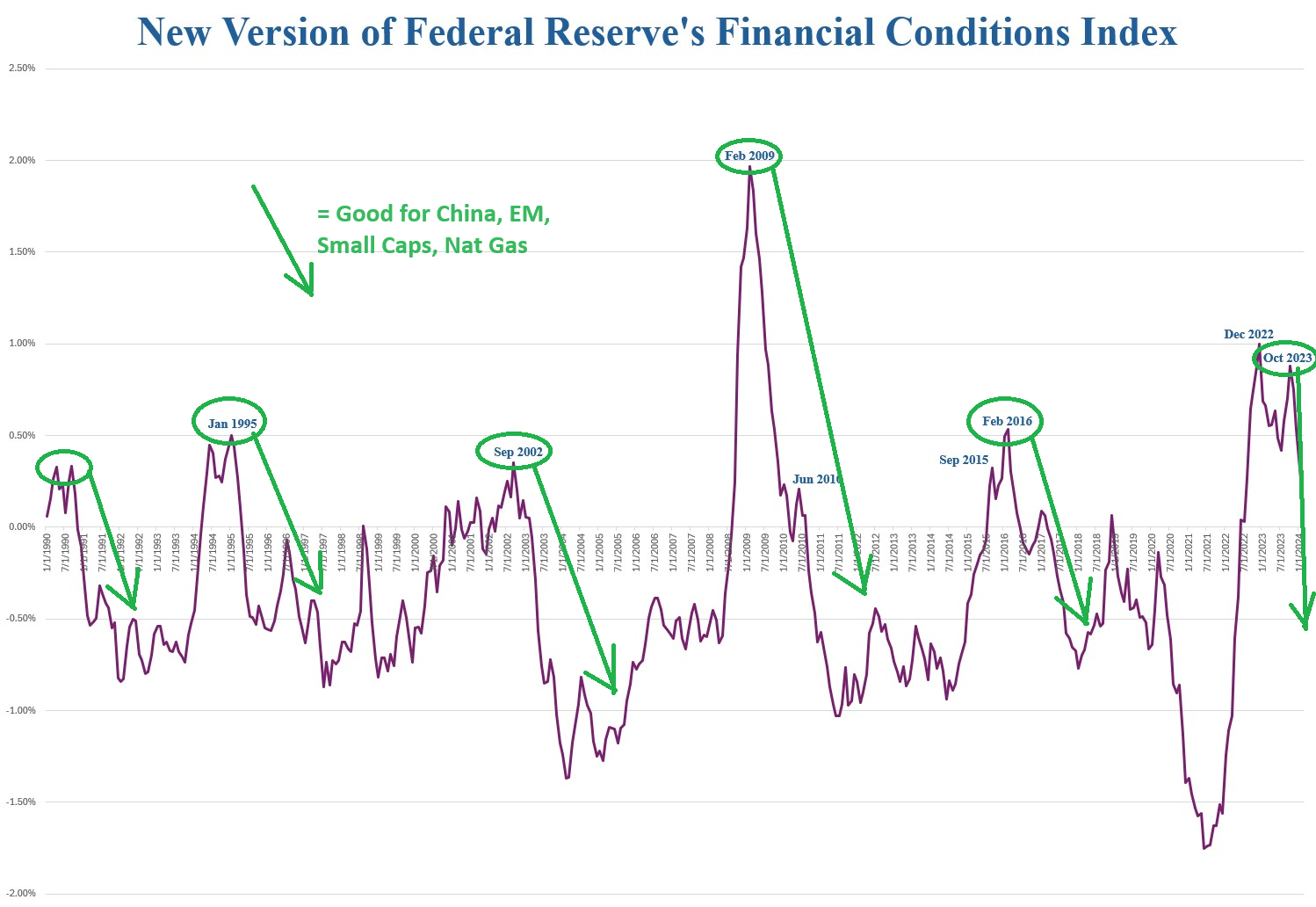

In our weekly | we’ve been laying out the case that numerous current conditions mirror the 2002-2007 period where both Small Caps and Emerging Markets/China (and commodities) had some of their biggest runs in history: You can see above the four year performance of the Hang Seng, Small Cap 600, Range Resources (nat gas), and Comstock Resources (nat gas).Here’s the “Zoom Out” version (in the blue box):

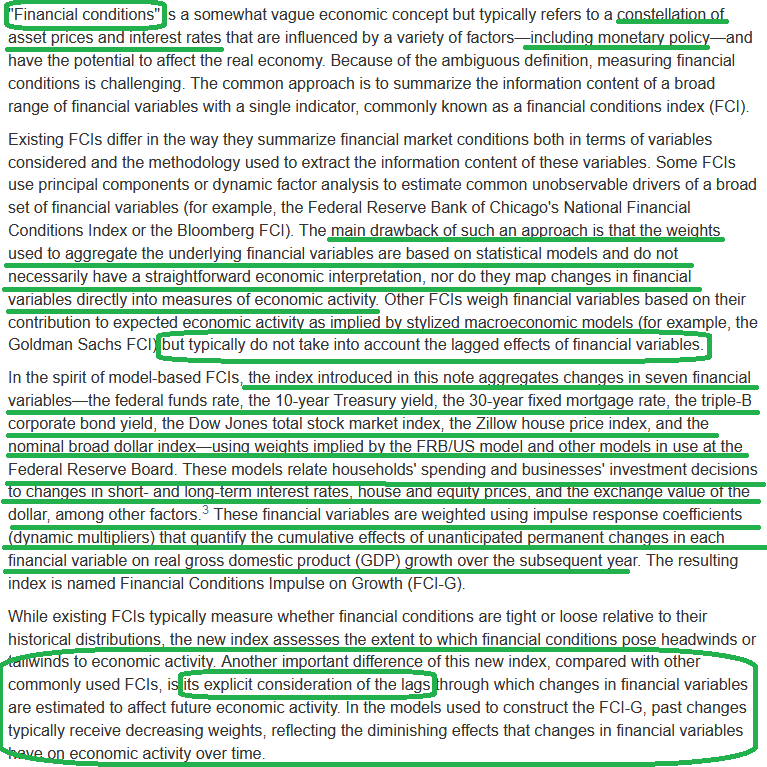

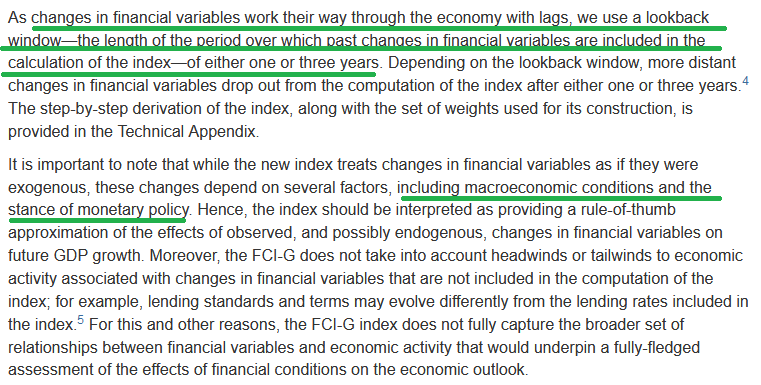

You can see above the four year performance of the Hang Seng, Small Cap 600, Range Resources (nat gas), and Comstock Resources (nat gas).Here’s the “Zoom Out” version (in the blue box): One more metric we look at – that points to an imminent similar period of out-performance – is the Federal Reserve’s New Financial Conditions index. It their words:

One more metric we look at – that points to an imminent similar period of out-performance – is the Federal Reserve’s New Financial Conditions index. It their words:

Note the similar periods of the New FCI-G indicator (peak and rollover), and what happened to the Hang Seng and Small Caps stocks during these periods:

Note the similar periods of the New FCI-G indicator (peak and rollover), and what happened to the Hang Seng and Small Caps stocks during these periods:

As a friendly reminder, here’s a message I sent to a good friend this week:

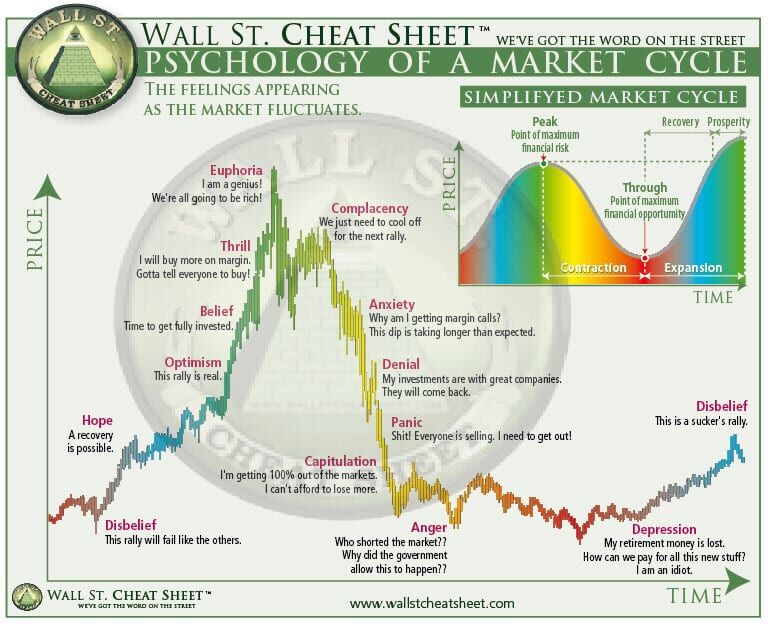

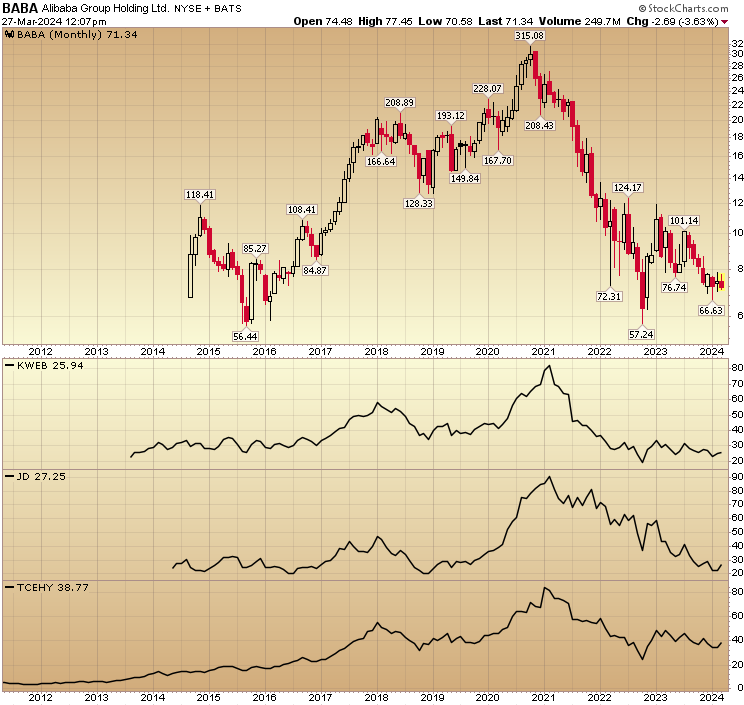

As a friendly reminder, here’s a message I sent to a good friend this week: Whether , , , or Tencent, it’s all the same chart (for now). Fundamentals won’t matter (in the short-term “emotional” voting machine) until they do (in the long-term “fundamental” weighing machine). We are past the lows and finishing the “Depression” stage. Standby for the “Disbelief” rally (when people BEGIN to pay attention to fundamentals again):

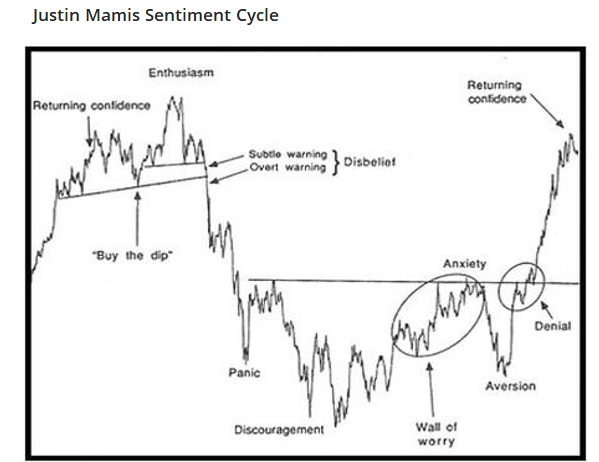

Whether , , , or Tencent, it’s all the same chart (for now). Fundamentals won’t matter (in the short-term “emotional” voting machine) until they do (in the long-term “fundamental” weighing machine). We are past the lows and finishing the “Depression” stage. Standby for the “Disbelief” rally (when people BEGIN to pay attention to fundamentals again): Said another way, we are at the “aversion” phase of the bottoming process. This is where even the most ardent of the “patient investors” finally throw in the towel. It is also right before the magic begins!

Said another way, we are at the “aversion” phase of the bottoming process. This is where even the most ardent of the “patient investors” finally throw in the towel. It is also right before the magic begins!

Now onto the shorter-term view of the General Market:

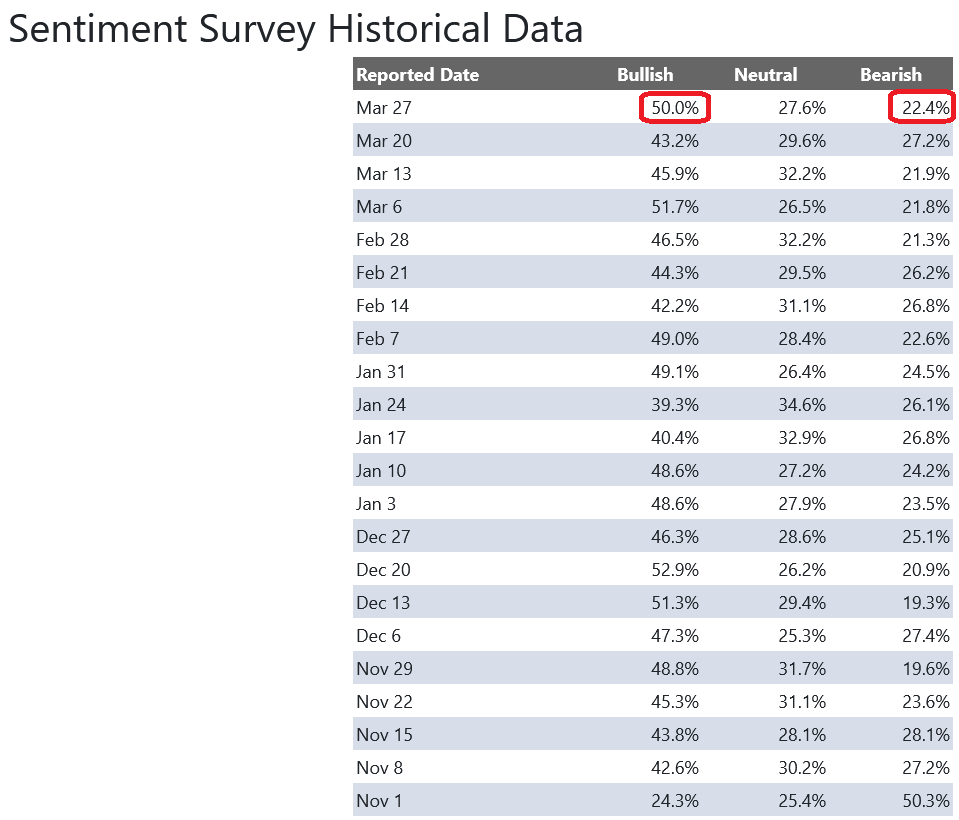

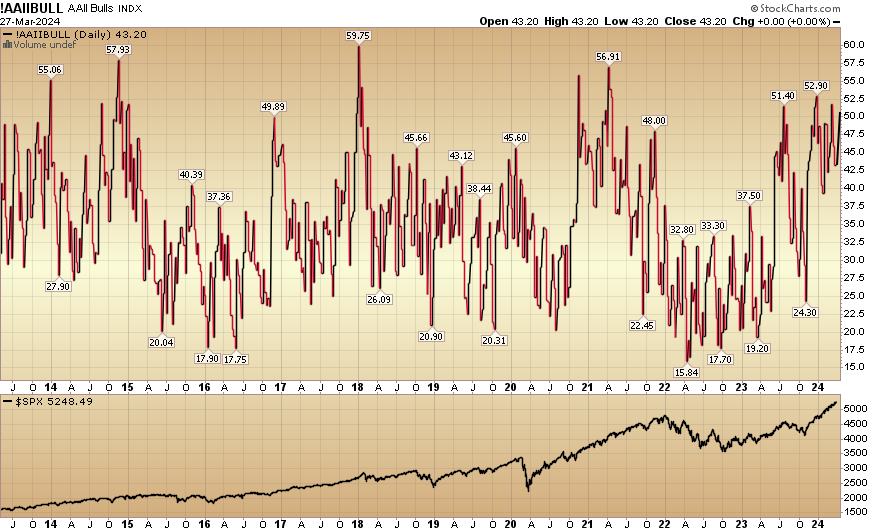

In this week’s AAII Sentiment Survey result, Bullish Percent () moved up to 50% from 43.2% the previous week. Bearish Percent dropped to 22.4% from 27.2%. The retail investor is approaching euphoria.

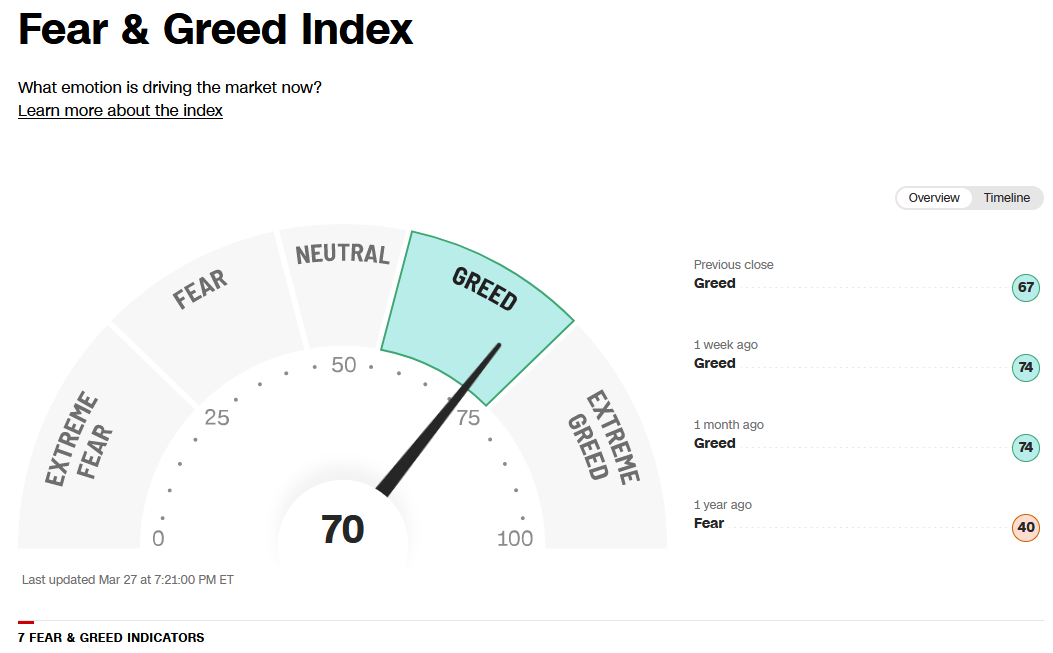

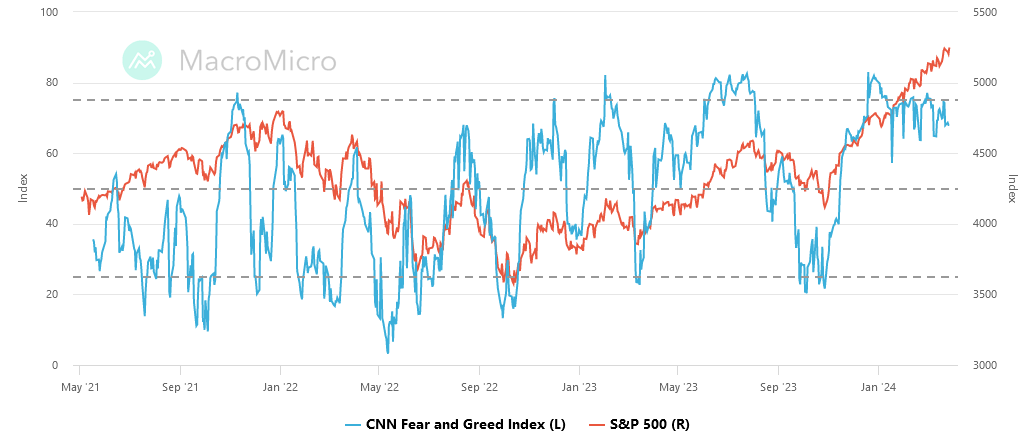

The CNN “Fear and Greed” flat-lined from 71 last week to 70 this week. You can learn how this indicator is calculated and how it works here: ()

The CNN “Fear and Greed” flat-lined from 71 last week to 70 this week. You can learn how this indicator is calculated and how it works here: ()

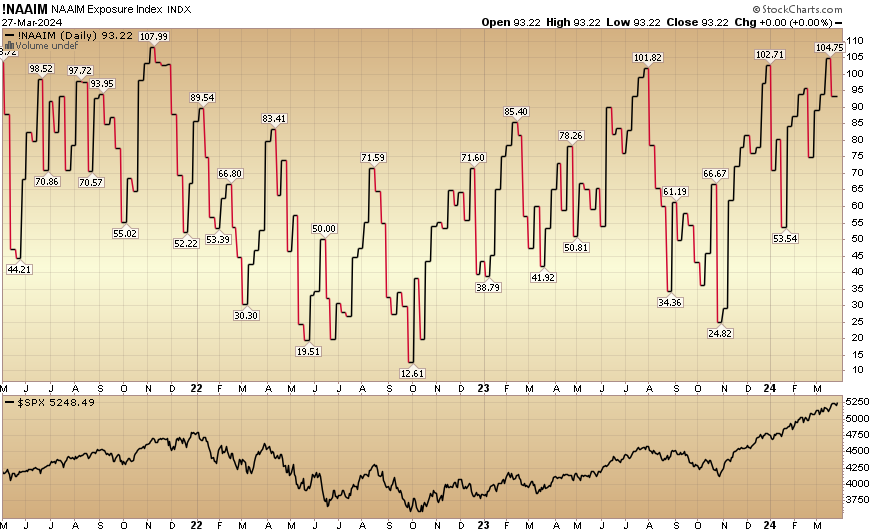

The NAAIM (National Association of Active Investment Managers Index) () dipped to 93.22% this week from 104.75% equity exposure last week.

The NAAIM (National Association of Active Investment Managers Index) () dipped to 93.22% this week from 104.75% equity exposure last week. Our | will be out later today. Each week, we have a segment called “Ask Me Anything (AMA)” where we answer questions sent in by our audience. If you have a question for this week’s episode, please send it in at the contact form .

Our | will be out later today. Each week, we have a segment called “Ask Me Anything (AMA)” where we answer questions sent in by our audience. If you have a question for this week’s episode, please send it in at the contact form .