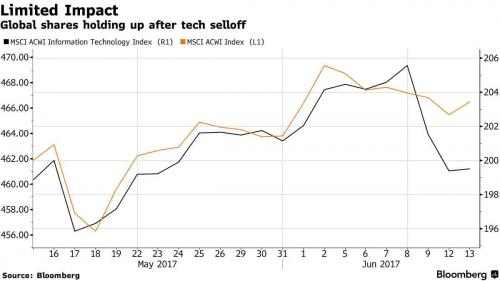

As the Fed begins its two-day meeting, global stocks have recovered their footing and European shares rise, led by a bounce in tech stocks as last Friday’s global selloff that started in the sector shows signs of abating. Asian stocks and U.S. futures gain as investors turn their attention to today’s Jeff Sessions testimony as well as tomorrow’s barrage of macro data including Yellen, CPI and retail sales.

It has been a risk-on session globally as the tech rout ended and technology stocks rebound from recent weakness and amid a lack of negative fundamental catalysts. European equity markets open higher with technology sector leading, travel stocks also well supported. Bund futures pushed lower, with supply pressure also coming from 10y DSL auction. Gilts sell-off after higher than expected U.K. CPI, short sterling curve bear steepens aggressively. USD broadly weakens across G-10 except for USD/JPY which is supported by lift in EUR/JPY and general risk sentiment. SEK spikes higher after strong domestic CPI data, NOK rallies in tandem after bullish domestic growth survey.

As Bloomberg notes, highlighting the importance of the tech, “should the rebound in tech shares carry through into U.S. trading investors will likely breathe a sigh of relief; the sector has been a key driver of global equity gains and a prolonged selloff would have represented a major threat to the ongoing bull market.”

Tomorrow, the Fed is widely expected to raise its benchmark interest rate in a decision scheduled for Wednesday and may also provide more details on its plans to shrink $4.5 trillion dollars of assets it amassed to nurse the economic recovery. The gap between benchmark U.S and European bond yields hit its widest in a month as the Fed meeting also shone a light on the slow pace of change in European Central Bank policy. “If the Fed is tightening policy and embarking on a gradual normalization path, whether it is the short-term policy rates or the balance sheet, it wants the market to believe it and to adjust to it,” said Frederik Ducrozet, an economist at Pictet Wealth Management.

“It is not just about complacency and the creation of financial bubbles…but also about its own credibility.” The Bank of Japan and the Bank of England also meet this week, although no major policy changes are expected.

According to a Retuers poll, a small majority of traders in China’s financial markets think its central bank will likely raise short-term interest rates again this week if the U.S. Federal Reserve hikes its key policy rate. But the reaction to this in bond markets has been concerning. China’s two-year yields have in the last few sessions risen above its 10-year yields- a trend that has only happened in a few instances over the past decade and suggests investors have worries over the long-term health of the world’s second biggest economy.

This morning, almost every industry group in the Stoxx Europe 100 Index traded in the green, with the abovementioned tech bounce meanings technology shares are poised for the largest gain in more than a month. The Stoxx Europe 600 Index climbed 0.6 percent as of 11:17 a.m. in London, after dropping 1 percent on Monday. Tech shares rose 1.3 percent. Futures on the S&P 500 Index rose 0.2 percent. The Nasdaq 100 fell 0.6 percent on Monday, adding to its 2.4 percent rout on Friday. Apple fell 2.4 percent while Microsoft Corp. slid 0.8 percent.

In Asia, MSCI’s broadest index of Asia-Pacific shares outside Japan rose 0.5 percent, recouping about half of the previous session’s losses. The MSCI Asia Pacific Information Technology index steadied, after sliding 1.4 percent on Monday. Australian equities rallied 1.7 percent, the most since November, as bank stocks jumped after investors returned from a holiday. South Korea’s Kospi added 0.7 percent, with Samsung Electronics Co. little changed after leading declines in Asia during Monday’s rout. Hong Kong’s Hang Seng rose 0.6 percent as Tencent Holdings Ltd., which tumbled 2.5 percent in the previous session, rebounded 0.7 percent.

Some analysts had predicted Asian tech shares would not see as intense a sell-off as their U.S. peers as their valuations were less stretched. “Comparatively, valuations for the IT sector in the Asia Pacific region are less expensive compared to the U.S., which may be why we’re not seeing the situation further aggravate for a second session,” said Jingyi Pan, market strategist at IG in Singapore.

Sterling headed for the first increase since the election that’s left U.K. Prime Minister May battling to shore up her position. She’ll meet Northern Ireland’s Democratic Unionists today, seeking the votes she needs to be able to pass any legislation. The pound strengthened 0.4 percent to $1.2711 after sliding 0.7 percent on Monday.

The Canadian dollar hit a two-month high after a policymaker said the central bank would assess if it needs to keep rates at near-record lows as the economy grows.

“It feels like a long time since markets have been treated to unscheduled hints of tightening, and this was quite apparent when you saw the positive reaction of CAD crosses overnight,” Matt Simpson, senior market analyst at ThinkMarkets in Melbourne, wrote in a note.

Elsewhere, the euro fluctuated before gaining less than 0.1 percent to $1.1210. The Bloomberg Dollar Spot Index fell by 0.1 percent.The yen fell 0.2 percent to 110.12 per dollar, after Monday’s 0.3 percent gain.

The yield on 10-year Treasuries was little changed; before today it climbed for four straight sessions. German benchmark yields rose two basis points, French equivalents increased three basis points and U.K. yields added five basis points.