Image Source:

Image Source:

The FTSE 100 in Britain reached a new all-time high on Thursday, driven by a surge in miner Anglo American’s stock following a buyout offer from BHP Group. Additionally, investors were pleased with the strong financial results from several leading companies such as Unilever, AstraZeneca, and Barclays. Following BHP’s announcement of a buyout offer for Anglo American, the London-listed miner’s shares soared by 12.7% to their highest level in nine months, valuing the company at 31.1 billion pounds ($38.84 billion). If successful, this deal would establish the world’s largest copper miner, accounting for approximately 10% of global output. However, BHP’s stock on the UK market experienced a 3.7% decline in response to the news.Unilever experiences a surge in stock value following better-than-expected sales results. At 9:23, shares of Unilever, a consumer goods group, rose by 4.1% to 4,023 pence, making it one of the top gainers on the FTSE 100 index. The company reported a 4.4% increase in sales, reaching 15 billion pounds ($18.74 billion) in the first quarter. Unilever maintains its full-year outlook, projecting a sales growth of 3% to 5%. CEO Hein Schumacher expressed confidence in the company’s ability to achieve sustained volume growth and accelerate gross margin expansion. The stock had experienced a decrease of approximately 13.5% in the last 12 months as of the previous closing.Barclays experienced a 4% rise in its shares, reaching 198.53p, the highest in over a year. This increase made the stock one of the top percentage gainers on the FTSE 100. Despite a 12% decrease in first-quarter profit, Q1 trading performed better than expected. Hargreaves Lansdown expressed some disappointment in the weaker net interest income guidance for 2024 but acknowledged that cost controls seem to be making a difference for Barclays. Interactive Investor noted that Barclays has shown stable, rather than dynamic growth over the quarter, surpassing expectations on most measures, but with some concerns about its US operations. Overall, Barclays’ shares are up approximately 30% year-to-date, including session moves.On the negative side of the ledger, Sainsbury, the British supermarket group, is experiencing a 2.2% decline in its shares, currently at 262.2p, making it one of the top losers on the FTSE 100. The company has reported that its profit from core banking products will be negatively impacted by higher funding costs and it expects its banking products to result in losses. Additionally, Sainsbury has highlighted the challenge of tougher comparatives in the grocery business. Looking ahead, the company anticipates a 5-10% growth in underlying operating profit for 2024/25, reaching 1.01-1.06 billion pounds. Barclays has observed that the midpoint of implied pretax profit, based on Sainsbury’s outlook comments, is approximately 2.5% below its consensus. Sainsbury has attributed half of the decline in outlook to the Bank and anticipates that the market may partially forgive this, considering the company’s previously announced phased withdrawal from Financial Services. Over the last twelve months, the stock has experienced a decrease of approximately 4.5% as of the last close.

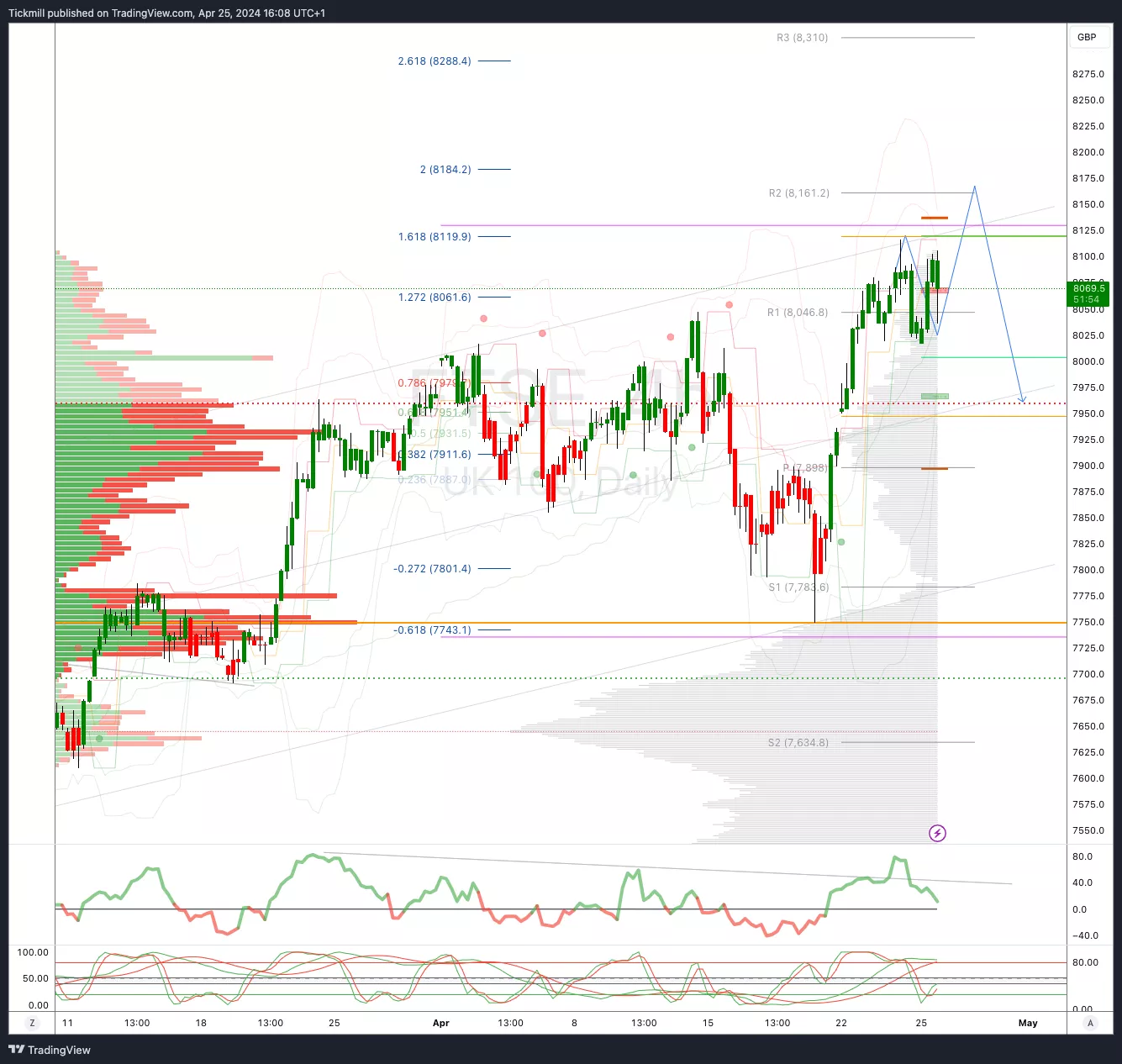

FTSE Bias: Bullish Above Bearish below 8000

(Click on image to enlarge)