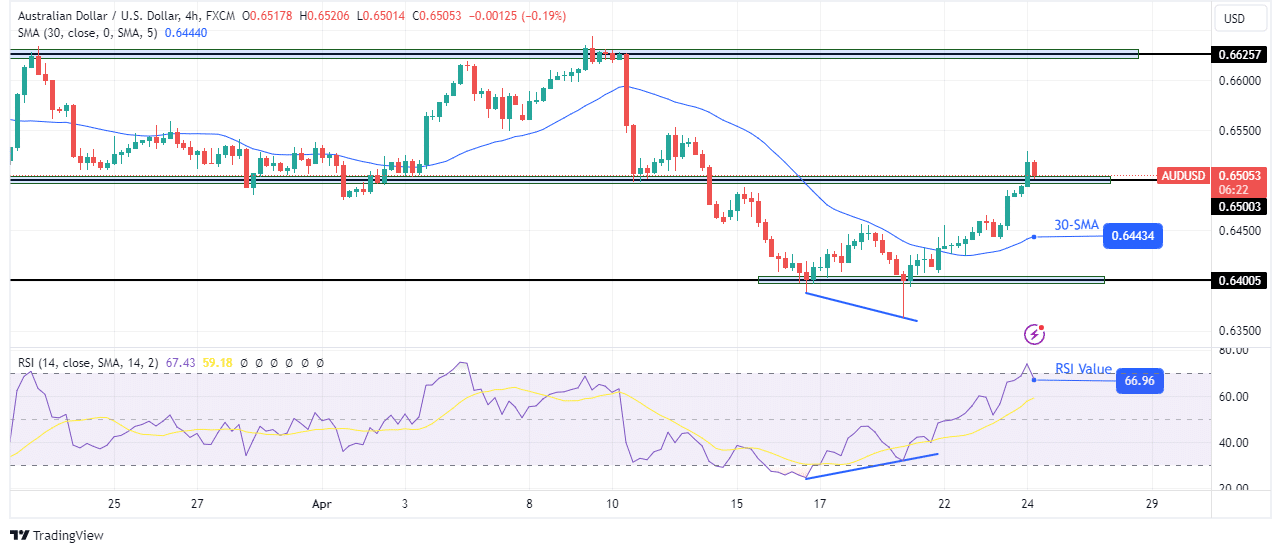

The Australian dollar is rising, propelled by unexpectedly high inflation figures, painting a bullish picture for the AUD/USD forecast. After this report, investors have lowered their expectations for a Reserve Bank of Australia rate cut. On the other hand, the dollar was weak after PMI data revealed a slowdown in the economy. Investors abandoned hopes for an RBA cut this year after Australia’s Consumer Price Index beat forecasts. In Q1, the CPI increased by 1%, beating estimates for an increase of 0.8%. Notably, the increase came from stubborn service cost pressures. After the report, there was a sharp decline in RBA rate cut expectations, with some even pricing a 4% chance of a hike in August.The RBA has remained mostly cautious about cutting rates due to the still-tight labor market. However, there was some hope that the central bank would start sometime this year. This latest report has changed that outlook, as the RBA might not cut rates in 2024. As a result, the Aussie has a slight edge over other major currencies, given the RBA might cut rates after the Fed. Meanwhile, the AUD/USD pair got additional support from a weaker US dollar. On Tuesday, PMI data showed a decline in US business activity in April, which relieved the Fed. Any sign of weaker economic demand gives policymakers more confidence that inflation will decline. AUD/USD key events todayInvestors will keep absorbing the impact of Australia’s CPI report as no major reports are coming from the US. AUD/USD technical forecast: Bulls set their sights on the 0.6625 resistance (Click on image to enlarge) AUD/USD 4-hour chart On the technical side, the AUD/USD price sits well above the 30-SMA, showing bulls are in the lead. Moreover, the RSI trades near the overbought region, supporting solid bullish momentum. Bears lost market control when they failed to close below the 0.6400 key support level. Instead, the price made a large wick, signaling a rejection of lower prices. At the same time, the RSI made a bullish divergence that revealed weaker bearish momentum. With bulls in the lead, the price has breached the 0.6500 key psychological level. They might pause at this level for a while before targeting 0.6625.USD/JPY Outlook: Intervention Warnings Mildly Lift YenGBP/USD Forecast: 1.23 Broken Following BoE’s RemarksGold Price Retreats As Tensions Ease Following Israel Attack

AUD/USD 4-hour chart On the technical side, the AUD/USD price sits well above the 30-SMA, showing bulls are in the lead. Moreover, the RSI trades near the overbought region, supporting solid bullish momentum. Bears lost market control when they failed to close below the 0.6400 key support level. Instead, the price made a large wick, signaling a rejection of lower prices. At the same time, the RSI made a bullish divergence that revealed weaker bearish momentum. With bulls in the lead, the price has breached the 0.6500 key psychological level. They might pause at this level for a while before targeting 0.6625.USD/JPY Outlook: Intervention Warnings Mildly Lift YenGBP/USD Forecast: 1.23 Broken Following BoE’s RemarksGold Price Retreats As Tensions Ease Following Israel Attack