by Michael Clark

Considering that the US Dollar, gold and oil all seem to be pretty much natural adversaries, which is in a better position to advance in price in the near future?

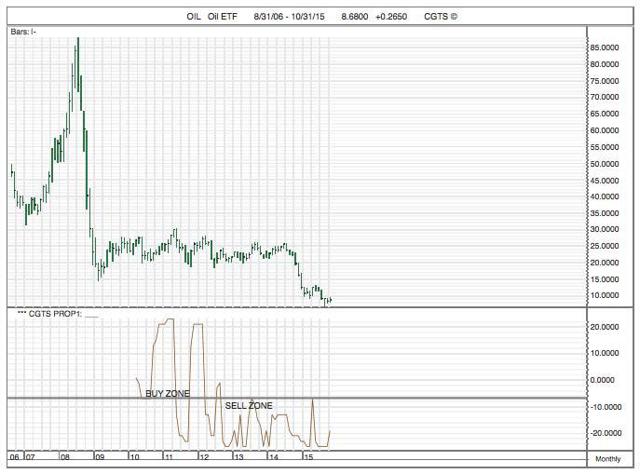

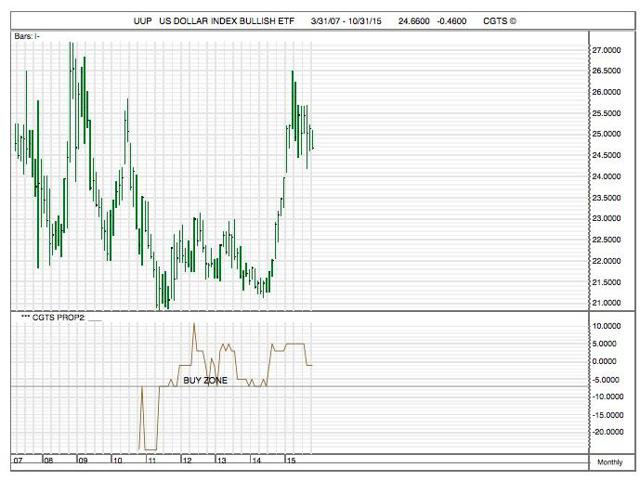

Looking at monthly charts…well, let’s look at monthly charts:

These charts show a clear winner. With all the talk on the decline of the Dollar, these charts show a Dollar that, despite recent consolidation, after massive gains, is poised to make higher highs, this much to the detriment of both gold and oil. And also to the detriment of stocks, at least that is my conclusion, based on recent history.

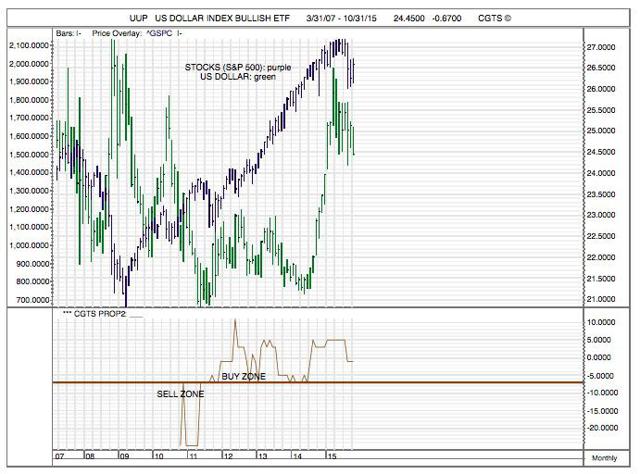

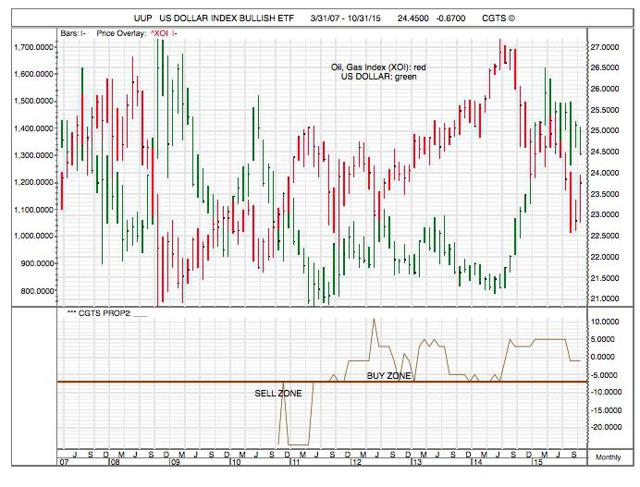

The charts below show a largely adversarial role between the US Dollar and stocks, gold and oil, at lease from 2007 to the present.

Stocks are tipping, tipping — and the strong Dollar is the force that is bringing stocks to their knees, world-wide. Note the weakness in the US Dollar (NYSEARCA:UUP) from 2011 through 2014, which allowed global stocks to race higher — this is the FED’s QE and ZIRP monetary manipulation of the Business Cycle — stealing or borrowing money from the future in order to spend today, on financial markets.

The US Dollar looks strong in the monthly charts. There is a reason for this. American QE weakened the Dollar and lowered interest rates and seeded a cheap bonanza of US-Dollar borrowing across the globe. Now the strong Dollar is getting ready to harvest this crop of global expansion. This will inevitably lead to a period of default in emerging markets that borrowed too much (in cheap Dollars) and now must buy more expensive Dollars to service outstanding debt (in weaker local currencies).

In the 1982 Bull Dollar run, Mexico and Latin America experienced a default crisis; in 1988-2001, Asian nations (remember the Asian Currency Crisis) and Russia (the Russian debt default crisis) both collapsed from the weight of the strong Dollar. In fact, the 2008 global collapse was also triggered by a Bull Market in the US Dollar, which the US muted with QE and NIRP — but, guess what, the strong Dollar is back, and the default crisis is only going to get worse.