Image source:

Image source:

The wizards at the Fed and US Treasury have been forced to acknowledge that their “transitory,” inflation is, in fact, quite “sticky”. And with the now acknowledged by the circus of high finance, Treasury yields keep inching up, recently reaching 4.7% — the highest since November. The Fed is stuck: It needs to raise interest rates to tame inflation and make Treasuries more attractive. But , with an already-untenable cost to service the existing debt and loan-dependent industries teetering on the brink.Once the 10-year Treasury yield goes above 5%, enters especially dangerous territory, endangering industries like the automotive market and commercial real estate that . With no good options, the Fed will be forced to print money one way or another to stimulate borrowing, turning an inflationary creek of their own making into a raging river of dollar destruction.

10-Year Treasury Yield jumps to 4.7%, its highest level since November 1 pic.twitter.com/yObR8D4uY0

— Barchart (@Barchart) April 26, 2024

The only way the Fed can possibly tame inflation is with interest rates so high that everything collapses. Jamie Dimon himself sees being needed to tame America’s Fed-fueled inflation beast — but with an economy addicted to a low cost of borrowing, this would make loans unaffordable for entire sectors of the economy that can’t do without.A serious implosion in commercial real estate would certainly bleed into the , beginning a chain reaction. Meanwhile, with no chance of the US reigning in spending and getting its fiscal house in order, interest on the US debt can already only be paid with even more borrowed money.That doesn’t even take into account the with their breaking-down cars, mortgages on homes that need repairs, and credit cards they use to fund basic expenses. Neither the most loan-dependent industries nor the average American can handle the rising cost of goods, materials, and energy. But they can’t handle 8% interest rates either. This is — raising rates to the levels they need to actually tame inflation or allowing inflation to run amok with fresh money printing to keep borrowing artificially affordable will both result in disastrous outcomes for the economy.

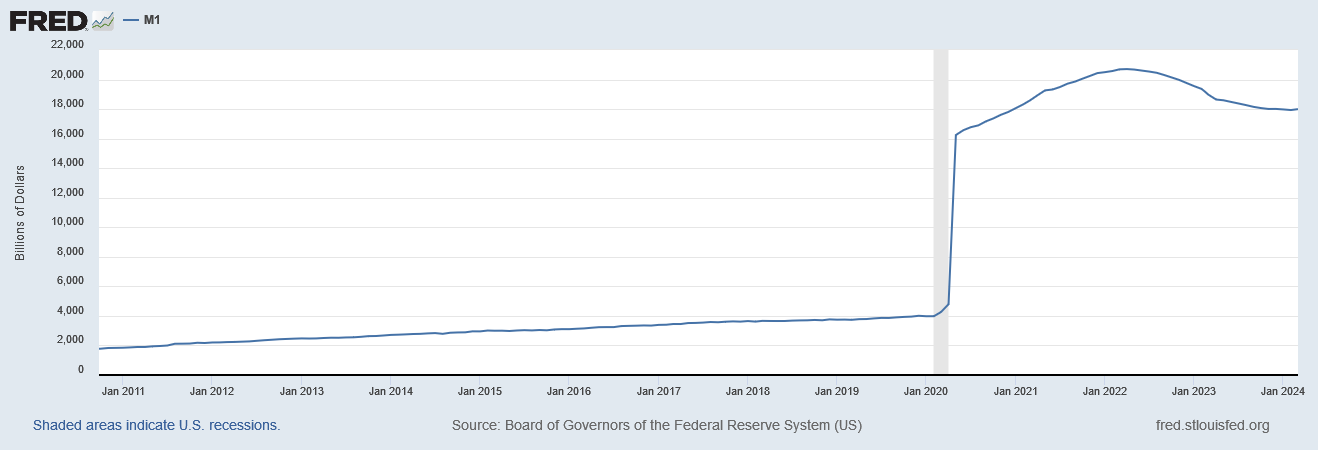

The COVID M1 Hockey Stick (Federal Reserve Bank of St. Louis)(Click on image to enlarge) Source:

Source:

The truth is, out-of-control spending and lingering COVID stimulus mean that inflation isn’t going away just because of some small rate hikes, as Peter Schiff has repeatedly pointed out, and as Dimon wrote in his recent :

“Huge fiscal spending, the trillions needed each year for the green economy, the remilitarization of the world, and the restructuring of global trade—all are inflationary.”

So while 2024’s rate cuts may get delayed, the Fed knows it might be able to kick the bond market bomb down the road by printing money. And the central bank will do whatever it has to in order to prevent a short-term implosion — even if it means destroying the dollar in the longer term. This is especially true now, as the Fed during an election year, giving it further impetus to make the economy look as rosy as possible, at least until the start of the next presidential cycle. That means rate cuts or full-blown QE to prevent a , and worrying about hyperinflation later.Without gold to preserve your purchasing power, you might be about to see what happens to your money when the Fed is forced to fire up the money printers while inflationary pressures are already in a way not seen in years. And if the Fed holds strong and refuses to cut rates this year, or even raises them anywhere near the levels they need to avoid killing the dollar, hold onto your hats — and your gold — and try not to get caught under one of the falling dominos.