The latest jobs number out of the US was a loss of 33,000 jobs in a hurricane-ravaged September. Despite the job losses, the unemployment rate ticked down to 4.2%. Viewed narrowly, this number puts the Fed on hold until December. But viewed more broadly, I believe now is the time to talk about Minsky’s ‘instability of stability’ and what it means for the economy going forward.

First, looking at the numbers narrowly, the job loss is not horrible. Last month, I wrote that we should expect some gyrations on the jobs front. And we have seen elevated jobless claims since then.

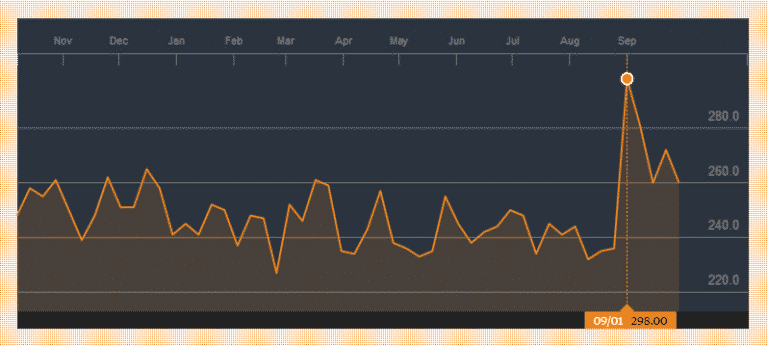

But while I am not worried yet, even last week’s figure was elevated relative to the average in the 240,000 to 250,000 range over the past year. And so the impact of the natural disasters on the third quarter growth numbers is going to be pretty sizable – larger than initially expected.

The way to think about this is as lost income that pulls down GDP growth numbers, as people having less money to spend due to job loss. If that job loss increase is large enough and sustained enough, it can lead to a recession.

In the past, an increase of 50,000 in average jobless claims or a decrease in payrolls for three consecutive months was enough of an economic shock to indicate recession. The second post I wrote on Credit Writedowns in March 2008 predicted that we began recession in December 2007 or January 2008 because of the job loss numbers. By December, this was confirmed.

But things simply don’t look like that right now. These numbers are skewed by the storm and don’t tell us anything about employment trends. They can be dismissed out of hand by policymakers. The Fed is widely expected to stand pat until December. These numbers will not change that.

As an aside, I want to point out that jobs data are also good at highlighting upturns as well. See my April 2009 post, “Are jobless claims peaking?”, which coincided with the upturn in the US economy as an example. To my mind, the claims series is the best real-time data set we have. And despite the recent uptick, the numbers have already receded enough to predict continued economic growth for the US.