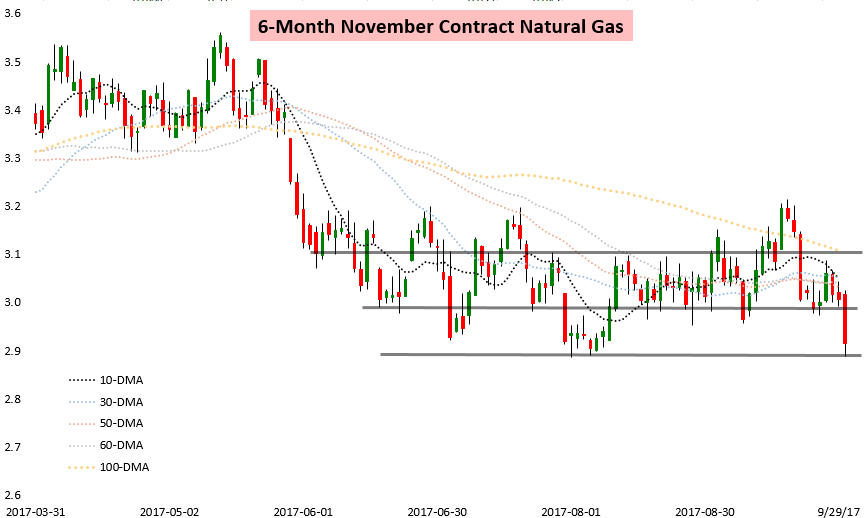

On our blog on Friday, we explained why natural gas trading today was likely going to be exciting and how the natural gas strip was giving us a bearish red flag. Well, that red flag verified, with the November contract plummeting 3%.

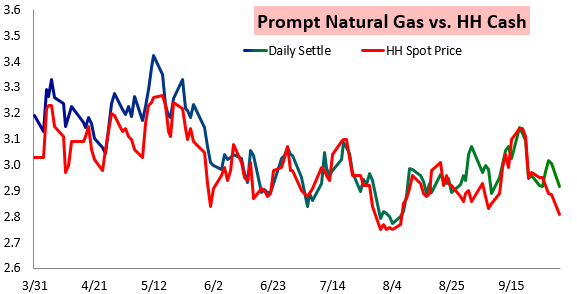

Physical gas prices were extraordinarily weak today, with Henry Hub cash weakness pulling down the whole natural gas strip.

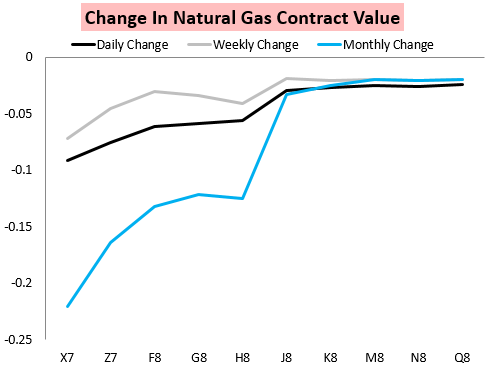

This can clearly be seen with today’s prompt month isolation, as the prompt contract saw by far the largest losses with further back contracts not moving nearly as much.

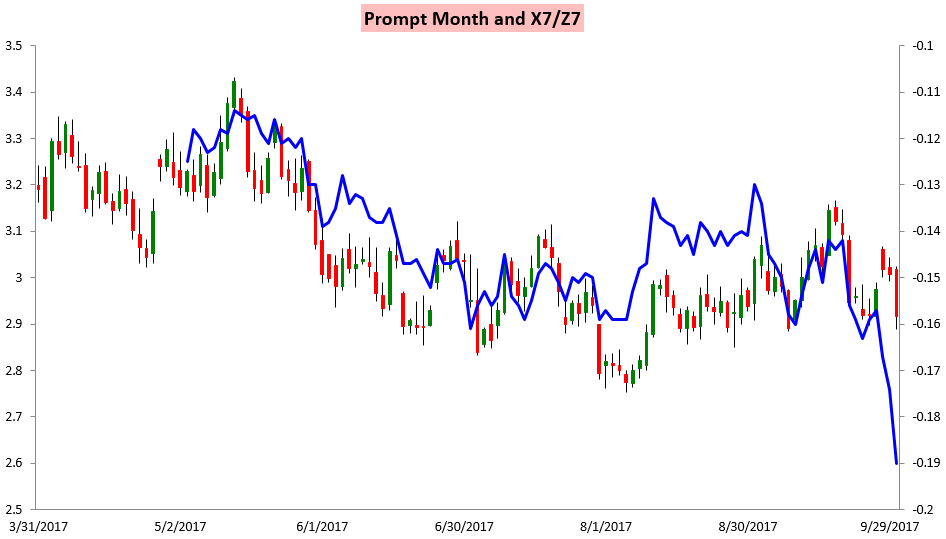

X/Z clearly widened significantly as well.

Overall, it became clear that physical balances over the weekend were loosed than expected, and today we saw the market correct accordingly. With prices right near support, however, we expect weather and in-week balances to significantly drive prices, and a tight EIA print can be expected on Thursday.