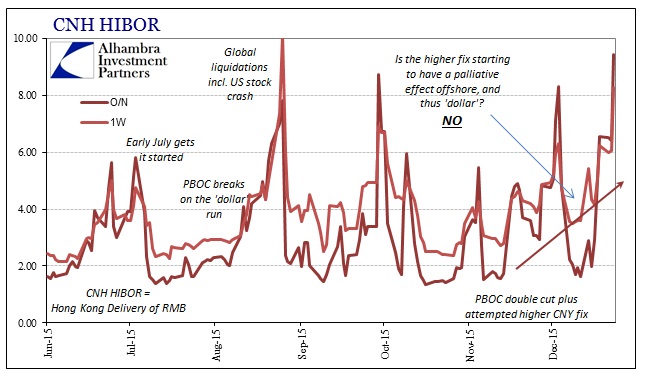

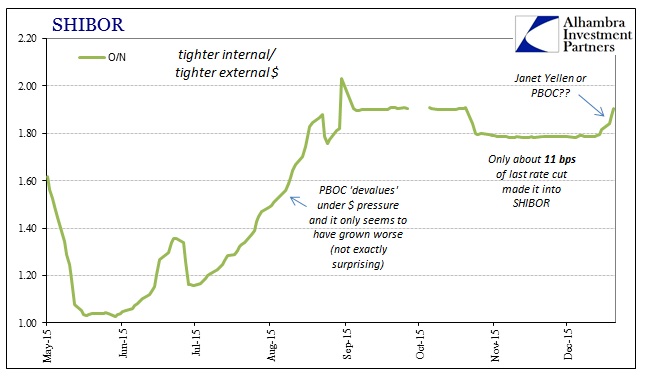

This isn’t surprising, but events in China are accelerating. Just as the West heads into year-end coma, there is much to be concerned about on the other side of the Pacific. For, one, either the PBOC has taken off whatever means it has been using to suppress SHIBOR or the strain has become too much to bear. As much as it might seem to be a choice for the Chinese central bank, offshore CNH suggests otherwise. Hong Kong renminbi delivery is simply out of control once more, with overnight CNH HIBOR spiking sharply to just shy of 10%; the highest O/N rate on record.

The one-week CNH rate is below its August 25 high, but at this point it doesn’t really matter as the front end of the offshore RMB liquidity market is all over the place. Thus, I don’t think it too much of a leap to suggest that the sudden appearance of SHIBOR in the “wrong” direction is something other than a central bank choice. The timing in coincidence with the Fed decision may or may not be significant; from my point of view it is simply the same problem repeated as the Fed unleashes the common central bank “ability” to make a bad situation worse.

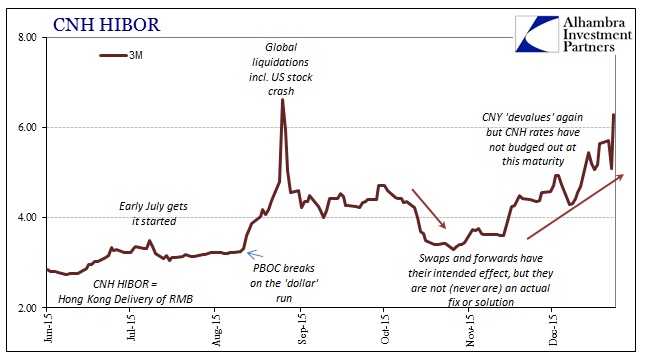

In other words, the illiquidity that is plainly evident both onshore and offshore in China predates the FOMC. That view is specified by 3-month CNH which has been on an alarmingly steady incline dating back to mid-October. The volatility in the front of the HIBOR curve is therefore an expression of more systemic problems currently without answer. Not for lack of trying, however, as the PBOC has clearly been asserting all sorts of wholesale measures in order to counter both internal and external imbalances; to no avail.

The durability of this disruption may be shocking in some quarters, but, again, it was both predictable and perhaps inevitable. The reason for it is the “global dollar short”; emphasis on the “short.” The internals in China have been disastrous, as I detailed here(subscription), which can only lead to the drawn out confirmation of the worst case – that wholesale banking has been and remains the problem all along.