Stocks Have An Endless Bid

The S&P 500 was up again on Monday, foiling my thesis that there would be a correction this week. The S&P 500 is up 5 out of 5 days this year for a gain of 2.77%. Some investors who outperformed last week already had gains which equal a good year in the first 4 days of trading. It doesn’t get much better than that. This is the best start to a year since 2006. The best streak of record highs to start a year was 6 in 1964. The 2.6% increase last week would have been the best week in 2017, showing that the momentum has only accelerated. As we’ve discussed, when stocks have a good January, it means the rest of the year is going to be great. In the 15 years where stocks were up 2% or more in the first 5 days, the full year return has been positive every time with a median return of 18.9%.

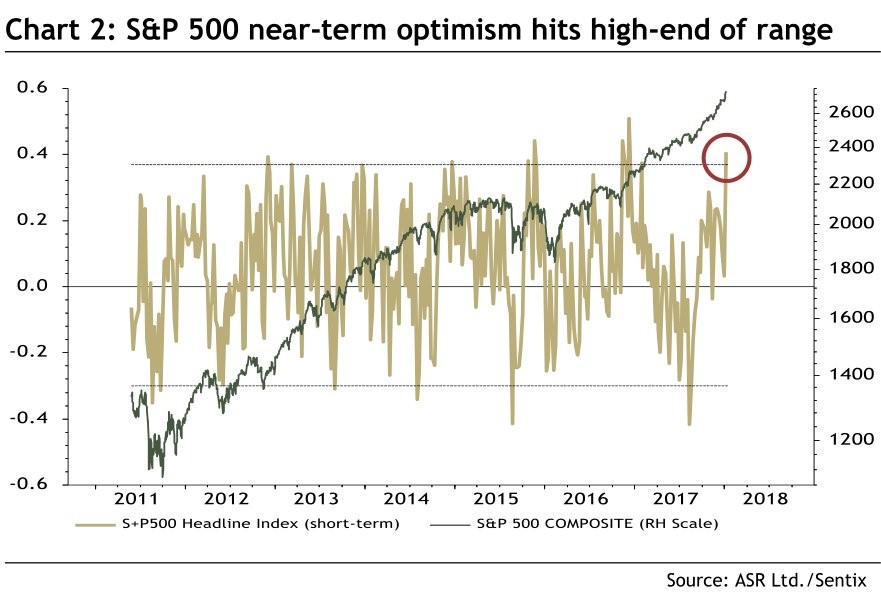

My bearishness on high yield debt hasn’t worked out yet either as the HYG is up 0.64% year to date. Anything which is risky is catching a big at a higher rate than last year. The chart below shows us what we already know; the sentiment is high. It is the highest since late 2016. Since 2013, the bull market has continued regardless of whether the near term optimism has reached extreme levels. As we’ve discussed, low volatility and high sentiment beget higher optimism and lower volatility. It’s a self-fulfilling situation until a catalyst derails it.

S&P 1500 Estimates Also Look Good

While the high sentiment implies stocks are in a euphoric bubble, that’s not what’s happening. The earnings are backing up the rally making this time different. It’s easy to wax poetically about how long term returns will be low, but as long as the earnings come through, the intermediate term performance will look good. We’ve discussed the solid results that are expected to be reported in the S&P 500, starting this week. The chart below supports that concept as the 4 year rolling total S&P 1500 earnings estimate revisions are in the strongest uptrend since at least 2008. Earnings growth won’t be the fastest of this cycle because the 2010 earnings results had easy comparisons, but the results will be the most impressive. It’s unprecedented to see such a sharp push higher at the end of a cycle. That’s what happens when tax cuts come 9 years into an expansion.