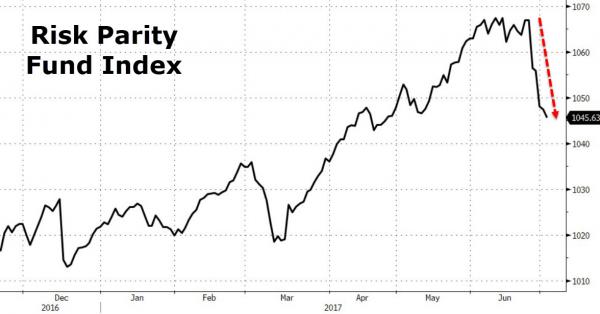

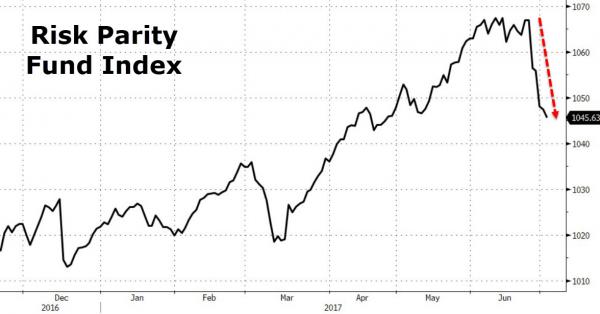

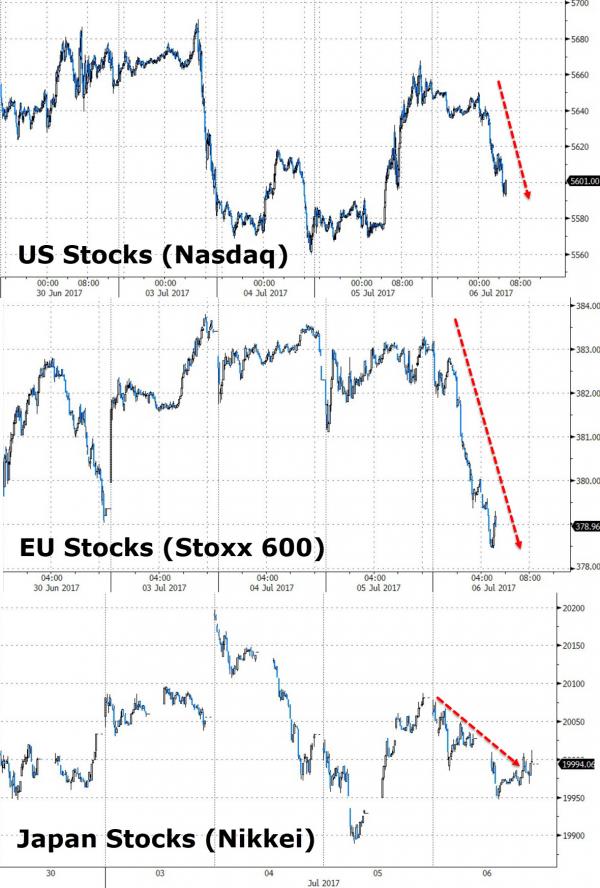

As Risk-Parity funds begin their 7th down day in a row – the biggest decline since Sept 2016 – so global bonds and stocks are feeling the leveraged unwind.

Something just changed:

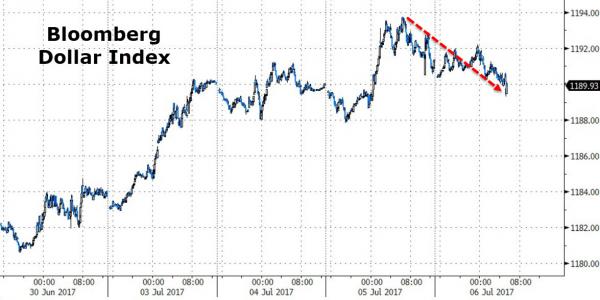

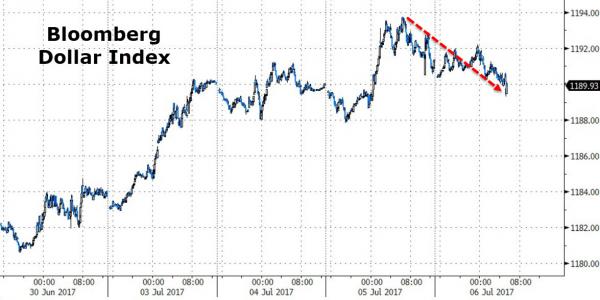

The dollar is limping lower…

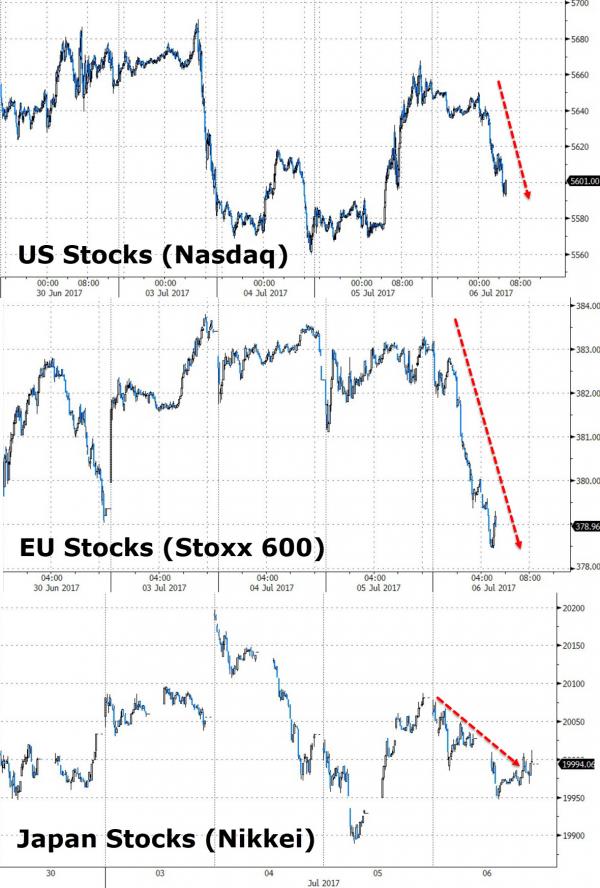

Stocks are in trouble…

And so are global stocks…

NOTE: 10Y JGB yields are back above BoJ’s crucial 10bps level.

Also of note, this morning we got the ECB’s cautiously hawkish minutes. While the overall tone was cautious, Citi highlights that there are certainly some interesting extracts specifically pertaining to changing communication on QE easing bias and the impact on markets. We highlight below with our own emphasis:

On QE easing bias: While there were valid reasons at this juncture to retain the APP easing bias, it was noted that, as the economic expansion proceeded and if confidence in the inflation outlook improved further, the case for retaining this bias could be reviewed. More generally, it was highlighted that the overall degree of policy accommodation was determined by the combination of all the ECB’s monetary policy measures in place and not just the sum of individual policy measures.

On communication being misinterpreted: At the same time, it was cautioned that even small and incremental changes in the communication could be misperceived as signalling a more fundamental change in policy direction. This could trigger unwarranted movements in financial conditions, which could put the prospects of a sustained adjustment of inflation at risk.

On financial conditions: it was remarked that, as the economic conditions and fundamentals in the euro area improved further, also compared with other regions in the world, some tightening in financial conditions, notably with respect to bond and foreign exchange markets, was to be expected.

On the impact of elections: Political risks inside and outside the euro area also remained relevant, even though they had diminished somewhat. In this context, a call was made not to overestimate the impact of normal electoral cycles on economic confidence or on financial market developments