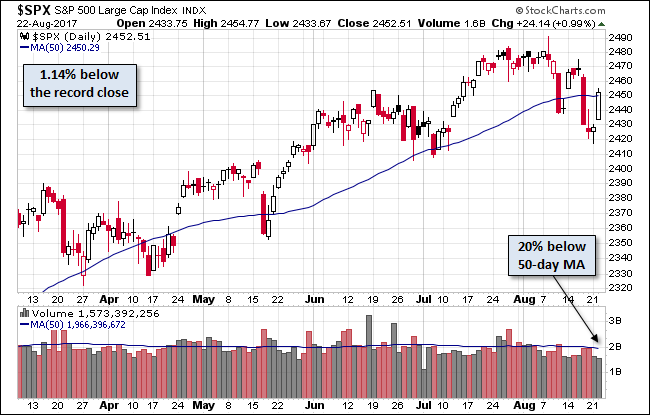

On Tuesday, the S&P climbed throughout the day and closed with a gain of 0.99%. The index saw daily losses in 2 of the last 5 market days and is up 9.54% YTD.

The U.S. Treasury puts the closing yield on the 10-year note at 2.22%.

Here is a daily chart of the S&P 500. Today’s selling puts the volume 20% below its 50-day moving average.

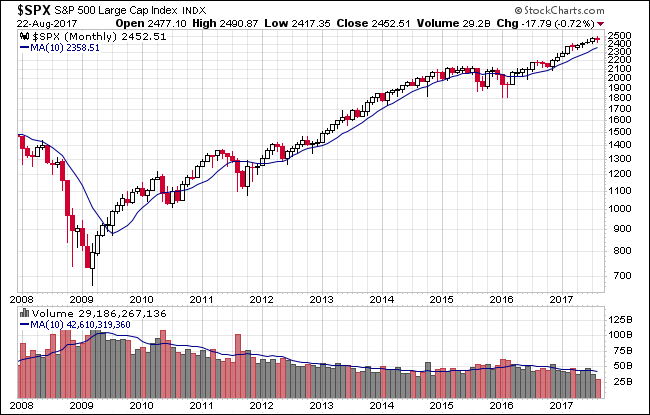

Here’s a monthly snapshot of the index going back to December 2007.

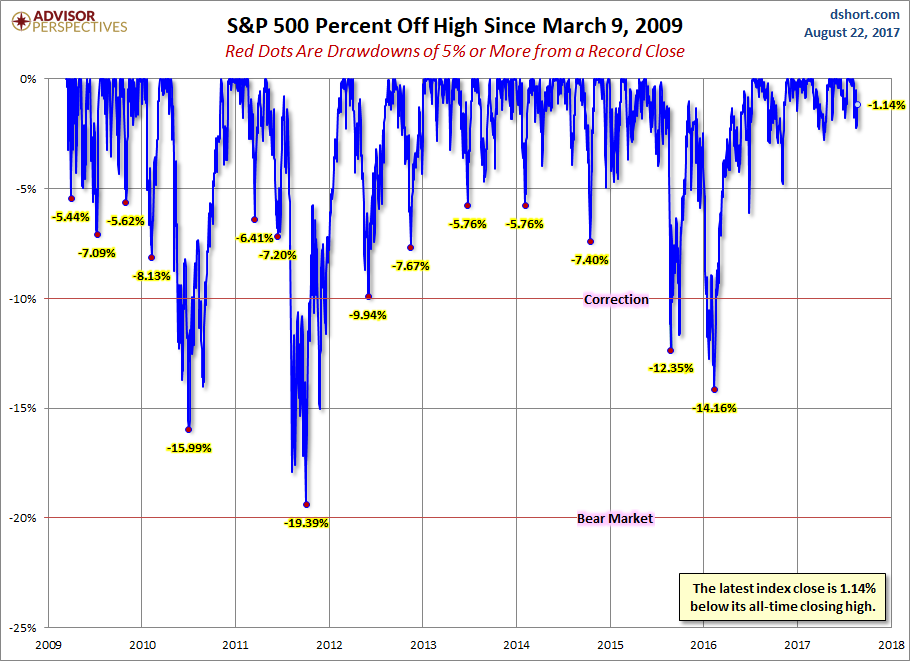

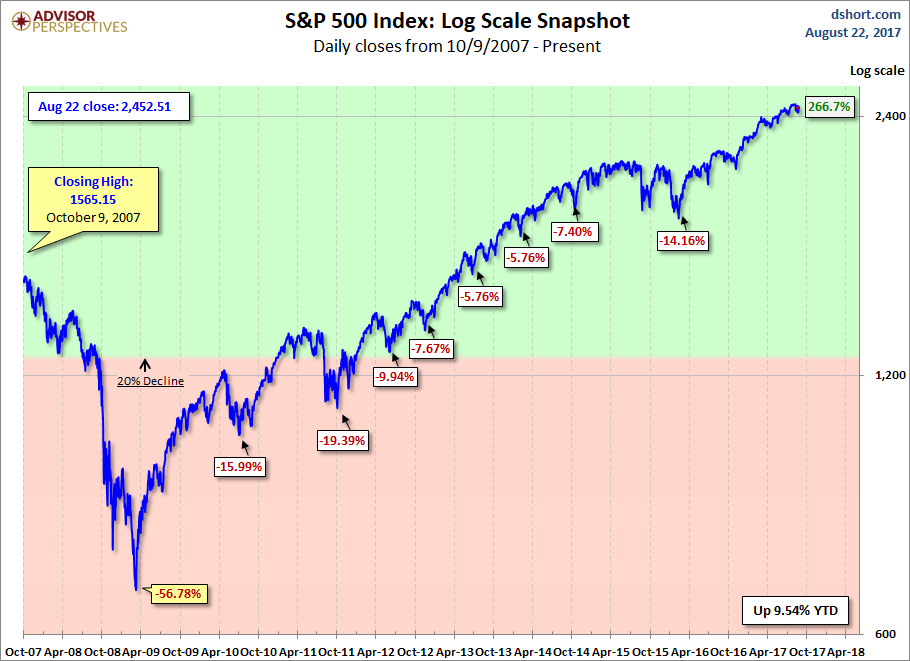

A Perspective on Drawdowns

Here’s a snapshot of record highs and selloffs since the 2009 trough.

Here is a more conventional log-scale chart with drawdowns highlighted.

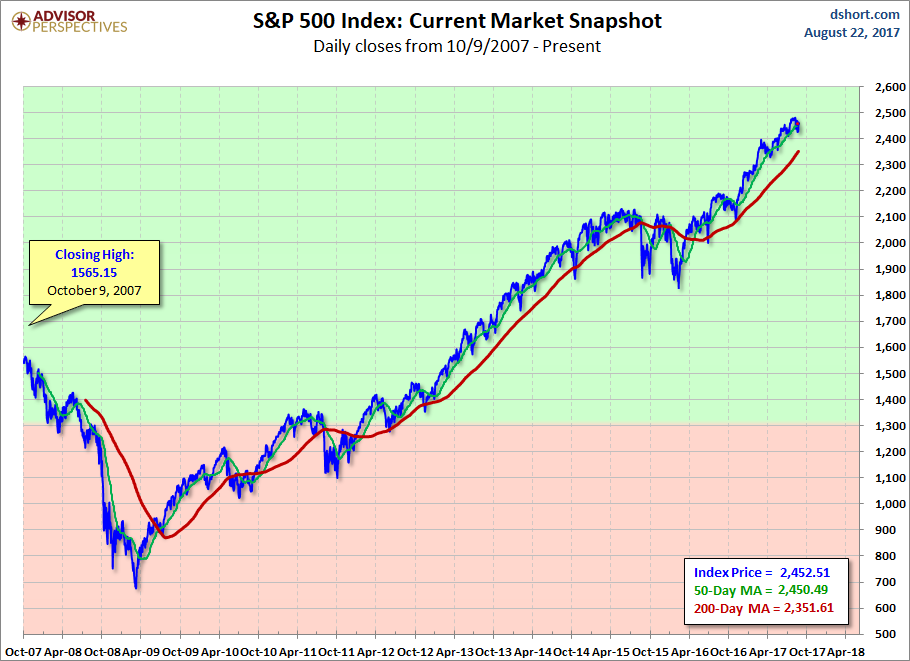

Here is a linear scale version of the same chart with the 50- and 200-day moving averages.

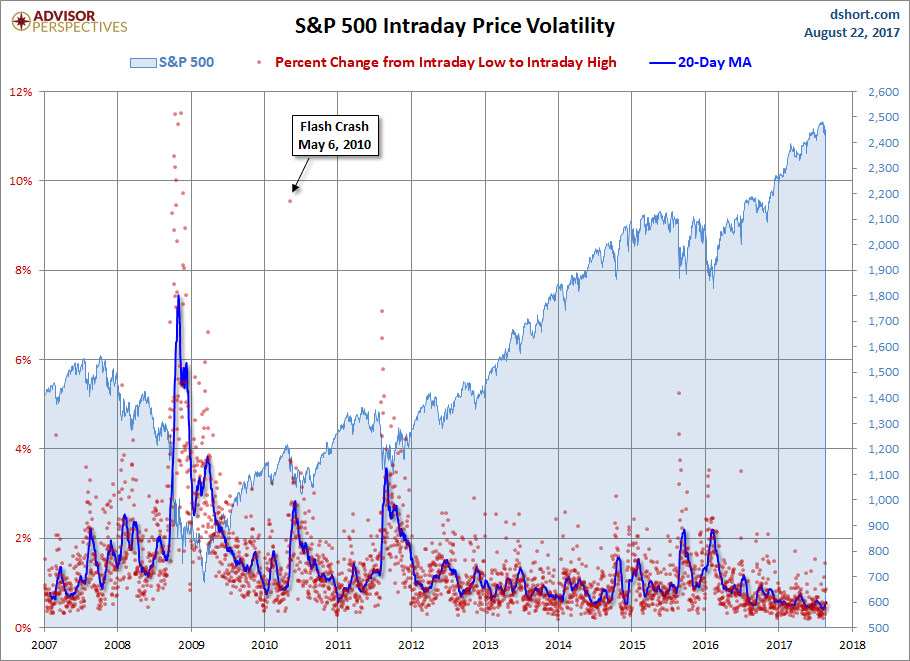

A Perspective on Volatility

For a sense of the correlation between the closing price and intraday volatility, the chart below overlays the S&P 500 since 2007 with the intraday price range. We’ve also included a 20-day moving average to help identify trends in volatility.