By John Davi, ETF.com

First, let’s address the recent FOMC announcement, which always brings a healthy amount of debate.

The Fed told us that inflation was softer while economic growth was stronger. It has more conviction in its near-term policy path, while it lowered the long-run neutral rate.

From a big-picture standpoint, the Fed still remains very accommodative, and the same goes for other central banks globally. We still have an upswing in the global earnings cycle that supports international equities whose margin of safety is higher compared to U.S. stocks. Lastly, with the Fed lowering the neutral rate, income strategies should continue to remain in vogue.

Astoria Portfolio Advisors believes the following offer an attractive risk reward: international equities, U.S. small-caps and U.S. cyclicals. And for income strategies, we believe that preferreds, senior loans, emerging market debt, munis and master limited partnerships are attractive.

Let’s walk through a few select ideas.

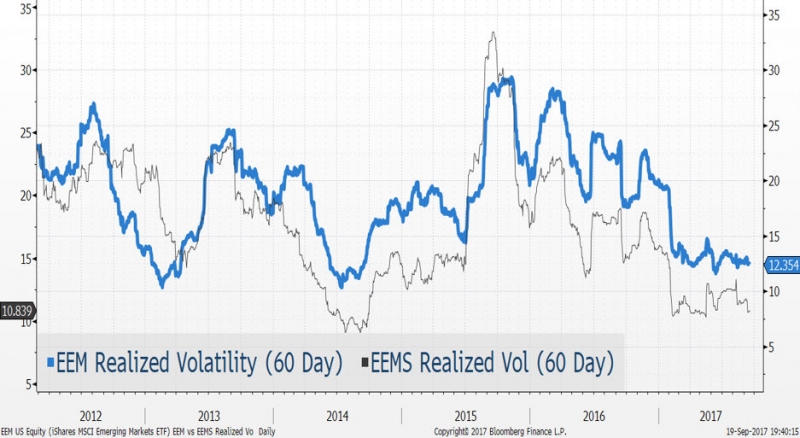

We remain constructive on EM equities given the weaker dollar, lower rates and cheaper valuations.

Sources: Bloomberg, Astoria Portfolio Advisors LLC