I’m focused on the medium-term trend at the moment, and it looks like a downtrend has probably started with a target of a low around mid to late September. I will wait until the end of the week to confirm.

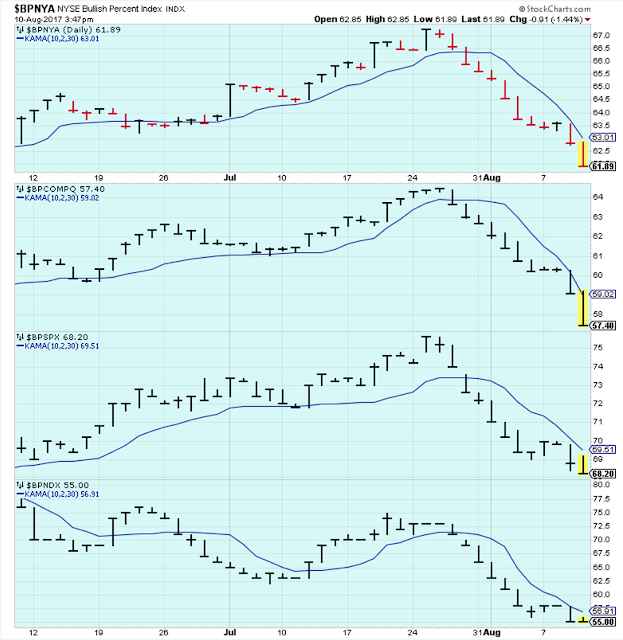

The bullish percents continue to point lower, but I think it is interesting to note that the NDX didn’t tick lower today despite the brutal selling in the general market.

The medium-term may be just starting to turn lower, but the short-term trend has been pointing lower for a couple weeks and it is looking oversold. So, if some of the global tensions were to improve, then we could get a sharp, short-term counter rally.

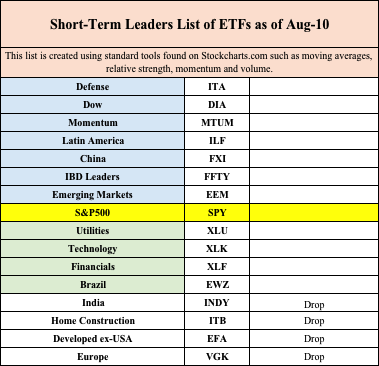

The Leader List

Treasuries were strong, and everything else was weak.

The headlines are that this is a flight to safety trade, but it looks like there have been buyers of TLT going back a few months.

You know it is a bad day when momentum stocks close below the 20-day average.

Outlook

The long-term outlook is positive.

The medium-term trend has probably started to turn lower. Wait for the end-of-week confirmation.

The short-term trend is down as of July-28. Stocks are now short-term oversold.