In the aftermath of the October 15th, 2014 Treasury flash crash that was much fake “confusion” among the punditry about what caused the dramatic 20-sigma move in the 10 Year treasury. For us, however, there was no confusion, it was all due to a vicious case of HFT algo quote stuffing – a key component of algos trying to establish whether there are credible size orders to be frontrun – gone horribly wrong.

Several months later, in July, the Joint-Staff Report released by the Treasury, Fed, SEC and CFTC confirmed as much, and even if they didn’t explicitly single out HFTs as the culprit for the flash crash (that would mean having to redo the topography of the market, in the process gutting and redoing the entire market structure after tacitly admitting the market is broken), they did very clearly note that it was “self-trading”, or quote stuffing, that was responsible for the unprecedented move.

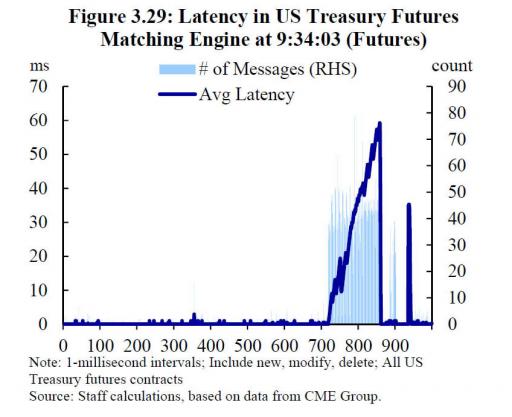

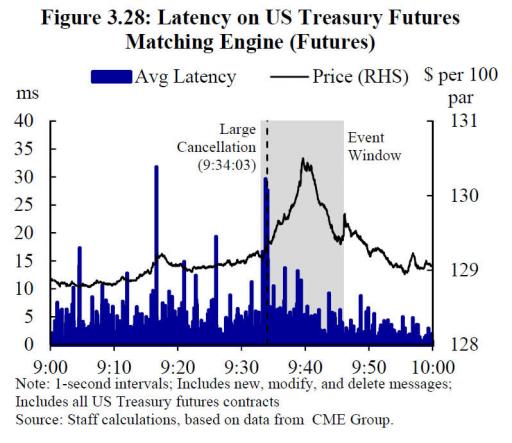

Here are the only two charts that mattered from that report:

As we thoroughly documented back in July, this is what the staff report said: “Given the finite capacity of any matching engine to simultaneously process messages and execute matches between buyers and sellers, extremely high message rates appeared to cause trading platform latency to temporarily jump higher”, or as we explained it ” a massive burst of quote stuffing (seen with absolute clarity on Figure 3.29 above) in the form of a surge in messages, resulted in a burst of accumulated order latency, which in turn was the catalyst to send the price soaring from 129 to over 130 in the span of 5 minutes, and then sliding back down again once the quote stuffing effect was eliminated.”

Which brings us to our documented back in July, :

… what is surprising is that unlike the SEC’s Flash Crash report which was a travesty and blamed the crash on Waddell and Reed, to be followed by another travesty of a report, one which has sent an innocent trader behind bars, this time HFT is explicitly, if not deliberately, singled out.

Which in our opinion sets the stage. The stage for what? Why blaming the upcoming market crash on HFTs, of course. As Bloomberg commented, these findings “will probably add to regulatory scrutiny of the industry.”

The reality is that regulators know very well what is really going on in the markets, and now that HFTs have been exposed as the catalyst for the bond market crash, when the inevitable stock market crash – a crash that will be the result far more of the ruinous decisions of central planners around the globe – it will be the HFTs, pardon, PTFs that will be the first to blame, while the central bankers do their best to quietly slip out to a non-extradition country.

Just look at China: the government is so terrified of losing control over its own stock market bubble and the potential for violent, social conflict that would result, that it will throw everything at the market to support it. In the US, the regulators are already one step ahead: they know a crash is inevitable, and the only thing they need is the scapegoat to blame it on when it all comes crashing down.

Nameless, faceless algos would be just the perfect scapegoat.