India, the world’s seventh largest economy today, will grow to be the world’s second-largest by 2050 according to PWC, outpacing the US economy by around 33% as the sleeping giant reaches financial maturity and modernizes its economy.

This potential presents an enormous opportunity for investors. Bank of America published a report illustrating the opportunity last week, outlining the key drivers behind the country’s growth.

Financial Maturity Will Turbocharge Growth

BoA’s report titled, “The Last BRIC In The Wall” claims that India will overtake Japan to become the world’s third-largest economy within ten years and financial maturity and a demographic dividend starts to pay off.

“Rising saving and investment rates, driven by falling dependency ratios, should fund high 7% real growth (even assuming the current no total factor productivity growth) for the next 10 years. The dependency ratio is slated to fall to 46.2% in 2028 from 52.2% now and 71.7% in 1990. This should sustain the saving rate at 32% of GDP, at the least, in 2028, comparable to 31.4% in 2000-17 up from 20.5% in 1980-1990s.”

Saving and investing will drive part of India’s growth over the next decade. A rising saving rate should push up the investment rate to 35% of GDP in 2028 from 32.4% now and 22.1% in 1980-90s. With the country’s population saving and investing, industry has the financial backstop it needs to be able to capitalize on the region’s commercial maturity and transformation into a consumer-driven economy. BoA believes that, India’s development will be powered by capital accumulation rather than efficiency gains, which should drive economic growth to 10% from 7.1%. A well-educated, young workforce will only compliment the capital investment.

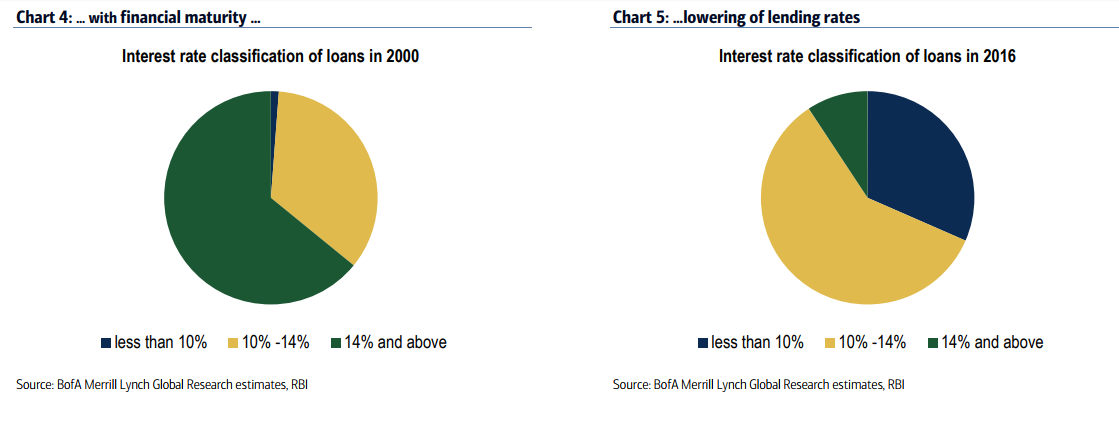

Financial maturity coupled with the demographic dividend will create a powerful combination. The credit to GDP ratio, a proxy for financial maturity, should climb to 83% from 44% (2001-17) and 25% during 1980-90s according to BoA’s report. Development of financial markets. This, in turn, is pulling the structure of interest rates lower. The share of loans, advanced at lending rates of 14+%, has fallen to 9% of total now from 64% in 1996.