Following yesterday’s dramatic geopolitical shock, U.S. equity index futures rise as Russia has not escalated the confrontation with Turkey as some had feared, while Asian shares fall, reversing earlier gains. European stocks are rallying and the euro is falling on the back of a Reuters report that the ECB is mulling new measures to prop up lending, although it’s not clear at this point what the real impact from these measures would be.

As a result, global stocks are little changed for a second day as investors assess the geopolitical fallout from the downing of a Russian warplane by Turkey. U.S. President Barack Obama and French President Francois Hollande called for Russia and Turkey to avoid escalating the confrontation. Hollande meets German Chancellor Angela Merkel in Paris today before heading to Moscow tomorrow to meet President Vladimir Putin.

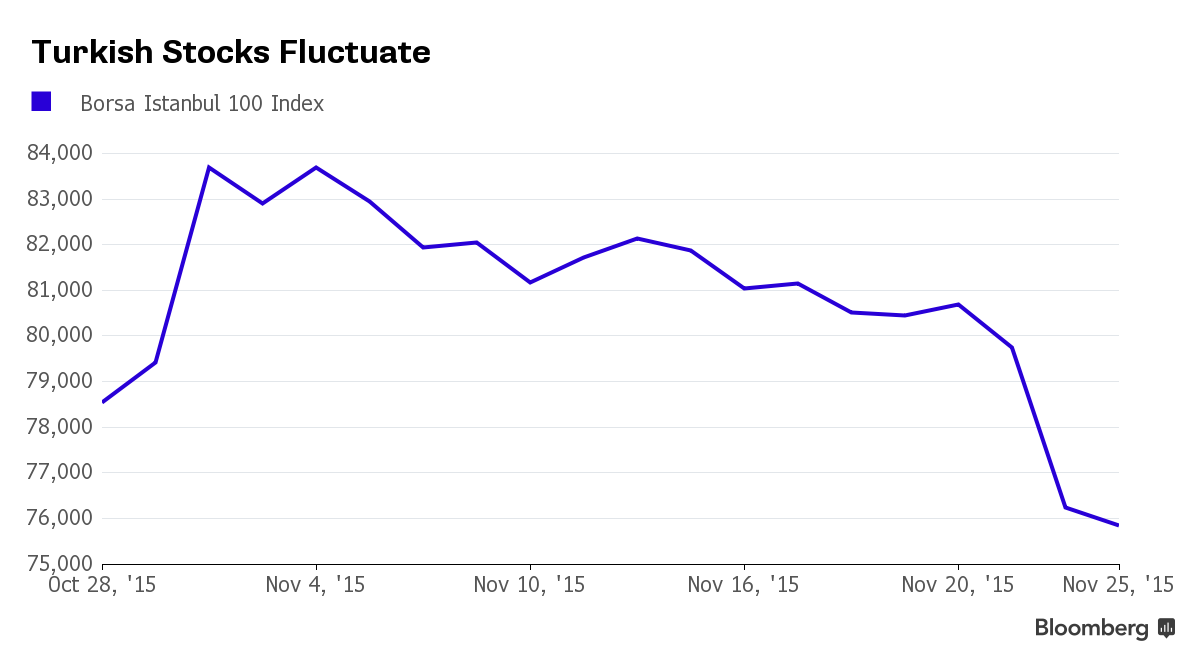

As Bloomberg reports, Tuesday’s worst performing global equity benchmarks are experiencing differing fortunes today. On Tuesday Turkey’s Borsa Istanbul Index sank 4.4 percent, the most in four months.

Russia’s RTS Index dropped 3.3 percent, the most since Sept. 1. Today Russian stocks rose as much as 1.6 percent, while Turkish equities fluctuated between gains and losses. Russia was the biggest source of Turkey’s imports in 2014, while some 12 percent of all tourists to Turkey were from Russia last year, according to Renaissance Capital. Turkey is Russia’s second-biggest market for gas exports, and relies on Gazprom to meet half of its gas needs. Turkey’s lira fell for a third day against the dollar.

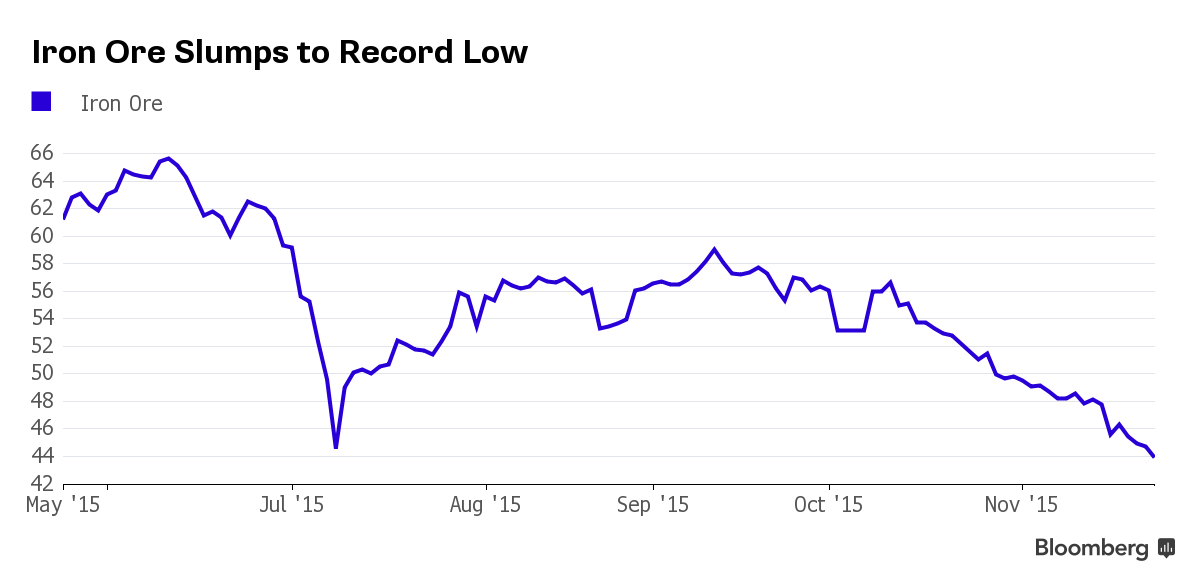

Elsewhere the commodity rout continues, and the rout in iron ore continues. Today it slumped to the lowest since 2008 as output cuts at Chinese steel mills hurt demand. China accounts for half of global steel output. At the same time, mining companies like BHP Billiton and Rio Tinto are continuing to expand low-cost iron ore supplies. Ore with 62 percent content delivered to Qingdao, a global benchmark, has sunk 38% in 2015 to just above $43 a dry metric ton and is on track for a third consecutive annual decline.

Oil, gold and copper decline while food commods gain. Dollar also advances. The top overnight news stories include the aftermath of Turkey’s shooting of Russian bomber, SEC suit of former Goldman compliance worker, UnionPay/Apple agreement, U.S. Senate Committte’s pending review of inversions, and China data offering early glimpse of 4Q.

Moving the FX market was news from Reuters that the ECB is discussing 2-tiered bank charges, and bond buys, namely that the ECB mulls

staggering charges for banks that park money with central bank or

buying more debt.

Market Wrap

Looking at regional markets, Asian equity markets traded mostly lower despite the flat close on Wall St., as geopolitical uncertainty dampened risk sentiment. The ASX 200 (-0.3%) was pulled lower by consumer staples amid profit taking in retail giant Woolworths. Financials underperformed in the Nikkei 225 (-0.4%) as several large banks including Nomura are told to increase their capital ratio. Shanghai Comp. (+0.9%) swung between gains and losses as broad sector strength was offset by losses in brokerages amid speculation that the recent rally had been overdone. 10yr JGBs traded higher as the risk off tone drove inflows into the paper, while a better 20yr JGB auction where b/c was at its highest YTD also stoked demand into the 10yr.

Key Asian Data: