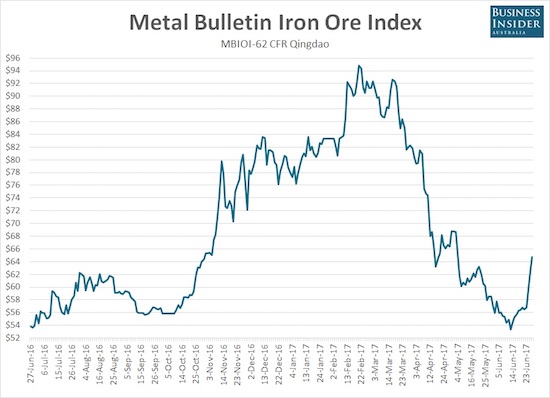

I have been bearish on the Australian dollar (FXA) for quite some time now. My main driver was a reversal in fortunes for soaring iron ore prices that in turn weighed down the currency. Iron ore prices rebounded so much since hitting one-year lows last month that the raw ingredient for steel is now technically in a bull market.

Iron ore has experienced a very sharp rebound in recent weeks.

Source: the raw ingredient for steel is now technically in a bull market

Even if iron ore pulls back and cools off a bit from here, I think this spike in buying interest looks strong enough to create a fresh bottom for prices. On that basis alone, I need to drop my bearishness on the Australian dollar.

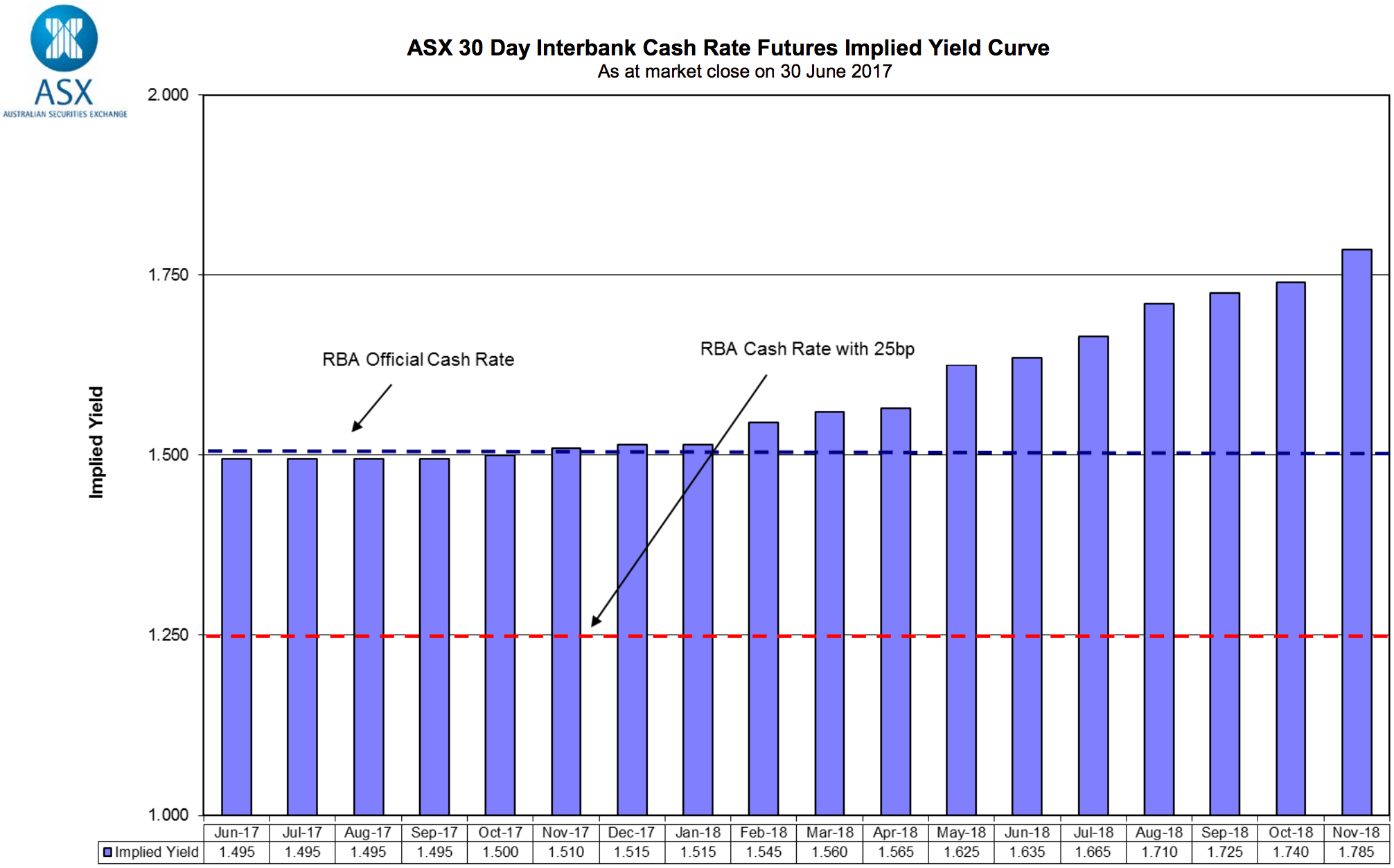

Interest rate expectations also opened my eyes on the Australian dollar. The ASX 30 Day Interbank Cash Rate Futures Implied Yield Curve shows that market participants no longer expect any further rate cuts. Instead, they are expecting a small rate hike sometime in 2018.

Click image for a larger view…

Currency markets are looking forward to a slightly higher interest rate for Australia in 2018

Source: ASX RBA Rate Indicator

John Edwards, a director of the Committee for the Economic Development of Australia (CEDA) and former board member of the Reserve Bank of Australia (RBA), recently went as far to suggest that 2018 to 2019 will deliver EIGHT rate hikes from the RBA in 25 basis point bites. Writing at the Lowy Institute in a piece titled “Rising interest rates and the RBA“, Edwards makes the simple argument that the RBA needs to hike by 2 percentage points based on the Bank’s own economic projections:

“If inflation does indeed return to 2.5%, as the Bank now expects, if growth does indeed return to 3% ‘within a few years’, as the minutes of the June board meeting predict, if the world economy is indeed picking up, then a policy rate of 1.5% is too low.

Let’s say for argument the RBA wants to start next year and get to 3.5% in two years, which is surely within the range of outcomes it would think about. If each increase is 25 basis points, it needs to make eight of them, or say four a year. This implies that within three years Australia’s economic world has returned to more-or-less normal, with wages growth of 3.5%, inflation of 2.5%, and output growth of 3%. But this is, after all, exactly the forecast that both the Bank and the Australian Treasury publicly offer.”