EU Session Bullet Report – USD trades lower ahead of the FED

The USD is weakening against low-yielding currencies like the EUR, JPY and CHF but strengthening against commodity currencies like the CAD. EURUSD hit a one month high at 1.1047 before retreating.

On the contrary, the GBPUSD weakened after dovish remarks from a BoE member mentioning that he ‘won’t vote for a rate hike until convinced wage growth will be sustained at a level consistent with inflation target; for the record, BoE is expected to be the next bank after the FED that will raise rates.

As oil prices continue to be under stress (+0.08%) stock markets continue to feel the pressure, dragged down mostly by energy stocks. German DAX dropped more than 2% however, in the US, major indexes erased early losses and marked gains as oil prices found support.

The declining oil price trend is still in place, though, and it is too early to call the bottom.

Key market drivers continue being the FED rate decision tomorrow and the developments in oil prices.

The last piece of interesting US data ahead of the Fed decision will be released today with the November US inflation numbers.

Trading quote of the day:

If past history was all there was to the game, the richest people would be librarians. – Warren Buffett

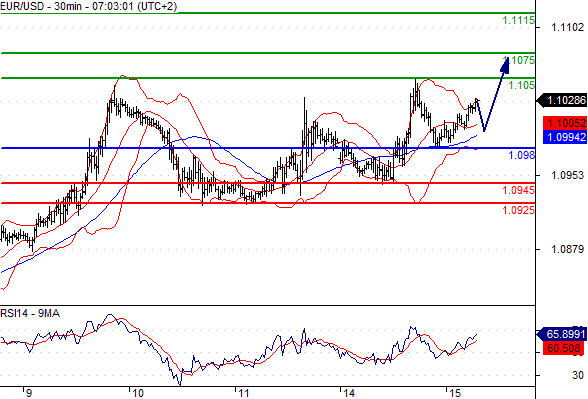

EUR/USD

Pivot: 1.098

Likely scenario: long positions above 1.098 with targets @ 1.105 & 1.1075 in extension.

Alternative scenario: below 1.098 look for further downside with 1.0945 & 1.0925 as targets.

Comment: the RSI is bullish and calls for further upside.

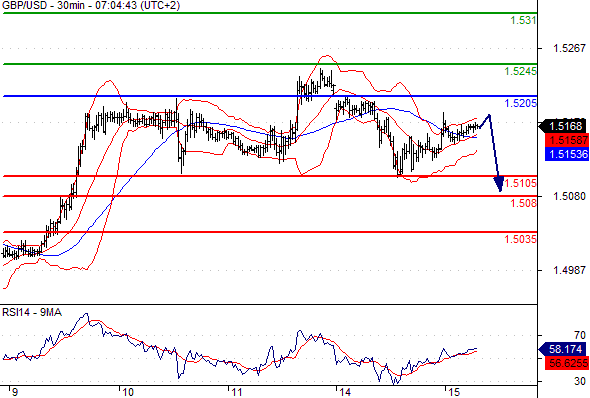

GBP/USD

Pivot: 1.5205

Likely scenario: short positions below 1.5205 with targets @ 1.5105 & 1.508 in extension.

Alternative scenario: above 1.5205 look for further upside with 1.5245 & 1.531 as targets.

Comment: as long as the resistance at 1.5205 is not surpassed, the risk of the break below 1.5105 remains high.

AUD/USD

Pivot: 0.719

Likely scenario: long positions above 0.719 with targets @ 0.728 & 0.731 in extension.

Alternative scenario: below 0.719 look for further downside with 0.7155 & 0.713 as targets.

Comment: technically the RSI is above its neutrality area at 50.