After six weeks of consolidation I’m starting to see a lot of encouraging signs. It appears that the market finally wants to move higher. Our measures of risk and quality have now joined our measures of market strength in positive territory. If they can hold into Friday’s close we’ll be reducing our hedges and adding longs to the portfolio.

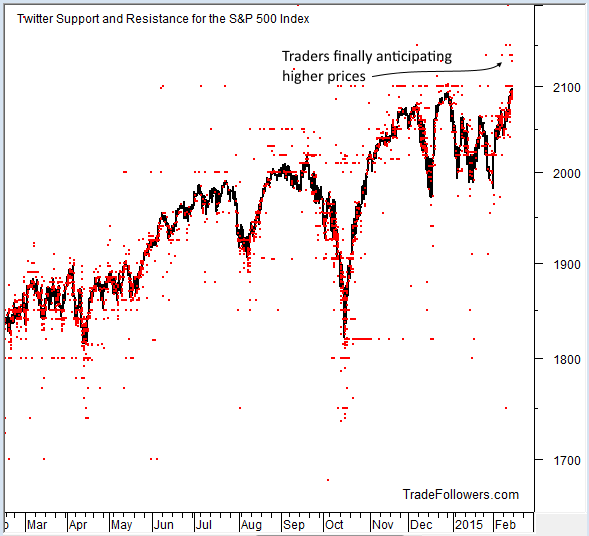

Here are a few things I’m seeing from Trade Followers that bolsters the argument for a rally above 2100 on the S&P 500 Index (SPX). First is support and resistance levels. After months of next to no tweets above current prices, traders are now projecting prices as high as 2200. The majority of tweets are near 2040 and 2050 so a break above the strong resistance level of 2100 should carry to a minimum of 2040.

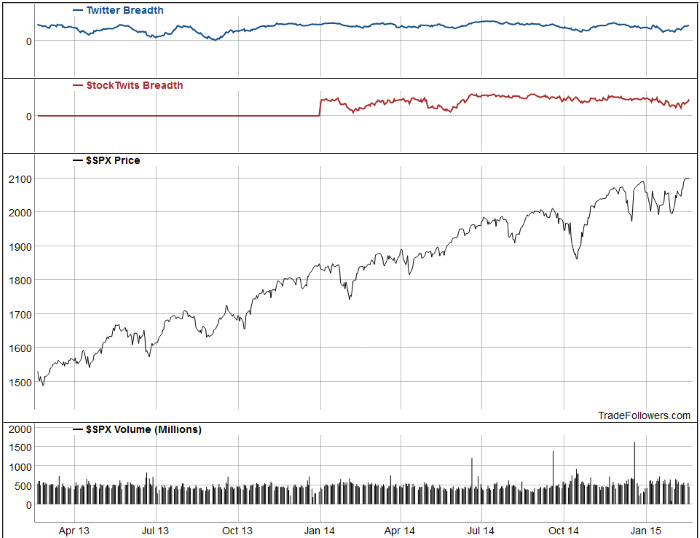

Another thing that is improving is breadth. The number of strong stocks is rising and the first few days of this week saw the number of weak stocks fall even though the market is pausing at 2100. This is in line with other measures of breadth that I track and suggests that buying is getting more wide spread.

Bottom line, it looks like the market is getting ready for another push higher after some healthy consolidation. It’s time to get your buy list ready. Here are some stocks that are turning bullish that you might want to explore as candidates.