The safe haven currencies returned to favor this week as mounting tensions between the United States and North Korea saw investor’s trim their risk appetite. The currencies gained despite some risks. For example, the Swiss franc which is also a sought after safe haven currency always faces the risk of central bank intervention from the Swiss national bank.

Staying in line with his rhetoric, the US President Donald Trump said that he would hit North Korea with “fire and fury” amid facing falling approval ratings and widespread reshuffling of his cabinet. President Trump also said that he would hit North Korea with the likes that the world has never seen before.

The strong words from Trump saw an equally strong threat from North Korea which responded that it would hit the island of Guam in the Pacific. The back and forth rhetoric saw investors rushing to bonds and sending the yields lower, alongside a pick up in the safe haven currencies.

Gold, traditionally seen as a safe haven bet also posted strong gains. The precious metal rallied to a two and a half month high. Still, the precious metal remains broadly trading in a range for the past four months. Price action in gold suggests that the yellow metal is trading within the range of 1296 and 1212.

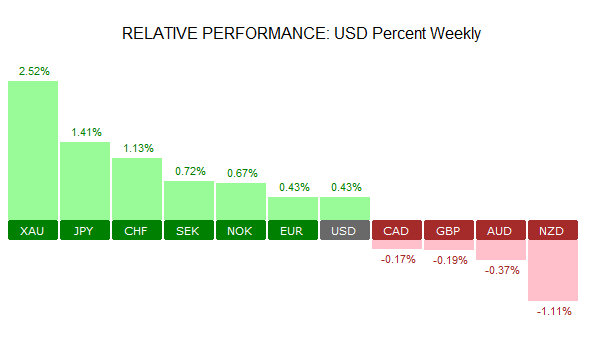

USD Weekly Performance: Week ending August 11, 2017

Investor concerns were also aptly reflected by the CBOE VIX index. Known as the fear index, the CBOE Volatility Index spiked to 15.51 by Friday’s close.

US Consumer prices rise 0.1% in July

Consumer prices in the United States rose 0.1% in the month of July. The data was disappointing as economists forecast a 0.2% increase in consumer prices. On a year over year basis, consumer prices in the U.S. are up 1.7%. The core CPI, which excludes the volatile food and energy prices was seen rising 0.1% in July. This was also below the estimates of a 0.2% increase. Core inflation is also up 1.7% on the year.

U.S. Inflation Rate YoY: 1.7% (July 2017). Source: Tradingeconomics.com