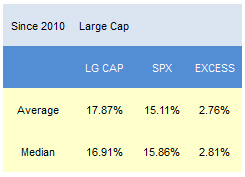

Since 2010, the top scoring stocks in our large cap report each week have outpaced the SPX by a median 281 bps in the following year.

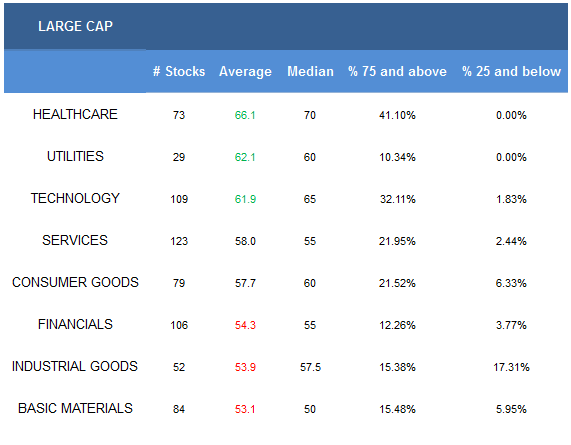

The average large cap score is 58.10, which is below the 59.73 average score over the past four weeks. The average large cap stock in our large cap universe is trading -12.02% below its 52 week high, 3.59% above its 200 day moving average, has 4.12 days to cover held short, and is expected to grow its EPS by 14.09% next year.

The best large cap sector to own is healthcare. Utilities and technology also score above average, which isn’t uncommon at this time of the year. Services and consumer goods score in line with the average universe score. Financials, industrials, and basics score below average — stay stock specific and underweight until scores improve.

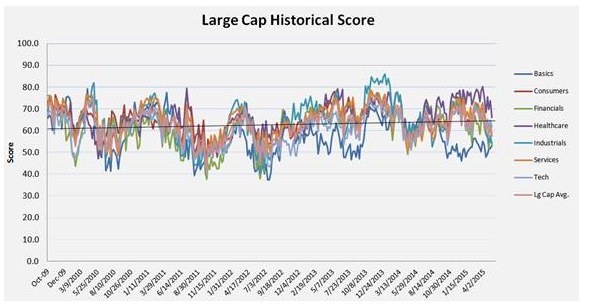

The following chart shows historical sector scores across large cap since 2010.

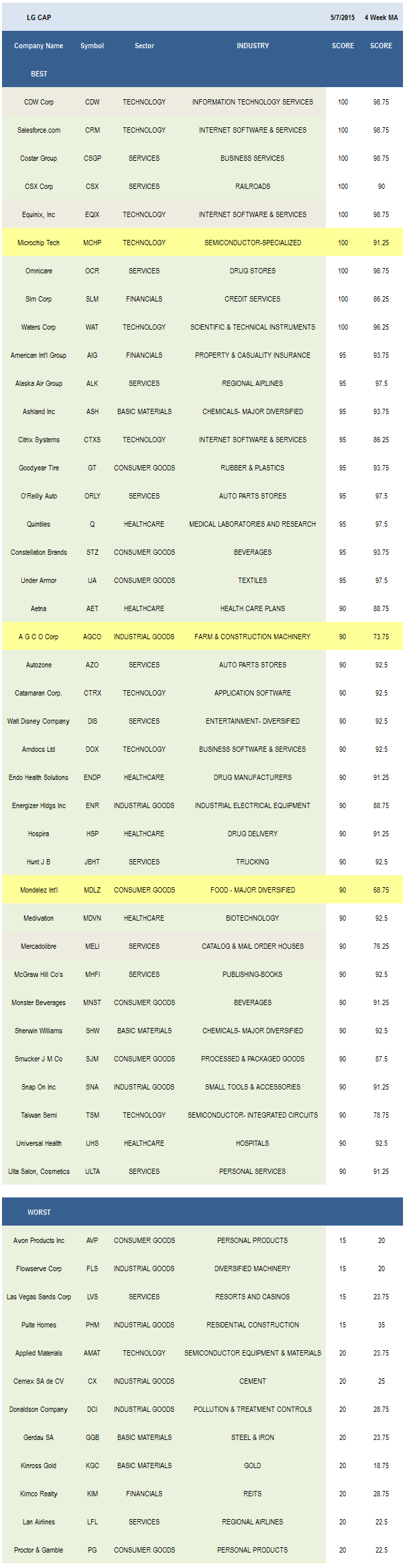

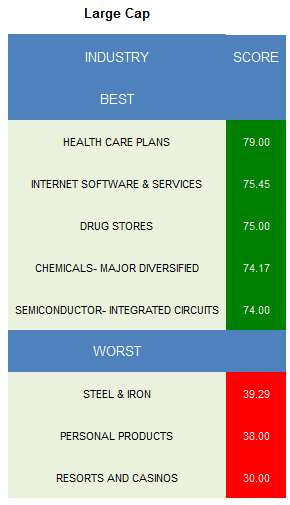

The best scoring large cap industry is healthcare plans (AET, HUM, ANTM). Healthcare plans have been over-delivering on sand-bagged projections since the ACAs launch and the trend continued in Q1. Internet software (EQIX, CRM, CTXS, VRSN, AMZN) is strong scoring, as are semiconductor ICs (TSM, SUNE, SWKS, BRCM). However, as a reminder, semi seasonal strength tends to taper off in the second quarter alongside a peaking in book-to-bill ratio. Drug stores (OCR, RAD, CVS) offer upside as an increasingly older and insured population boosts script same store sales growth and large operators continue to benefit from leveraging buying power. Specialty pharmacy valuation is also being bumped up by M&A chatter. Major chemicals (ASH, SHW, EMN) are also strong scoring thanks to lower input costs and the potential for global economic expansion amid EU QE.

Major chemicals are the only buyable basket across big cap basics. In consumer goods, focus on auto parts (JCI, TRW, LEA, ALV), cigarettes (RAI, LO), and major food. Continue to watch EU vehicle registration data, which is suggesting higher production rates and parts demand. Defensive consumer groups do tend to hang in better during the tepid summer season — plan accordingly. In financials, only credit services (SLM, MCO, EFX, DFS) and S&Ls (NYCB) are above average. Healthcare plans, drugmakers (ENDP, VRX, VRTX, PFE, NVS, ABBV), and biotech (MDVN, GILD, CELG, BMRN) can be bought in healthcare. Only aerospace/defense (TDG, SPR, BA, GD) scores above average in industrials. Historically, aerospace has been a solid performer leading up to the summer air show season. In services, concentrate on drug stores, diversified entertainers (DIS, TWX), and discount/variety stores (DLTR, DG, TGT). Internet software, semi ICs, and scientific & technical instruments (WAT, MTD) are best in technology. Utilities (EQT, HNP, EIX) score above average, in part because of falling scores in other baskets.