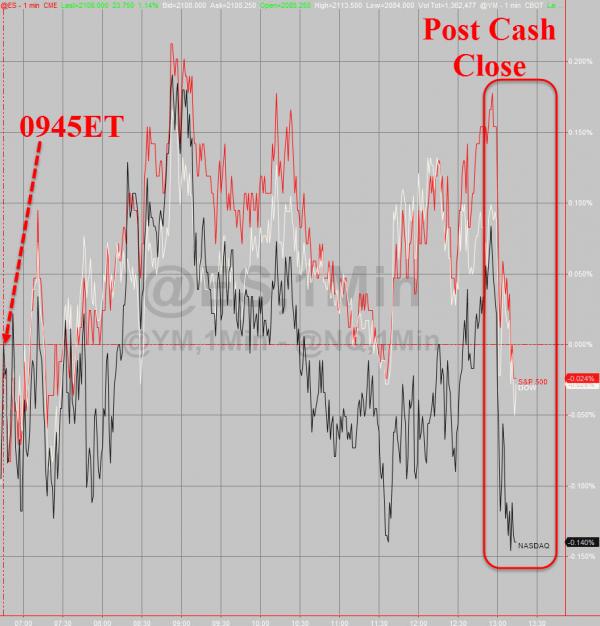

UPDATE: After the cash close, futures have tumbled – removing all post-US-Open gains…

With a ‘record number of Americans not in the labor force’ and Wholesale Inventory data that strongly indicates a recession was enough to drive stocks up near all-time highs, there appears only one clip that is appropriate…

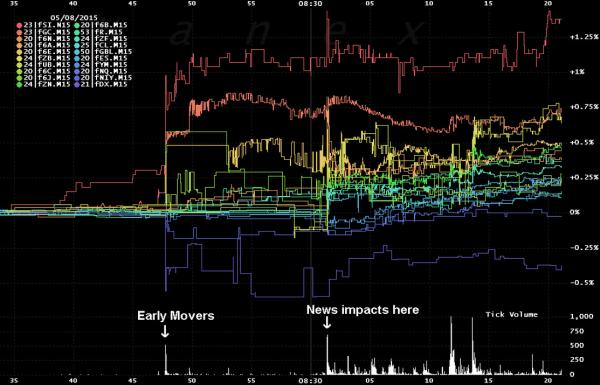

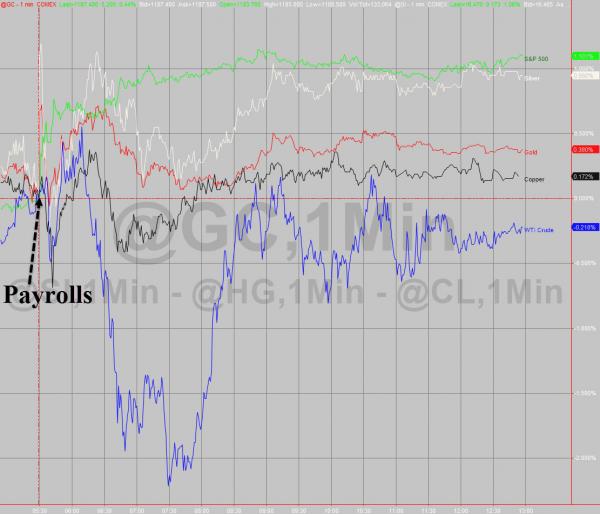

Jobs data was all that mattered and it appears it was just crap enough to warrant moar easy money… but it is clear FX and gold/silver traders appeared to get the news early…

Volume disappeared completely again…

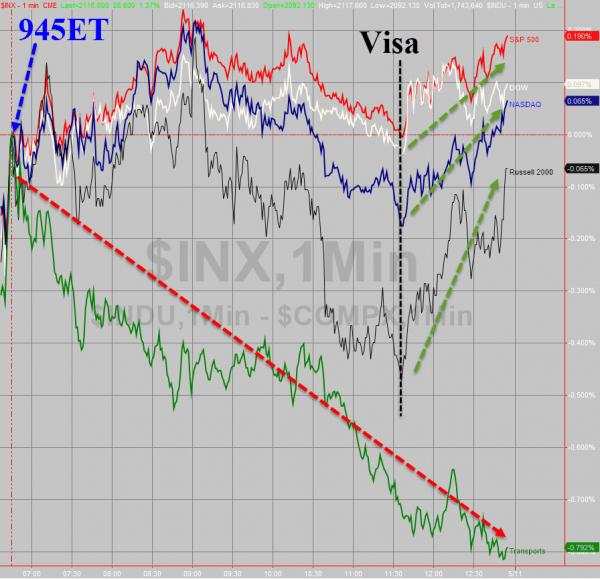

But Stocks were what mattered…Today was The Dow & The S&P’s best in over 3 months!! on shitty data!

And here are the cash indices from yesterday’s lows…

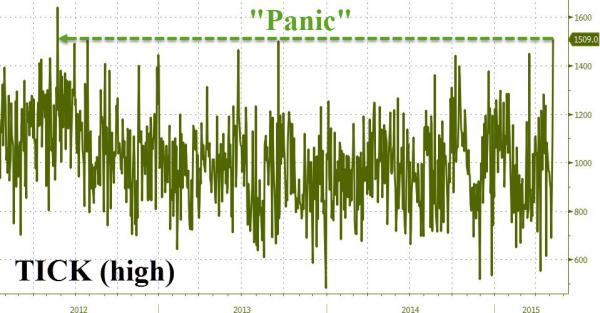

As the greatest buying panic in 3 years hit at the open…the opening TICK count was extreme to say the least…

which lifted everything green for the week (even Nasdaq briefly) – and despite the best ramping efforts Nasdaq closed the week red

Thanks to the biggest short squeeze in over 3 months…

And even with Visa’s jump helping stall the leak, from the first few minutes stocks faded all day long…

NOTE: Everything is awesome because Dow>18,000; S&P >2,100; Nasdaq>5,000

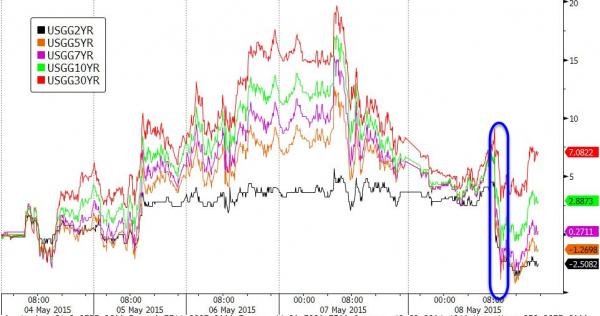

Treasuries rallied notably on the jobs data but leaked back off in the afternoon to close modestly lower in yields on the day. Yields dropped for bonds out to 7Y on the week…

The Dollar was somewhat volatile around the payrolls print but was remarkably dead today, ending the week -0.5%. The dollar is down for 4 weeks in a row for the first time since June 2013… and the worst 4 weeks since Oct 2011

Copper was the only commodity to close lower on the week with Silver up 2%. Crude scrambled back into the green after a post-Payrolls plunge…

Stocks beat Silver post-payrolls…

Crude had another crazy week… but the head-and-shoilders is clear…