The US Ministry of Truth has been hard at work the last month and nowhere is that more evident than in the blatant “tap on the shoulder” that The National Association of Credit Managers must have got this week… to revise their catastrophic indicators back to ‘stable’…

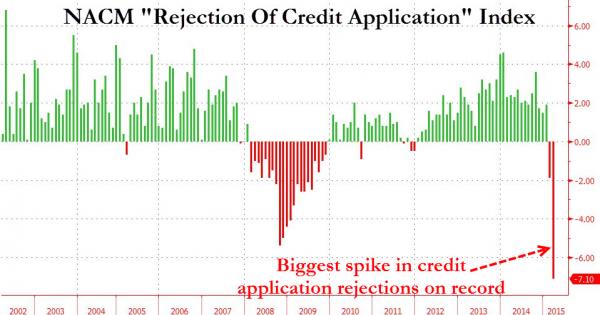

Two weeks ago we highlighted what was a stunningly clear indication of the looming recessionary environment (that The Atlanta Fed is now also seemingly suggesting and is consistent with the worst collapse in macro data since 2008). The largest spike in ‘credit application rejections’ indicated a credit crunch and “serious financial stress manifesting in the data and this does not bode well for the growth of the economy going forward.”

According to the CMI, the Rejections of Credit Applications index just crashed the most ever, surpassing even the credit crunch at the peak of the Lehman crisis.

This can be seen on the chart below.

And without any new credit entering the economy, a recession is all but assured.

More details on what may be the most critical and completely underreported indicator for the US economy. The report continues, with such a dire narrative that one wonders how it passed through the US Ministry of Truth’s propaganda meter:

By far the most disturbing is the rejection of credit applications as this has fallen from an already weak 48.1 to 42.9. This is credit crunch territory—unseen since the very start of the recession. Suddenly companies are having a very hard time getting credit. The accounts placed for collection reading slipped below 50 with a fall from 50.8 to 49.8 and that suggests that many companies are beyond slow pay and are faltering badly. The disputes category improved very slightly from 48.8 to 49, but is still below 50. This indicates that more companies are in such distress they are not bothering to dispute; they are just trying to survive. The dollar amount beyond terms slipped even deeper into contraction with a reading of 45.5 after a previous reading of 48.4. The dollar amount of customer deductions slipped out of the 50s as it went from 51.8 to 48.7. The only semi-bright spot was that filings for bankruptcies stayed almost the same—going from 55.0 to 55.1. This is the one and only category in the unfavorable list that did not fall into contraction territory and that suggests thatthere are big, big problems as far as the financial security of these companies are concerned.