One of the themes we’ve been keen to advance this year is the idea that the rally in US equities is in large part attributable to corporate buybacks. In essence, companies tap yield-starved investors in the debt market and use the proceeds to repurchase shares, thus ensuring a constant bid for their stock while artificially inflating earnings and propping up the value of equity-linked compensation at the same time. All of this comes at the expense of capex (i.e. investing in future productivity and growth) and as we’ve noted on several occasions, is easy to spot if one looks at the divergence in the percentage of companies beating earnings estimates versus the percentage of companies beating revenue estimates.

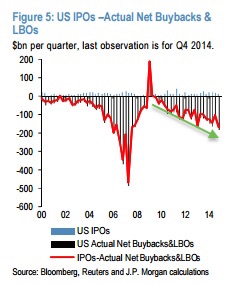

Over the weekend, we pointed to data from JPM which shows that equity withdrawal in the US (IPOs minus buybacks/LBOs) is the most negative it’s been since early 2008 and has trended lower in lockstep with the long-running rally in US stocks, suggesting yet again that in this case, correlation may indeed imply causation.

Here’s more from Morgan Stanley on the buyback binge, its relationship to the equity rally, and what it all means for corporate health: