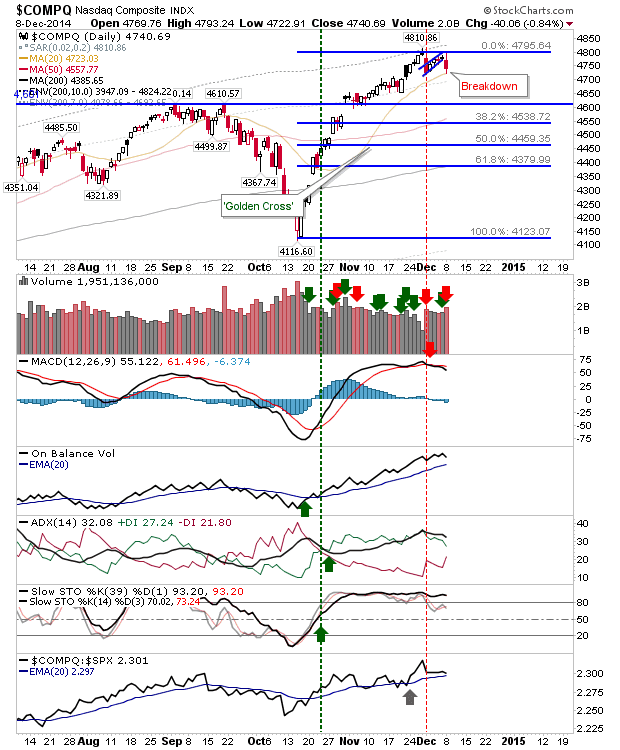

Bears paid an early visit to Santa with a broad selling. The relative loss was minor, although volume climbed to register to confirmed distribution. The Nasdaq delivered on the ‘bear flag’ breakdown, which will give shorts something to work with. The index finished on its 20-day MA. but this hasn’t played as support in recent months.

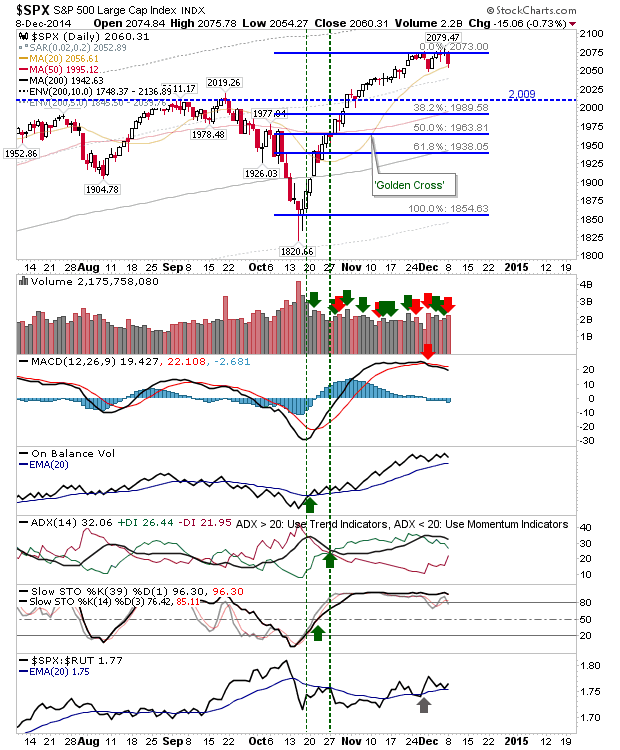

The S&P may be creating a bearish ‘evening star’ with today’s loss following from Friday’s doji. The index finished at its 20-day MA, although this hasn’t provided much support in past tests this year. Further losses are likely. First look for a test of 2,009, with follow through down to Fib levels.

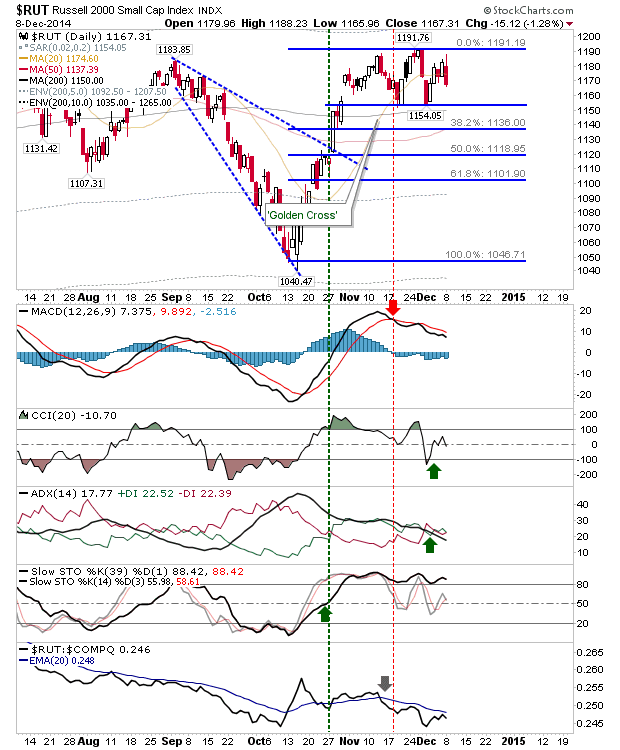

The Russell 2000 suffered the largest loss of the day. This may morph into a bearish head-and-shoulder pattern, but for this to confirm a close below 1,155 is required.

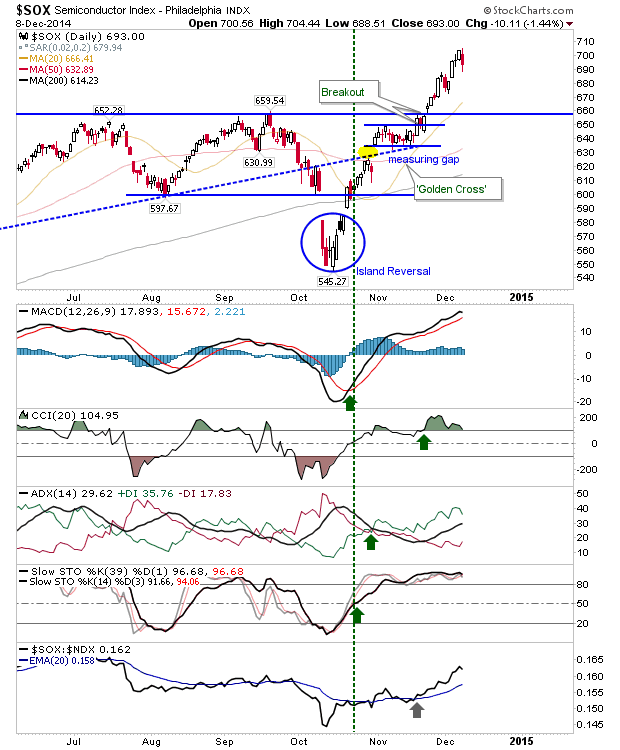

Losses in the Semiconductor Index look bad, but damage was minor.

For tomorrow, look for expanding losses in markets. The Nasdaq was the most bearish heading into today, and remains the index best positioned for shorts to attack.