As the North Korean threats continue escalating, the US has sent a colloquial response “full of fire and fury the world has never seen” that signaled institutions to take some stock market profits. Some bullies will say anything for attention on the school playground. Bullies seeking importance by announcing preparations to attack with nuclear missiles minutes from the US mainland can quickly move beyond the limits of civil discourse. The new tit for tat between Kim Jung-un and Trump was enough to spoil another record breaking day in the stock market and send investors scurrying for the exits. However, in the big picture prices only fell 1% and half of that has already been recovered, setting the table for another run to new highs.

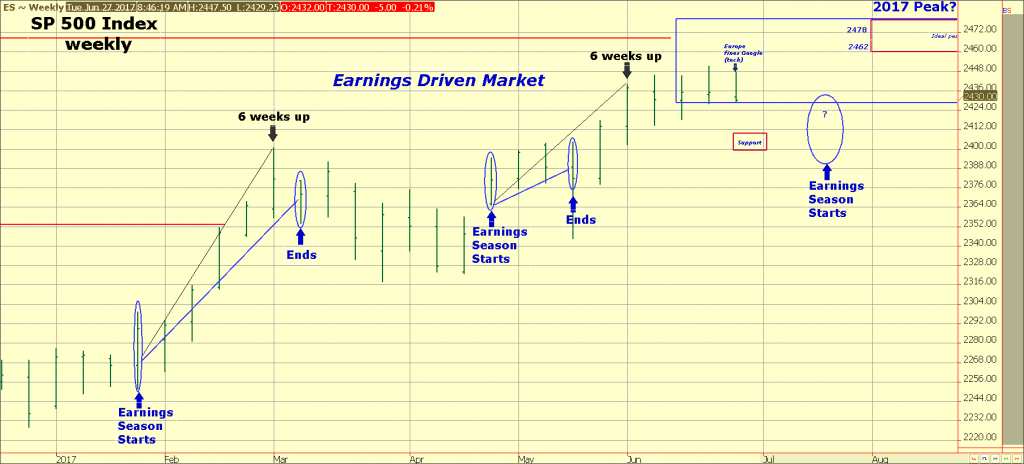

In June we presented the chart below as our likely outline of the price action to come with the possible culmination of a stock market peak in August.

The price action traced out our outline as precisely as one could expect as the projected twin lows in late June and early July caught the time and price for The Lows in stocks prior to our forecasted earnings season kick-off to the upside. The only element we adjusted in early July was the top end of the red box where we thought the summer highs would occur closer to 2500 S&P. With an ideal top due next week (+ or – one week), it’s time to revisit this forecast and consider what’s next.

The bull market in stocks is one for the history books having persisted over 8 years with 274% returns and counting. Additional amazement that has kept many investors on the sidelines has been the lack of corrections in which to purchase stocks since Trump was elected. Without more than a 3% correction since November, spectating investors quickly shout sell with every dip, hoping for that elusive 10%+ haircut to start buying stocks below perceived nosebleed levels. When traders become nervous they buy put options. The surge in option-related pessimism shown here curtails our fear of an imminent top and serious correction just yet. If pessimism is rising while the Dow hits 9 straight record highs in a row, imagine how fast negative sentiment will build if prices actually fall a few percent.