Whether Rand Paul’s “audit the Fed” proposal is passed or not, there won’t be much improvement in monetary policy. The important facts about monetary policy are already well known. What’s not well known—either by the Federal Reserve or by the public—is what exactly the Fed should be doing.

Right now the Fed is audited, and they make available with a short delay minutes of their policy meetings, and they make available with a long delay transcripts of their discussions. However, audits exclude monetary policy transactions. We can see the aggregate results by looking at the Fed’s financial statements, and we can see their policy statements, but there is no reporting (as far as I can tell) of the specific transactions they undertake.

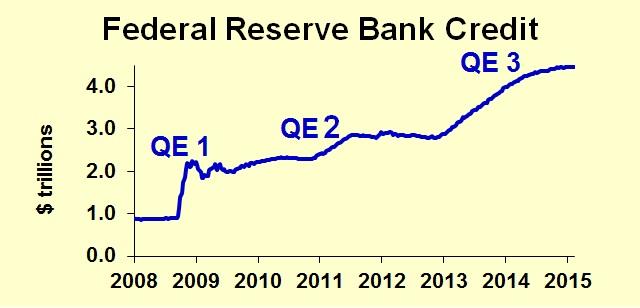

This is not a very important matter. The Federal Reserve injected a couple trillion dollars of stimulus into the economy, dutifully reporting the amount of the stimulus every week. More detailed information would not have changed a thing. The audit the Fed bill would change that, but would not change policy.

Two fundamental facts about government are important here. First, in a perceived crisis, all the rules are thrown out. Pearl Harbor gets bombed and American citizens of Japanese ancestry lose their constitutional rights. The 9/11 bombings lead to the USA Patriot Act which includes at least two provisions found to be unconstitutional. The Lehman Brothers bankruptcy prompted Treasury officials force banks to accept additional capital, an act that seems (to this non-lawyer) to be brutally illegal. And the Fed creates money out of thin air to buy bonds and mortgage-backed securities in unprecedented amounts, and with lackluster results. No after-the-fact audit will prevent panicked officials from throwing out the constitution and the laws of the land.

The second important fact: independence of the central bank (such as our Federal Reserve System) limits inflation. It’s not a perfect limit, but the worst inflationary periods around the world have come from central banks too subservient to political office-holders. Politicians usually want short-run benefits regardless of long-term consequences. Inflationary policy is just that sort of thing. If we are going to have a central bank, it really needs to be independent.