Walmart Set Sights On Clean Energy Kingdom

Walmart is attempting to position itself as the key mover and shaker in the renewable energy sector, and indeed, when Walmart makes a clean energy move it reverberates through the market. Walmart’s status as a leading company in terms of renewable energy adoption was furthered on 15 October with the release of the Solar Means Business report, which noted that Walmart remains America’s commercial solar leader, followed by Costco, Kohl’s, Apple, IKEA, Macy’s, and Johnson & Johnson—all in the top 25. Walmart currently has 89 megawatts of solar power at 215 locations. “As we work toward our ambitious goal to be supplied 100 percent by renewable energy, solar energy continues to be an important part of our renewable energy portfolio,” Kim Saylors-Laster, vice president for energy at Walmart, said in a statement. “With our size and scale, Walmart is in a unique position to encourage innovation and accelerate the adoption of cost-effective, clean energy alternatives, including solar power.” By 2020, Walmart wants to procure 7 billion kWh of renewable energy–the equivalent of powering 620,000 average American homes for a year. Some will go as far as to say that Walmart is the key driver of the renewable energy industry. “Every time Walmart makes a green commitment, it has reverberations throughout entire industry sectors. That’s just what happens when you’re the world’s largest corporation. And that’s why Walmart’s work in renewable energy could have a major impact,” writes the Energy Voice. Since Walmart first announced its ambitious sustainability goals back in 2005, […]

Fukushima Amplifies Japanese Energy Import Dependence

When Typhoon Wipha flooded Japan with heavy rains last week, the operator of the Fukushima nuclear power plant ordered precautionary measures to prevent leakage of contaminated water. Ever since the March 2011 earthquake and tsunami caused a reactor meltdown at the plant, Fukushima has become a symbol of a Japanese nuclear strategy and energy supply in disarray. As the clean-up from the disaster continues, all fifty of Japan’s nuclear reactors have been taken offline, creating a large shortfall in energy production that Japan has had to fill from abroad. Growing dependence on imports According to the U.S. Energy Information Administration (EIA), Japan falls far short of providing enough energy for its domestic uses, with only 16% domestic energy production. Not surprisingly, Japan needs to import heavily — it is the world largest importer of liquefied natural gas (LNG). Before the disaster at Fukushima and the following reevaluation of nuclear power in Japan, nuclear sources supplied 13% of Japan’s energy consumption. The EIA notes in another report that “Japan’s electric power utilities have been consuming more natural gas and petroleum to make up for the shortfall in nuclear output…” With this shift, fossil fuel use has jumped 21% in 2012 compared to 2011 levels. High energy costs in the near term (the IMF forecasts that the spot price for crude will remain above $100/barrel for 2014) pose a problem for Japan’s trade balance. As Japan imports more fossil fuels, its trade deficit widens (Japan ran a surplus before 2011). This hurts its current account, which has shrunk considerably. While […]

Globalisation on hold

Five years ago, George W Bush gathered the leaders of the largest rich and developing countries in Washington for the first summit of the G20. In the face of the worst financial crisis since the Great Depression, the leaders promised not to repeat that era’s descent into economic isolationism, proclaiming their commitment to an open global economy and the rejection of protectionism. They succeeded only in part. Although they did not retreat into the extreme protectionism of the 1930s, the world economy has certainly become less open. After two decades in which people, capital and goods were moving ever more freely across borders, walls have been going up, albeit ones with gates. Governments increasingly pick and choose whom they trade with, what sort of capital they welcome and how much freedom they allow for doing business abroad. Virtually all countries still embrace the principles of international trade and investment. They want to enjoy the benefits of globalisation, but as much as possible they now also want to insulate themselves from its downsides, be they volatile capital flows or surging imports. Globalisation has clearly paused. A simple measure of trade intensity, world exports as a share of world GDP, rose steadily from 1986 to 2008 but have been flat since. Global capital flows, which in 2007 topped $11trn, amounted to barely a third of that figure last year. Cross-border direct investment is also well down on its 2007 peak. Much of this is cyclical. The recent crises and recessions in the […]

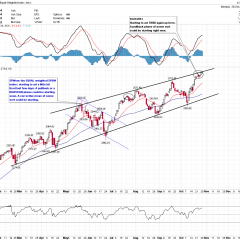

Waiting On The Fed At The Top Of Our Range

By Phil Davis of Phil’s Stock World Yes, it’s a RISING channel! That’s why we are long-term BULLISH but short-term BEARISH. As noted by TraderStewie (chart TraderStewie, click on to enlarge), this is a movie we’ve seen before, with the S&P making a power-move to the top of the channel, only to find resistance there. If we break out over that channel (for more than a spike), I will be HAPPY to play a new channel higher but let’s just make sure we get there first! In this chart of the Equal Weight Index, each company is treated as 0.2% of the S&P to eliminate the distortions of runaway Momentum Stocks. On our Big Chart (below), the S&P is already off to the races, over the 1,760 line (+10%) that marks the top of the range we’ve been following since early 2009. Overdue for a 10% correction is an understatement here! It’s very hard to quantify where we should be as the Dollar has been diving – all the way from 84.96 in July to 79.06 last week. That’s a 5.8% drop in the currency, which is the measuring stick we use to put a PRICE (not a value) on the stock market. In early July, the S&P was at 1,600 and, wouldn’t you know it, 1,760 is EXACTLY 10% over that line (the Must Hold line on our Big Chart). The Federal Reserve’s stance on QE makes its announcement tomorrow at 2pm so important. Its actions will determine whether or not […]

EC The S&P 500 Has Not Been Particularly Difficult To Beat…

I know this statement is in direct conflict with the teachings of modern finance. Modern finance provides us with multiple studies that, if taken at face value, offer a pretty convincing case that the ability to earn better than average returns is a fool’s game. Yet, our human nature cannot accept being average. It is our human nature that drives us to escape the realm of “average.” When we were young, our nature drove us to do an extra hour of homework to improve our grades. Our nature drove us to change the style of our hair or dress to be anything but average to those around us. As adults, it is our nature to spend $50.00 on gas traveling from store to store to save $30.00 on our latest purchase; just to feel as if we obtained the best deal in town. It is our nature to work an extra hour or two to get ahead. And it is our nature as investors to seek out higher than average returns no matter who tells us it’s nothing but a “fool’s game”. I will admit that I claim to be a member of the human race and take full ownership of all the baggage that comes along with this claim, including those little bits of human nature that want to be something other than average. So I work an extra hour or two in hopes that I gain a bit of knowledge that will be rewarded. A couple extra hours of work doesn’t […]