Written by Sammy Suzuki, Laurent Saltiel, Henry S. D’Auria – Alliance Bernstein

Emerging-market (EM) equities posted a strong recovery in 2017 after several tough years. But it’s not too late to invest. We think there are still good reasons to add or increase EM exposure in 2018.

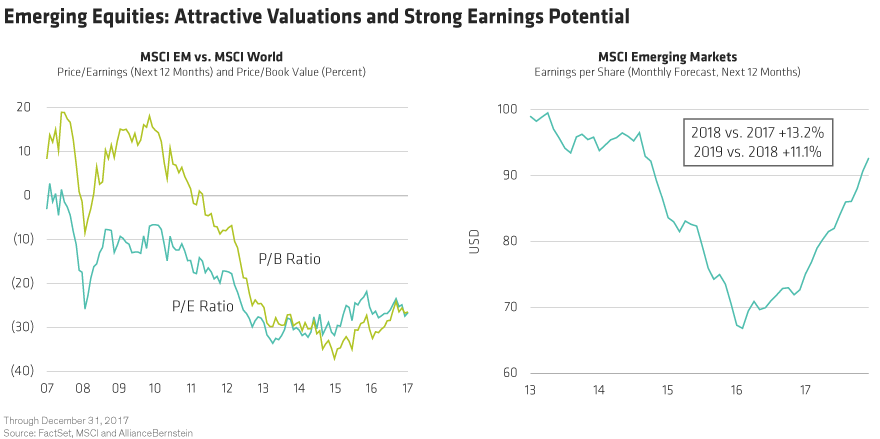

In 2017, the MSCI Emerging Markets Index advanced by 37.3% in US-dollar terms, outpacing developed markets by a wide margin. The recovery has been underpinned by many changes in the macroeconomic environment that have helped improve investor sentiment toward the developing world and strong earnings growth. EM companies are expected to deliver 13.2% earnings growth this year, according to consensus estimates. Yet even after last year’s rally, we think there are five good reasons to expect further gains:

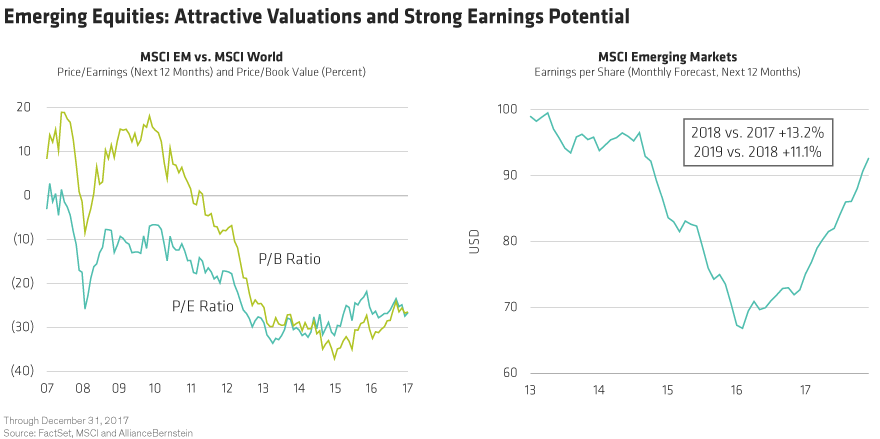

Attractive valuations—Even after a stellar 2017, EM stocks trade at 12.5 times estimated earnings for the next 12 months—a 27% discount to developed-market (DM) stocks. That’s only slightly higher than at the end of 2016, when EM stocks traded at 11.9 times estimated earnings for the next 12 months.

Catch-up just beginning—EM companies had several tough years, with subdued earnings, low profitability and depressed valuations. There’s plenty of room to catch up with DM peers. And in the past, EM equity cycles persisted for several years. Between 2002 and 2007, the MSCI Emerging Markets returned an annualized 28.6%.

Sources of returns—This year’s performance has been driven mostly by earnings growth—not multiple expansion. This indicates that there’s still plenty of pent-up return potential in EM equities.

Broadening recovery—Chinese and technology stocks have driven the rebound in 2017. We think the rally could broaden to more sectors and regions as earnings growth continues and confidence grows.

Easing China risks—Positive signs are surfacing in China, including firming producer price index inflation and improving profitability of commodity producers and industrial companies. We think these trends reduce the risks to the banking system. And a stronger China outlook may help foster confidence in EM stocks more broadly—and could lead investors to focus more on company fundamentals.