As first reported last night, Brazil has plunged back into yet another political crisis less than a year after the impeachment of Dilma Rouseff, when a report in Brazil’s O Globo newspaper revealed that President Michel Temer was involved in an “hush money” cover-up scheme involving the jailed former speaker of the lower house of Congress, Eduardo Cunha, who was the mastermind behind the impeachment of Rouseff.

Already an impeachment request against Temer has been filed by the opposition, although it was unclear who would replace him or what the process would look like. If Temer resigns or is impeached, Congress would elect an interim president until the next scheduled vote in October of 2018. An early election could only be held with a constitutional amendment approved by lawmakers.

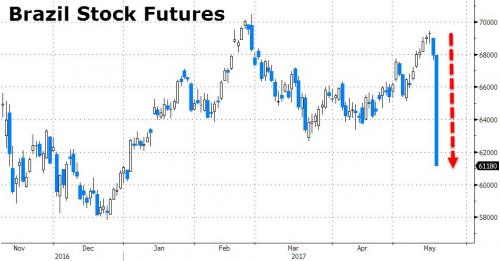

And while most Brazilian asset markets were closed at the time, a Brazilian stock ETF trading in Japan, gave an indication of what to expect: a drop of about -8%.

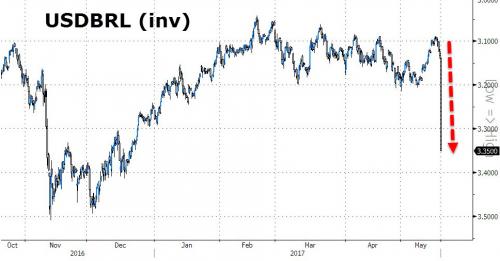

In retrospect it may have been optimistic, as moments ago the Brazilian real was halted for trading after crashing 6%…

… Bovespa futures plunged 10%…

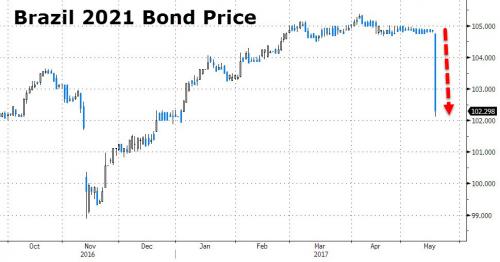

… and Brazil’s Eurobonds due 2021 tumbled the most on record.

… and Brazil’s ETF (EWZ) has collapse.

The collapse promptly dragged the Brazilian Central Bank which tried to assure markets, stating it was “monitoring the impact of recent information published by the press and will act to maintain full functionality of markets” adding that “this monitoring and action are focused on the good functionality of markets.”

So far it is failing.