In short, buy stocks.

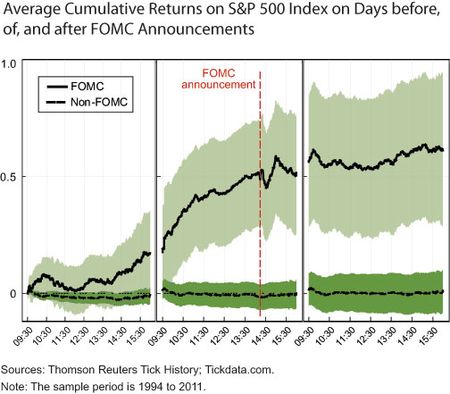

Remember that 2011 NY Fed study which found that since 1994, a stunning 80% of all equity returns on U.S. stocks were generated over the twenty-four hours preceding scheduled Federal Open Market Committee announcements, a phenomenon called the pre-FOMC announcement “drift.”

Well, we are now in that 24 hour period – which starts roughly now and accelerates into 2pm on Wednesday, when the Fed is widely expected to hike by another 25 bps – and over the weekend Goldman decided to take another look at this performance “drift”, or as Goldman calls it, “the FOMC Alpha” and similarly finds that average returns are higher on FOMC announcement days.

So is tomorrow (and today) a buy-and-forget “guaranteed profit” day for daytraders just because “new information” is released from the (overly dovish) Fed? The answer appears to be yes.

As Goldman writes, market participants and policymakers are well aware that asset prices respond to new information released on FOMC announcement days. But, what is perhaps less well known is that a sizable portion of average yearly asset returns is generated on these days. For example, a strategy that goes short the USD versus a basket of all other G10 currencies has provided an average daily annualized return of about 80bp on FOMC announcement dates, compared with an average daily annualized return of about 30bp on any other day of the year.

To make this point, the bank demonstrates that stocks and foreign currencies outperform on FOMC announcement days.

“We show that the ‘FOMC alpha’ has been sizable for long positions in major DM equity markets, as well as for strategies that short the USD versus all G10 currencies but the Yen, and versus some major EMs (TRY, ZAR and MXN in particular). By contrast, investments in major sovereign bonds do not tend to deliver a larger or smaller return on an FOMC day relative to the return earned on any other day of the year. We also find that these patterns are more sizable in the post-Global Financial Crisis (GFC) period.”