The investment value of oil and gas companies’ stocks is evidenced in a recent Sonecon report. According to the report, on average, US$1 invested in oil and gas stocks in FY 2005 by the two largest public employee pension funds in each of 17 American states was worth US$2.30 in FY 2013; by contrast, US$1 invested in all other assets over the same period was worth US$1.68. The recent oil price slide however, has impacted oil and gas companies.

Global oil prices plunged steeply over the past nine months to a near six-year low. In response, oil and gas companies have employed such cost-cutting measures as reduction in capital expenditure (capex) project deferrals as well as staff layoffs, among others. According to Wood Mackenzie, the result has been a 24% reduction year-on-year in capital costs for the industry. It added that the price required for companies to be cash flow neutral in 2015 was cut by more than US$20 per barrel (US$/bbl) to US$72/bbl; however average oil prices for Q1 2015 were US$53.91/bbl (Brent) and US$48.54/bbl (WTI), data from Energy Information Administration, EIA, reveal.

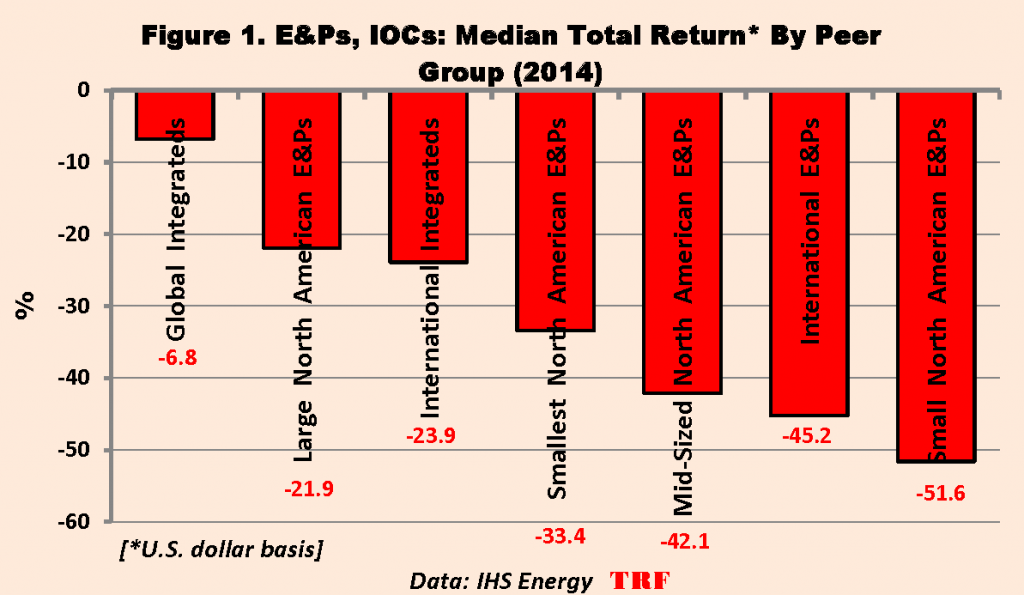

In its 2014 Global Upstream Performance Review, IHS Energy reported a median loss, including dividends, of 34% for 200 publicly-traded Exploration and Production (E&P) companies as well as Integrated Oil Companies (Figure 1).

Three critical operational metrics show the heavy cost burden on the world’s top oil and gas companies: First, unit capital productivity ― which measures the quantity of oil produced per dollar employed ― has declined significantly. Secondly, the massive growth in upstream capex has not been met with commensurate output, and finally, the growth rate in finding and development costs has outstripped that in cash flow. The EIA reports that, for oil and gas companies listed on United States stock exchanges, finding costs for year 2014 increased by US$2.92 per barrel of oil equivalent, US$/boe.

Integrated Oil Companies

Some global Integrated Oil Companies have restructured their operations away from the restrictive Production Sharing Contracts (PSCs) and Service Contracts (SCs) in order to avail themselves of spiking oil prices. Those contract regimes were entered into when oil prices were as low as US$10/bbl and were meant to guarantee corporate profit margins in exchange for increased production for host countries. Such restructuring however, also exposed the companies’ earnings to the vagaries of oil prices.

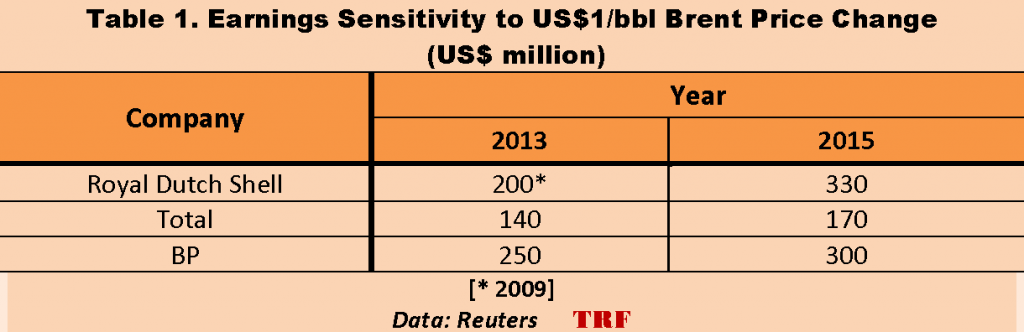

According to Reuters for example, in 2009, a US$1/bbl change in the price of Brent would, in sympathy, shift the earnings for Royal Dutch Shell (RDS-A) by US$200 million; by the year 2015, that shift was US$330 (See Table 1).

For ExxonMobil (XOM), there was very little sensitivity ― perhaps because it may still have significant PSC-led operations ― while figures for Chevron (CVX) were unavailable. The impact of the recent oil price slide on these companies would therefore be better appreciated.