Commentary and Performance

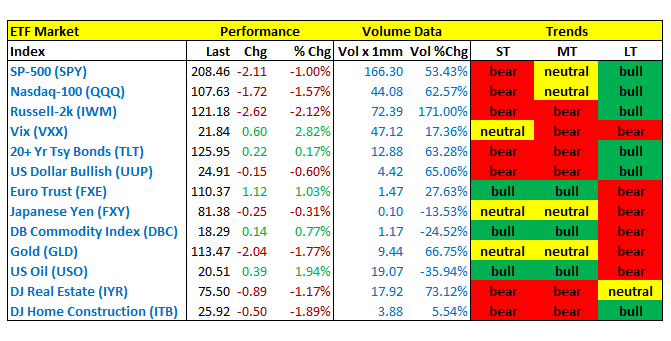

Equities: Yesterday the SP-500 (SPY) and Nasdaq-100 (QQQ) joined our canary in the coalmine, i.e.Russell-2000 (IWM), into bearish territory. All three major indexes were down on significantly higher volume as investors decided to not wait for the arrival of May to begin selling.

Volatility: The VIX (VXX) is gearing up for a short-term bullish trend, but it is not quite there. Nevertheless, it was upgraded from bearish to neutral.

Bonds: Despite a positive performance, the 20-Year+ Treasury ETF (TLT) remains bearish. Interest rates have essentially bottomed and the market realizes that at best the Fed can only defer raising interest rates. Eventually bonds will face their day of reckoning.

Currencies: The US Dollar’s (UUP) negative momentum is quickly accelerating and the bears have usurped control from the king. Amongst major currencies, that leaves Euro (FXE) next in line to assume leadership and it has with bullish trends for the short and intermediate terms. The Yen (FXY)has reverted to neutral territory and is likely to remain there with the negative outlooks from credit rating agencies.

Commodities: The market for Commodities (DBC) and Oil (USO) continues its bullish surge while Gold (GLD) has retreated from the the currently elusive economic inflation.

Real Estate: The outlook for Homebuilders (ITB) and Dow Jones Real Estate Index for REITs (IYR) continues to deteriorate. This asset class is approaching extremely oversold levels and may be due for a relief rally if it can establish even temporary price support.

Stay Hillbent for the Market Direction…