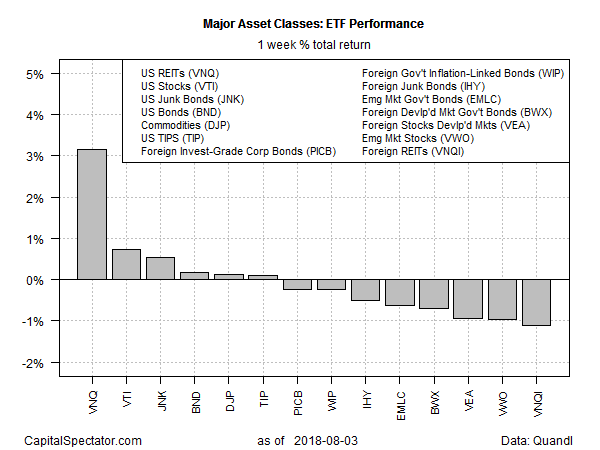

Securitized real estate shares dominated last week’s performance rankings at the extremes for the major asset classes, based on a set of exchange-traded products. US real estate investment trusts (REITs) posted the highest return for the week through August 3 while foreign REITs/real estate suffered the biggest loss.

Vanguard Real Estate (VNQ) popped 3.2% last week, the first weekly gain for the ETF in a month. The rally lifted the fund to a two-year high. The buying was “propelled by strong quarterly results across much of the sector,” according to Hoya Capital Real Estate. “Fundamentals appear to have inflected higher in 2018, aided by a strong labor market.”

While US REITs climbed sharply last week, an ETF that holds the foreign counterparts for real estate shares posted last week’s biggest setback for the major asset classes. Vanguard Global ex-US Real Estate (VNQI) lost 1.1% over the five trading days through August 3. The selling left the ETF near its lowest price so far in 2018.

A factor in VNQI’s recent weakness: a strong US dollar. Since VNQI doesn’t hedge foreign currency exposure, the prices of offshore real estate securities in dollar terms suffer when the greenback strengthens in foreign exchange markets, all else equal. The US Dollar Index ended last week at close to a one-year high, putting pressure on VNQI and other foreign securities after translating prices into US currency.

Turning to the one-year trend, US stocks continue to dominate the field by a wide margin. Vanguard Total Stock Market (VTI) closed up a strong 17.6% on Friday vs. the year-earlier price, after factoring in distributions.

The US equity market’s performance is well ahead of the second-strongest performer: foreign stocks in developed markets. Vanguard FTSE Developed Markets (VEA) is currently posting a modest 4.9% total return for the trailing one-year period.

The biggest one-year loss for the major asset classes: government bonds issued in emerging markets. VanEck Vectors JP Morgan Emerging Market Local Currency Bond (EMLC) has shed 4.8% over the past year through last week’s close.