The U.K pound plunged to a 3-week low following growing political uncertainty and weak economic growth.

The pound declined against all the Group 10 currencies amid doubt about Prime Minister Theresa May’s ability to bring the party together after what happened during annual Conservative Party conference on Wednesday.

“If sterling really has been sold today for fears of a rebellion, that may be short-lived,” said Nomura International strategist Jordan Rochester. “Tory rebels will likely remember the long game, which is to place all the blame from Brexit negotiation woes on Theresa and move on when 2019 presents itself.”

As projected in the previous analysis, weak manufacturing, construction and mixed services sectors weigh on the pound attractiveness as investors are uncertain if the Bank of England will raise interest rates in November following broad-based weak economic data and rising inflation rate.

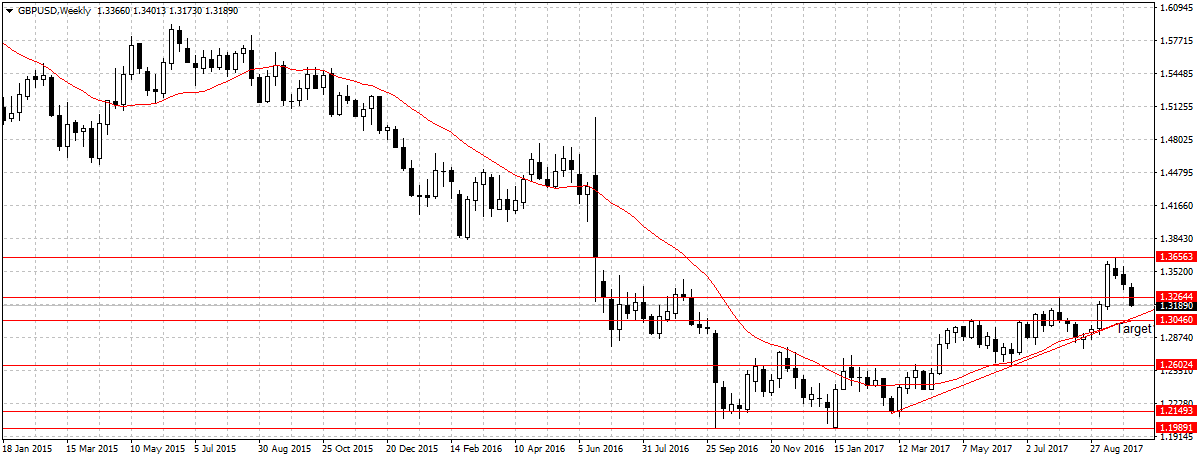

Therefore, a weak services sector number on Wednesday would plunge the pound further against other currencies and towards $1.3046 on GBPUSD pair. A sustained break of that price level would validate bearish continuation. However, a temporary rebound should be expected as the odds of rates hike rises. An excerpt from Tuesday analysis.

Again, the uncertainty and increased selling interest by leverage accounts will bolster selling pressure towards $1.3046 as stated.

The sterling dropped 0.4 percent against the US dollar to $1.3192 as of 10:00 a.m. in London and fell 0.5 percent to 89.17 to a Euro.