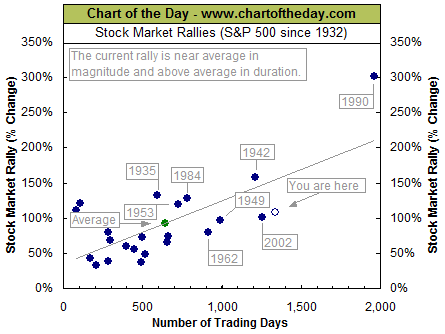

Chart of the Day’s report this morning notes the S&P 500 Index return since the October 2011 low is now the second longest since the Great Depression. Specifically, their commentary notes:

“With the S&P 500 once again in record high territory, today’s chart provides some perspective on the current rally by plotting all major S&P 500 rallies of the last 86 years. With the S&P 500 up 107% since its October 2011 lows (the 2011 correction resulted in a significant 19.4% decline), the current rally is above average in magnitude and the second longest rally since the Great Depression.”

Source: Chart of the Day

Notes:

– A major stock market rally has been defined as a S&P 500 gain of 30% or more (following a correction of at least 15%).

– The S&P 500 was not adjusted for inflation or dividends.

– Selected rallies were labeled with the year in which they began.

– There are 252 trading days in a year (100 trading days equal about 4.8 calendar months).