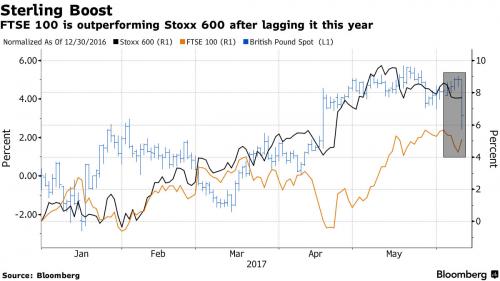

“Triple Threat Thursday” is now a distant memory, with both the ECB and Comey testimony “non-events” for the market, although the UK general election was a shocker in which contrary to expectations, Theresa May lost her majority in Parliament, sending sterling tumbling overnight and prompting even more confusion about the UK’s political fate and the future of Brexit. That however did not spook risk assets, and on Friday morning, European stocks gained with Asian stocks little changed, while S&P 500 futures were set for new all time highs. Just like after Brexit, it was U.K. stocks that rallied the most among developed markets as the pound fell.

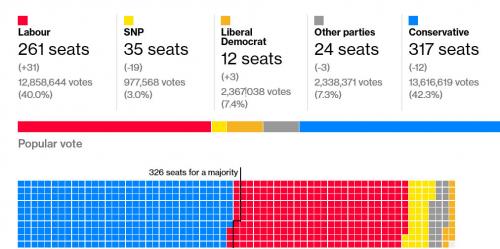

With the majority of seats counted, May’s Conservatives had no way to win an outright majority in parliament. That raised fears the political turmoil could delay and confound talks on leaving the European Union, which are due to start in less than two weeks, and the pound shed over 2 percent against the dollar.

Sterling dropped as low as $1.2636 in early London trading, before clawing back some ground. Yields on 10-year gilts fell 3 basis points to 1.00 percent. However, the damage contained, with S&P futures edging up 0.2 percent to 2,434, and just shy of record highs.

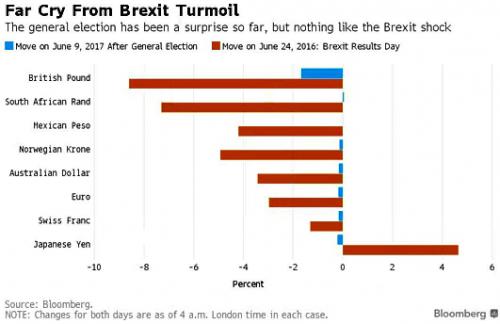

“The uncertainty is bad news for sterling,” said Bank of America, Merrill Lynch European equity & cross-asset strategist James Barty. “I think for the global market it doesn’t matter. Unlike Brexit, which at the time had a spillover into other markets, this is a very UK-specific thing.”

Most impacted by the UK result was the pound, which plunged the most in eight months as the election intended to strengthen Prime Minister Theresa May’s hand in negotiations with the European Union instead cast doubt over her future. The currency’s retreat gave British stocks a boost, but the election’s impact beyond the U.K. was muted.

The euro extended losses to three days, and the Stoxx Europe 600 Index swung. Fears of a supply glut continue to weigh on oil, but it managed to reverse an earlier decline.

“For now, the results of U.K. elections do not appear to be threatening the global growth story,” Mark Haefele, global chief investment officer at UBS Group AG, said in a note to clients. But for Britain,“political uncertainty is likely to more than offset any benefit from a marginally weaker pound,” he said.

The FTSE 100 Index jumped 0.8 percent. The Stoxx Europe 600 Index swung before trading little changed. Futures on the S&P 500 rose 0.1 percent. The underlying gauge advanced less than one point on Thursday, for a second day of gains.

In other overnight news, there was muted reaction to China inflation report as producer prices missed expectations, and eased further; PBOC reverse repos close to maturities; overnight Hibor falls for sixth day; Shanghai Composite closed modestly higher.

Overnight, Wall Street had also seemingly judged that the testimony of former FBI director James Comey was not life-threatening for the administration of President Donald Trump. Comey accused Trump of firing him to try to undermine the investigation into possible collusion by his campaign team with Russia’s alleged efforts to influence the 2016 election.

“I think the market is taking less of an alarmist review of this situation because there is no smoking gun here,” said Jefferies & Co money market economist Thomas Simons. “So it’s not particularly impactful for thinking about… Trump’s economic agenda to go through.”

In commodity markets, spot gold was 0.3% lower at $1,274.20 an ounce. Oil prices remained subdued, wit Brent having settled at its lowest since Nov. 29, the eve of an OPEC production cut deal.

Bulletin Headline Summary from RanSquawk

Market Snapshot

Top Overnight News