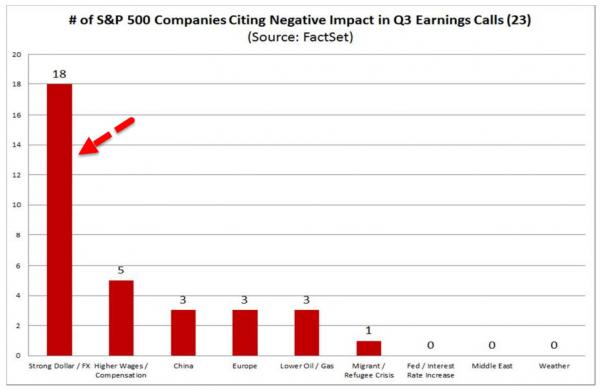

“It’s not the economy… it’s the dollar” – That would appear to be the message from the companies of the S&P 500 (SPY) who have reported in Q3. As FactSet reports, 18 of the 23 companies reporting so far have cited “the strong dollar” as having a negative impact on earnings. Not record domestic inventories (liquidation beginning), the plunge in world trade, not the economic collapse in take your pick of Brazil (depression), China (credit endgame), India (exports/imports crash), and so on…

What is being missed here is that “The Dollar” is the symptom, not the cause of the problems. Capital is flowing for a reason to drive the USD stronger (or printed for a reason)… because the underlying economies are collapsing (yes and interest rate arb hopes).

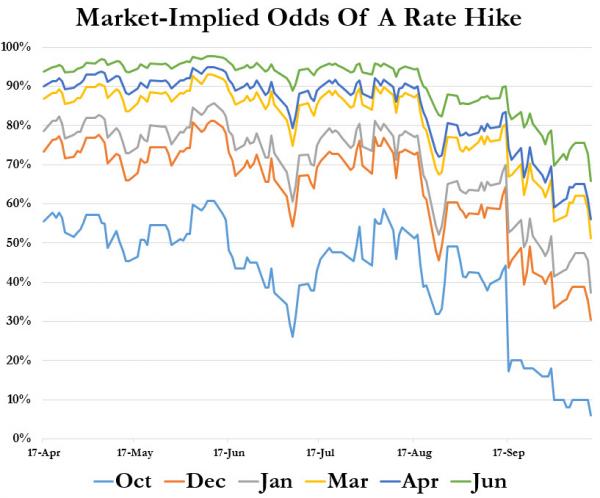

So if ever there was a reason for The Fed to NOT raise rates, the pressure from Corporate CEOs (through their various lobbying or newsletter-writing alumni) must be immense… which explains the sudden change of mind…

It appears, for now, financial engineering (buybacks) has kept the dream alive relative to the soaring USD vs Asian/EM countries (US growth opps); and “hopeful” projections have kept Forward estimates of earnings alive – even as The USD soars against the American companies’ most favored growth nations…

But at some point it’s inevitable – unless there is a seismic shift in Fed Policy (QE4?) – that the USD’s strength vs Asian/EM nations will crush earnings… and estimates will be unable to rise with even the biggest hockey-stick forecast.

* * *

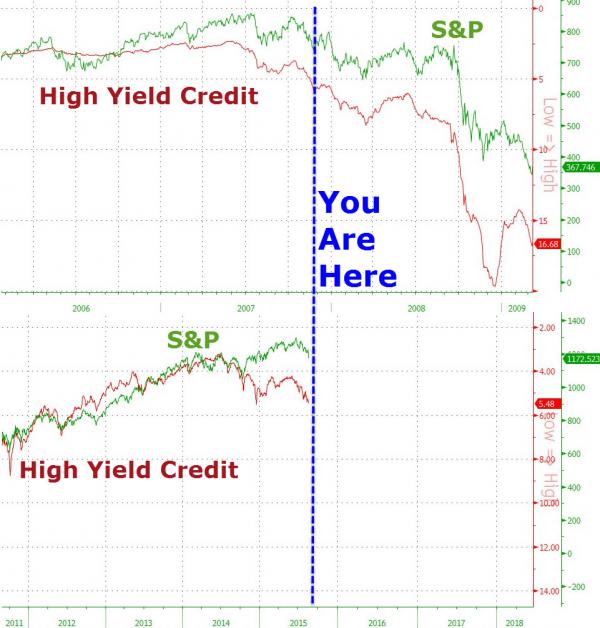

Remember. crises often start slowly… then erupt suddenly; and equity markets are always (without exception) the last to figure it out.

The credit cycle has well and truly rolled over…

Charts: FactSet and Bloomberg