Tuesday, December 8

Thursday, December 10

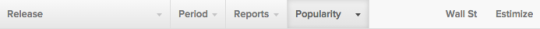

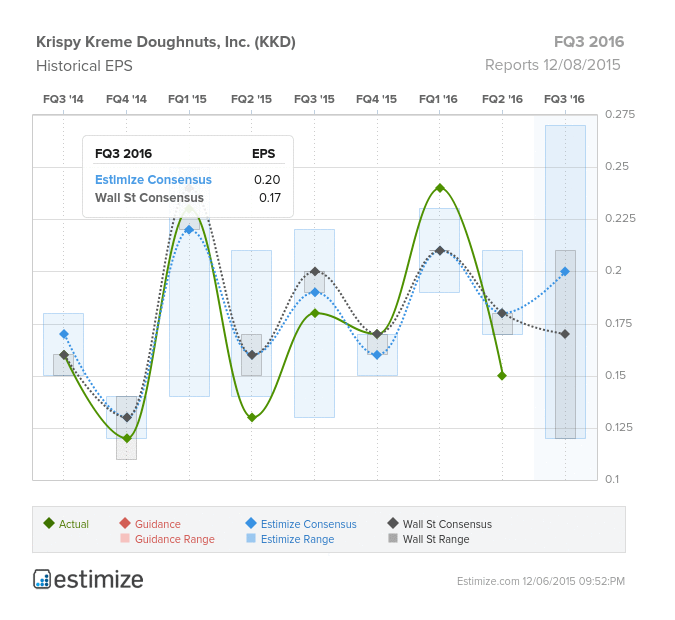

Krispy Kreme Doughnuts (KKD)

Consumer Discretionary – Hotels, Restaurants & Leisure | Reports December 8, after the close.

The Estimize consensus calls for EPS of $0.21, 4 cents above the Wall Street estimate. Even revenue estimates of $132.89 are higher than the Street’s expectation for $132.77.

What to watch: In five of the past seven quarters, Krispy Kreme has missed earnings expectations. Despite showing total revenue growth of 5.6% last quarter, the revenues still missed analyst projections by more than $4M. As health concerns are taking over the US, sugary indulgences like donuts have an uncertain future as demand continues to wane. Despite this uncertainty, the company continues to expand as new stores are popping up and same store sales increased annually by 5.5%. If the company is experiencing revenue and sales growth, what is the problem? Part of Krispy Kreme’s earnings dilemma is its business model. Unlike major competitor Dunkin Brands, Krispy Kreme does not operate a full franchise model. Rather, a majority of stores are company owned. Furthermore, operating margins are weak, hovering around 10%. Krispy Kreme shares are down roughly 30% year to date.

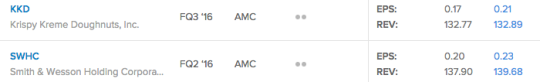

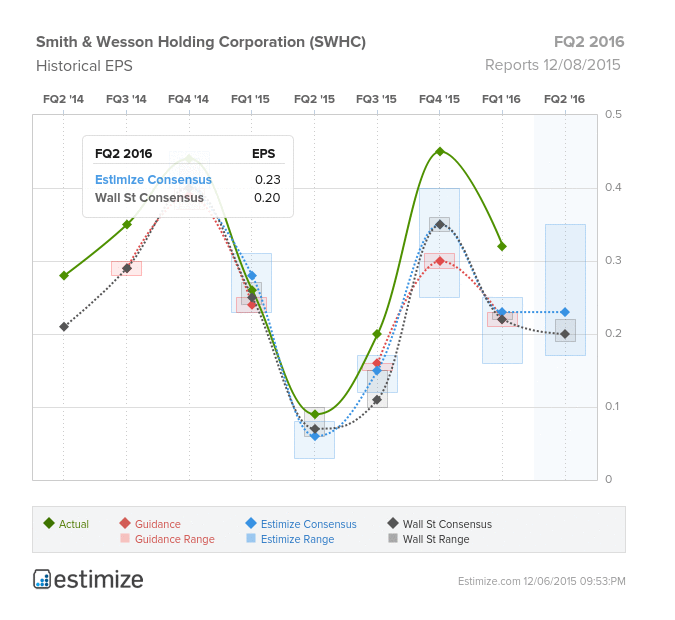

Smith & Wesson (SWHC)

Consumer Discretionary – Leisure Equipment & Products | Reports December 8, after the close.

The Estimize consensus calls for EPS of $0.23, three cents above the Wall Street consensus. Revenues of $139.68M are slightly above the Street’s expectation for $137.90M.

What to watch: For a good part of 2012 and 2013, fears in the US that tighter firearm laws were on the horizon helped drive sales for Smith & Wesson. As those fears began to dissipate in 2014, sales of guns and ammunition suffered. This year, however, Smith & Wesson has returned to year-over-year earnings and revenue growth, putting up double-digit EPS growth of 23% and sales growth of 12% in their latest quarter. During that period the company saw higher sales in both the firearm and accessories divisions, with firearms driven by robust orders for “M&P 15 Sport rifles, Thompson/Center Venture bolt-action rifles and M&P Shield polymer pistols.“ That growth should have carried over into the reporting quarter, as Q3 2015 Federal background checks were up 4% year-over-year, with the FBI processing a record of 1.98M applications in October alone. Even so, competitors such as Sturm, Ruger & Co. reported a 13 cent miss on EPS when they reported two weeks ago, yet beat on sales.