Well, another Christmas has come and gone, and ours went off without a hitch. I get apprehensive about hosting big family meals, particularly with four dogs galavanting around, but both meals went off beautifully and the dogs all got along. Nevertheless, it’s good to see it in the rear-view mirror, since it’s a lot of work. (I’d also like to thank those among you thoughtful enough to click the Donate button on Slope to send me some Christmas thank-you cash; much appreciated!)

As for being “apprehensive”, what I’m feeling about the final four trading days of this year dwarfs any concern I had about putting on a holiday meal, because I’m consumed with a What Have I Done??? sentiment. As I’ve mentioned, I covered everything, and I mean everything on Christmas Eve, just to “lock in” my profit for 2016 without any risk of surprises (especially those central banker ones seared into my soul, like the one from Halloween of 2014). While going through my charts later that day, I really started to question whether cowardice was a better choice than bravado.

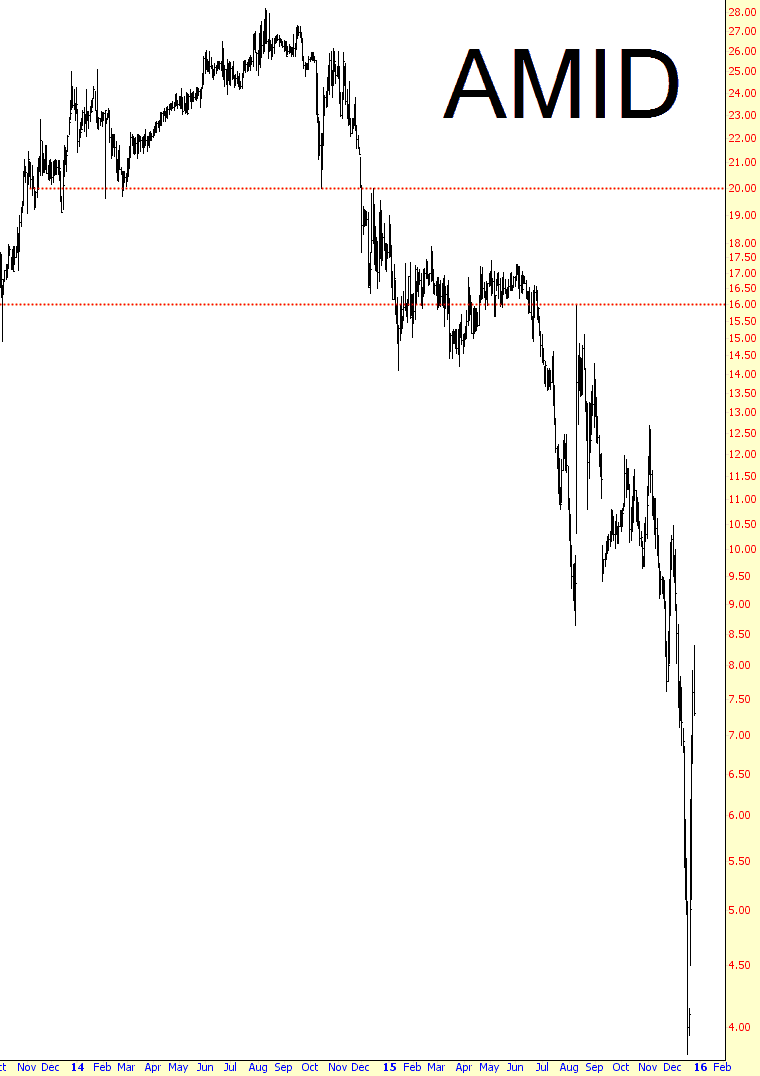

One particular sector that went haywire (in an upward direction, for a change) recently was energy, but the chart below captures neatly something I feel about the entire market, and it is this: do not let these bouts of strength fool you. The market, as a whole, is rolling over, and more and more charts are morphing into a series of lower lowers and lower highs, which do a marvelous job of completely confusing bulls and bears alike. Look no farther than this energy beauty:

This little honey surged over 100% in just a few sessions. Now that is one bullish stock, right? Who can argue with the “rip your face off” (Lord, I hate that expression) rally that buyers enjoyed? Well, I can, because I think it’s quite obvious from the graph above that the lunatics buying at present price levels are going to see their money vanish. Again.