My Swing Trading Approach

Neutral portfolio – I’ll go the direction the market decides to take today.

Indicators

VIX – Solid bounce today, but needs to break above the monthly highs to wrestle control from the sellers.

T2108 (% of stocks trading below their 40-day moving average) – Breadth was poor yesterday for the bears and it was reflected with a positive return on the T2108.

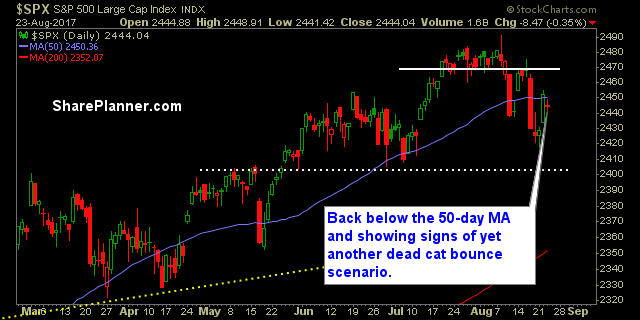

Moving averages (SPX): Very little usefulness with the MA’s right now as price continues to break above and below them with little resistance/support. Yesterday saw price slice through the 50-day again, after having recaptured it on Tuesday.

Industries to Watch Today

Tech looked hoppy out of the gate in the pre-market, but at an area of significant resistance for the Nasdaq, as well as the 20-day moving average. Financials struggling to find its footing still, Energy is in a bear flag pattern. UTILITIES is an absolute Freak-Show with its gains over the last two months. Cruise Lines have been getting more bullish by the day but Consumer Cyclical rolling over.

My Market Sentiment

I’m starting to believe that price action is on the verge of a pretty big sell-off – bigger than the two we have seen this month. But the dip buyers still have a grasp on this market, keeping the market, for now, from falling too far.

Large caps > Small caps.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance:

Recent Stock Trade Notables: