My Swing Trading Approach

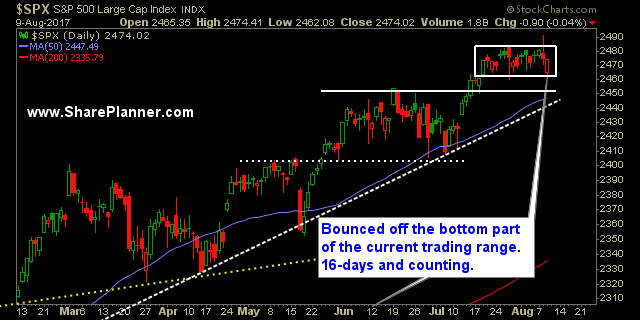

I’ve been aggresive with booking gains and will continue doing so going forward until the market breaks out of the current range that it is trading in.

Indicators

VIX – Rallied almost to 13 yesterday before all the gains were given up – only closed up 1.4%. The ongoing problem for the VIX is the late day sell-offs.

T2108 (% of stocks trading below their 40-day moving average) – Breadth in the overall market is horrible, despite a break even day on the indices, decliners had a +2:1 advantage, and T2108 dropped another 7% down to 45%. Stocks are NOT healthy.

Moving averages: Rallied back above the 20-day moving average, but trading below the 5 and 10-day moving averages.

Industries to Watch Today

Financials still one of the best industries to trade right now. Selective technology stocks have done well. Defense is undeterred by some of the weakness of late. Biotechs continue to deteriorate. Consumer Defensive continues to be a safe haven.

My Market Sentiment

I don’t like this market. I think the breadth is horrible and the bulls have little motivation to push the market to substantial new all-time highs.

Large caps > Small caps.

S&P 500 Technical Analysis

Current Stock Trading Portfolio Balance:

Recent Stock Trade Notables: