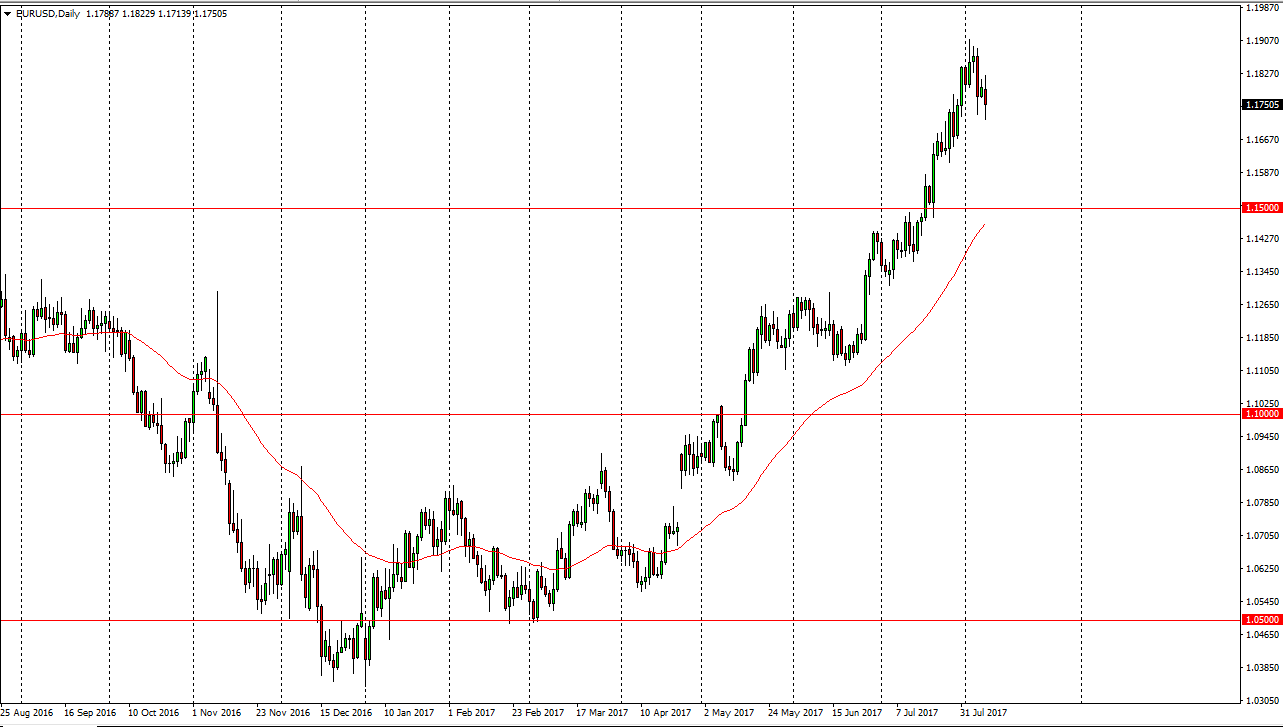

EUR/USD

The EUR/USD pair had a negative session during Tuesday trading, especially after the jobs announcement came out of the United States. With over 6 million jobs unfilled in the United States, it is obvious that the labor market is strong enough for the Federal Reserve to continue to raise interest rates. That being the case, I think we will probably see some type of pullback. This pullback could reach as low as the 1.15 level, and I think could make a nice buying opportunity eventually. I don’t have any interest in shorting this market, least not until we break significantly below the 1.15 handle, something that I don’t think to happen in the short term. Ultimately, we could go looking towards the 1.20 level above, but is can it take a significant amount of work to get there.

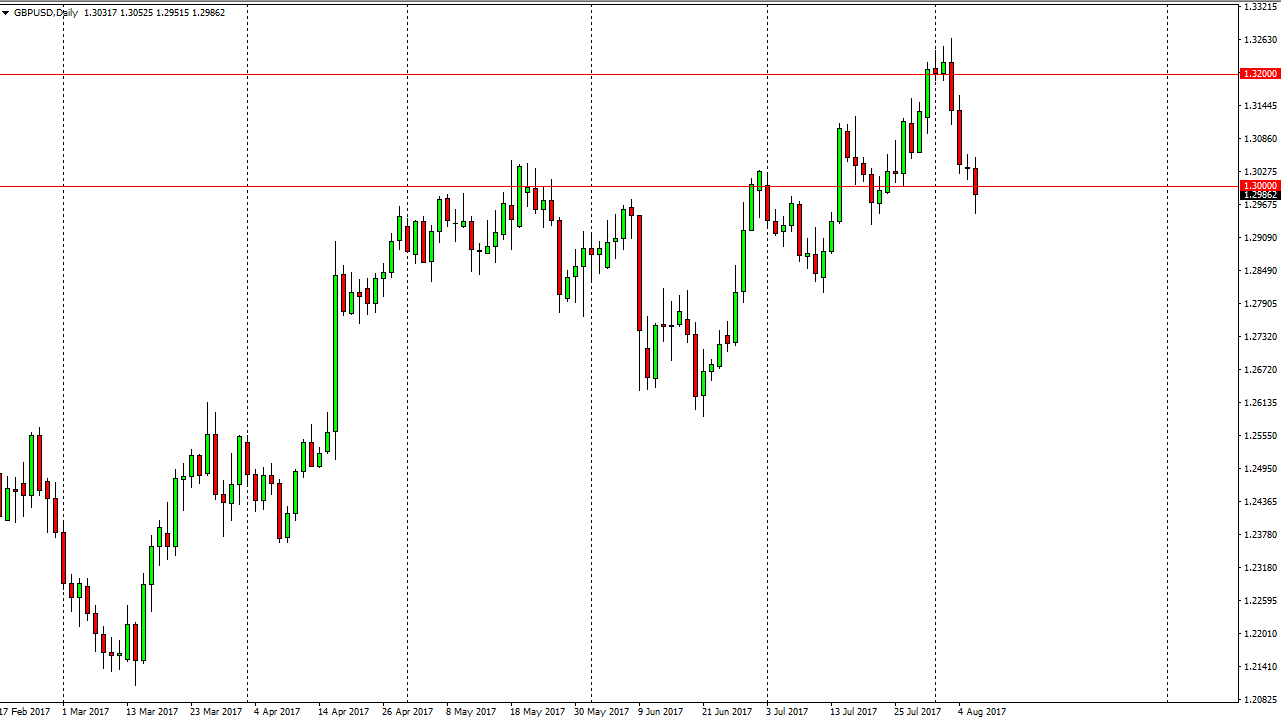

GBP/USD

The British pound fell during the day on Tuesday, slicing through the 1.30 level. If we can break down below the bottom of the range for Tuesday, I think that the market goes to the 1.2850 level below. Alternately, if we break above the top of the range for the day on Tuesday, the market will more than likely look for the 1.32 level above. The area that we currently find ourselves and is a previous resistance barrier, so it should now offer support. A breakdown could be rapid, and influenced by headlines coming across the newswires as Great Britain continues to negotiate the exit from the European Union, and that of course there is a bit of a wildcard into the market. I believe that the next couple of sessions will be vital as to where we go longer-term, so patience may be needed to let the market dictate which direction you should be trading.