TM editors’ note: This article discusses a penny stock and/or microcap. Such stocks are easily manipulated; do your own careful due diligence.

Recently Conatus Pharmaceuticals (CNAT) had announced that it had obtained a partnership with Novartis (NVS) to co-develop and possibly co-commercialize its drug Emricasan. This was announced in after-hours trade and the stock surged as much as 150% on this news. Before this announcement, the stock had been trading at around $1.91 per share valuing the company around $50 million in market cap. The deal made by Novartis to partner with Conatus involves the large interest for big pharmaceutical companies to get into the NASH space.

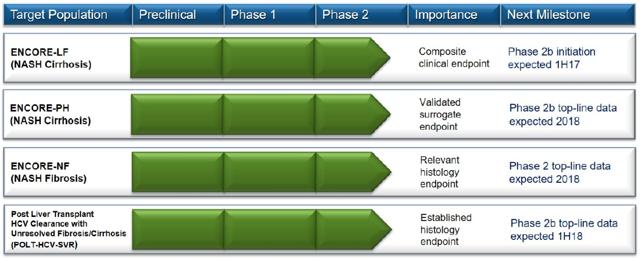

Back in 2016, there were many big pharma companies that wasted no time acquiring NASH biotech with rich pipelines. The reason why Conatus may have chosen not to sell itself is because management has stated, that its pan-caspase inhibitor Emricasan, can be used for other liver indications. Management has made it clear that it can use the cash for other acquisitions or develop a bigger pipeline targeting other liver etiologies. The deal was specifically for NASH Fibrosis and NASH Cirrhosis. That means Conatus can branch out to other liver diseases to build better value for its shareholders. This is the current pipeline in progress:

The reason why Conatus may have chosen not to sell itself is because management has stated, that its pan-caspase inhibitor Emricasan, can be used for other liver indications. Management has made it clear that it can use the cash for other acquisitions or develop a bigger pipeline targeting other liver etiologies. The deal was specifically for NASH Fibrosis and NASH Cirrhosis. That means Conatus can branch out to other liver diseases to build better value for its shareholders. This is the current pipeline in progress:

Source

Major Deal

The deal allowed Conatus to receive an upfront payment of $50 million dollars. That was the first good part of the deal because this is cash that Novartis can’t take back. If Novartis chooses to take the option to license Emricasan then Conatus is eligible to receive an additional $7 million in cash. In addition, if Conatus wants to it can also obtain up to $15 million in an upfront payment in the form of convertible promissory notes from Novartis. This all sounds very good but for the company, it is just the beginning. The deal is setup in such a way that Conatus has some freedom for other products.

The Deal Also entails other advantages such as:

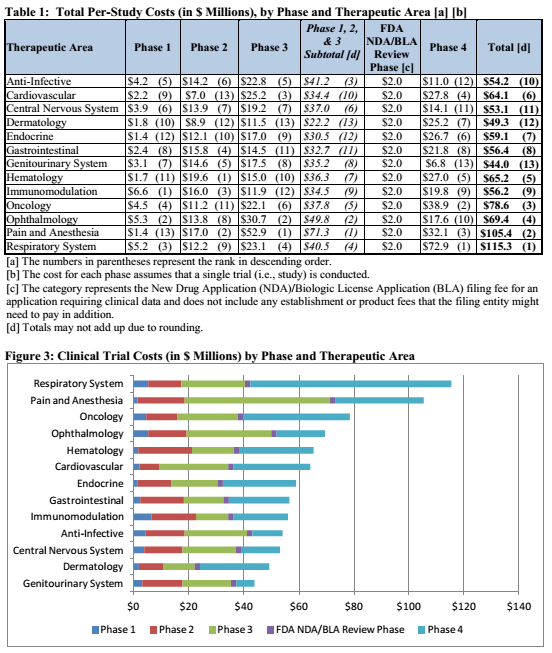

This deal has a lot of good stuff in it. The best part of the deal would be the potential to earn $650 million in cash over time, but there is something else that will help substantially. That is the fact that Novartis will be fully responsible for all phase 3 costs. This is a major point because on average a phase 3 trial cost a lot of money. This is evidenced by the graphic below:

Source

As observed in both graphics above, the cost of a phase 3 trial is largely dependent upon what the target indication is. But taking a look at the phase 3 costs in the charts above, the average would be around $21.8 million. Keep in mind that probably accounts for the average. In addition, it also depends on other factors such as the recruited patient population. That is that phase 3 trials can range from 300 patients up to 1,500 patients or more. In that case the range of a phase 3 could cost more. For the sake of argument lets say Conatus was to run four phase 3 ENCORE liver disease trials on its own and have to pay the average cost for each. Four clinical trials costing an average of $21.8 million each would mean a final cost of $87.2 million. Now, with Novartis being fully responsible for all the phase 3 trial costs Conatus would save that much in its cash reserves. That means Conatus doesn’t have to dilute shareholders and has enough cash to run its company until 2019. It still has to pay for half the costs of the phase 2b trials but most those trials are near completion anyways. In addition, as noted above CNAT received an upfront payment of $50 million with the potential to earn an additional $7 million if Novartis takes the option to license Emricasan. Excluding the potential to earn $650 million over time with clinical milestones, Conatus has enough cash until 2019.

One Condition

The main reason why Novartis chose to partner with Emricasan was that the drug targets an unmet medical need. A second reason would be that Emricasan, being a pan-caspase inhibitor, may have synergistic effects with Novartis’ FXR agonists drugs. Both of these points will be explored fully below. For Novartis to choose to license Emricasan all Conatus has to do is start the phase 2b Liver Cirrhosis — LC — trial by the 1st half of 2017. If you take a look at other deals that require an option to license a drug big pharma puts strict contingencies. In this case, all Conatus has to do is start the phase 2b LC trial on time and then Novartis will choose if it wants to license the drug. This is an important milestone and one that will likely move the share price. This is because if Novartis licenses Emricasan that opens the ability for Conatus to earn up to $650 million in milestone payments over time.

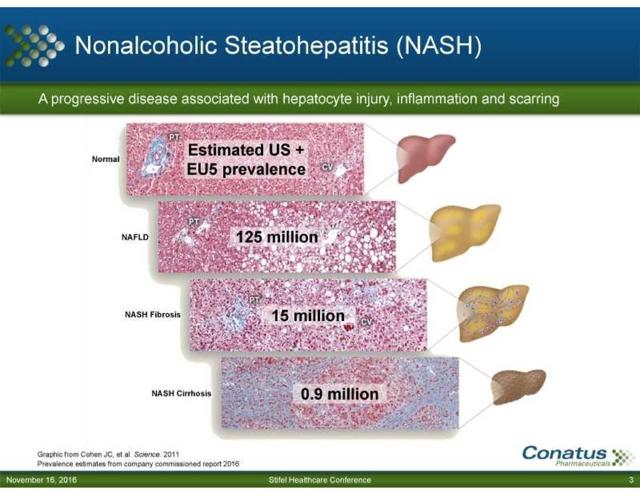

Liver Cirrhosis

Liver Cirrhosis is a deadly disease, one in which where there aren’t many treatment options available for patients. The main treatment option now for a liver cirrhosis patient is a liver transplant. While a decent option, there are several problems that arise with respect to this option. For starters, there is a liver transplant wait list. Why is this a problem? Liver Cirrhosis claims the lives of 36,000 U.S. patients each year. As shown in the graph below worldwide there are an estimated 900,000 or more patients who have Liver Cirrhosis:

Source

There are 7,000 liver transplants done on a yearly level. The problem with this is that there are 15,000 patients or more on the U.S. liver transplant wait list. This does not give a good outlook for patients that have to wait for a liver transplant. It is even possible that such patients might not live long enough to ever receive a liver transplant. According to the U.K. National Health Services, the average wait time for a liver transplant as an adult is 145 days and 72 days as a child. Living with a liver disease is bad enough as it is, but these patients also have to deal with the anxiety, stress, and other mental issues that go with it. This is strictly because of the wait list. These patients not knowing whether or not they will live long enough for a transplant is a tough event for them to handle. That is why there are support groups specifically set up to help patients deal with this mental issue.

This is why Conatus Pharmaceuticals has to shine because it gives patients another treatment option. One in which they won’t have to wait on a list for. Conatus is the only one of two biotech companies in development for a drug for Liver Cirrhosis with Emricasan. There is another drug in development for Liver Cirrhosis and that stems from a small-cap biotech company known as Galectin Therapeutics (GALT). Galectin has an ongoing trial in Liver Cirrhosis that is currently in phase 2 testing. It is testing its IV drug GR-MD-02 to treat portal hypertension in patients with NASH Cirrhosis. The trial is known as NASH-CX and has enrolled an estimated 156 patients. Results of this trial will be known by October 2017 according to the Galectin trial part of the clinicaltrials.gov website. While this may directly compete with Conatus, there is one major setback that GR-MD-02 has suffered. That was the fact that it had failed a phase 2a study in patients with advanced NASH fibrosis back in September of 2016. This means that Galectin has to achieve success with this trial if it wants to compete in the NASH Cirrhosis disease space.

Both Conatus and Galectin Therapeutics are the only two biotech companies working to find a functional treatment for Liver Cirrhosis. It would be ideal for some type of relief to come for these patients so they don’t have to rely on a wait list.

Liver Function

A severely decompensated liver is a very bad thing to occur for anyone. That is because the liver is largely responsible for many functions in the human body. One can’t hope to function without having a properly working liver. This is why if Emricasan achieves its endpoints in the ongoing clinical trials, it will change the paradigm in liver cirrhosis care for a long time to come. So just how important is the liver in the human body? Well many of these points illustrate why a fully functioning liver is important:

The Liver can……