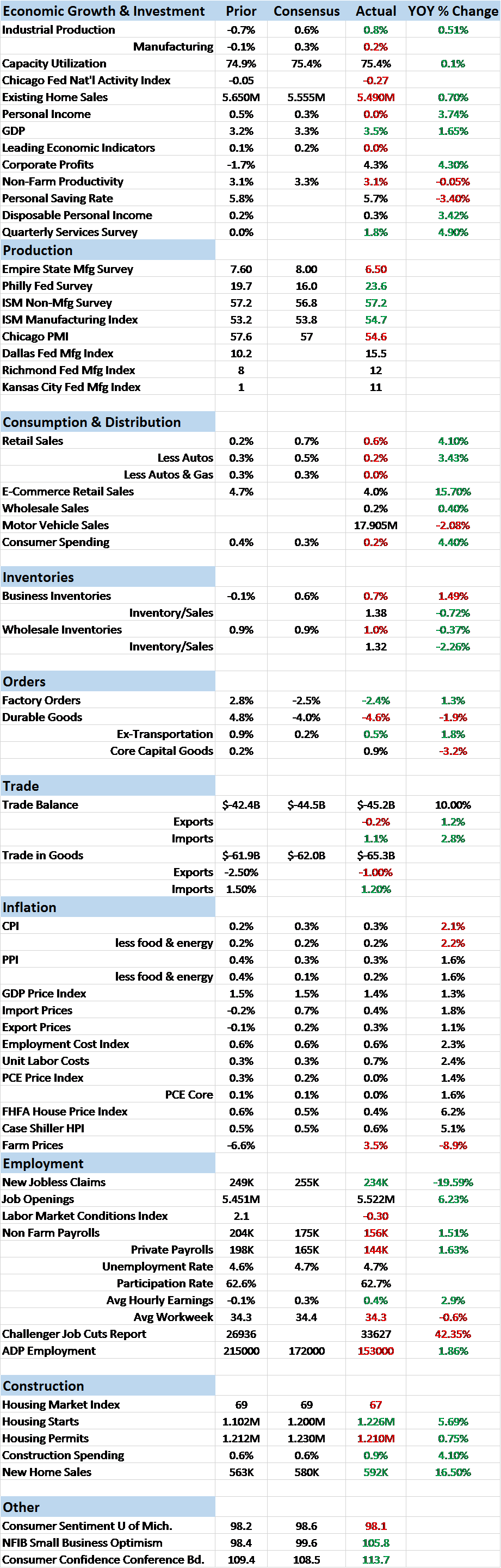

Economic Reports Scorecard

Well it’s time to get back in the habit of doing this every two weeks. The schedule was interrupted over the holidays and then again by my annual outlook piece.

The economic data released over the last two weeks was not particularly inspiring, not that hard data is what has been egging on the old animal spirits. That’s a decidedly political phenomenon not to be found yet in the economic statistics. Whether the political rhetoric will ever translate to actual improved economic growth is something I can’t answer just yet because I have no idea what policy changes will make the cut. Whatever we see out of the data today – with the exception obviously of sentiment measures in all its varieties – is not anything that can be credited or blamed on the new administration.

But back to the data. We’ve been getting what I’ve called mixed data for several years now. Good reports contradicted by bad ones, sometimes within the same press release. That is a product of the long period we’ve had of sub-par growth, running a bit less than 2% currently. The last two weeks continues this dismal trend of two steps forward and two steps back. The Labor Market Conditions index returns to negative territory while jobless claims dip into territory not seen since bell bottoms were in vogue. The JOLTS report shows lots of job openings with apparently no one qualified to fill them. But there doesn’t seem to be a surge in wages – a small recent rise notwithstanding – to support the notion that companies are scrambling to fill positions. There’s no urgency there.

Whatever workers are finding in their pay packets, they don’t seem anxious to spend it; retail sales ex-autos and gas were reported as a big old goose egg, 0.0% month to month and a sub-3% yoy rate. That’s confirmed by rising inventories at the wholesale and retail levels and inventory to sales ratios ticking up a tenth. Inventory to sales numbers had been moderating since the summer but now may be starting to move in the wrong direction again. Q4 GDP may get a boost from that but Q1 will see the payback, same as it ever was, same as it ever was (HT: Talking Heads). Maybe the punk sales are because inflation continues to tick higher with both PPI and CPI up 0.3% on the month. CPI is now above the Fed’s 2% inflation target although they don’t use CPI so as far as they’re concerned we aren’t there yet.